RUSSIAN ARCTIC LNG FOR JAPAN

PLATTS - 05 Feb 2024 - The state agency Japan Organization for Metals and Energy Security has fulfilled its liability obligations for Japan Arctic LNG, or JARC, repaying a total of around Eur814 million ($882.8 million) loan to banks Jan. 30, a day ahead of the expiry of the US sanctions waiver for transactions involving Russia's Arctic LNG 2 project.

JOGMEC's fulfillment of the loan guarantee, however, does not mean the end of JARC's participation with a 10% stake in the Arctic LNG 2 project, a JOGMEC official said Feb. 5, adding that the relevant Japanese parties will carefully respond while ascertaining sanctions developments.

Japan Arctic LNG BV is a Dutch company 75% owned by JOGMEC and 25% by Mitsui.

Loan contracts between JARC and banks became subject to a mandatory prepayment clause after the US government imposed sanctions on the project operator Arctic LNG 2 in November 2023, including designating it as Specially Designated Nationals -- a blacklist of entities linked to targeted countries and whose assets are blocked from conducting any transactions with US entities.

The repayment also came as several licenses from the US Treasury's Office of Foreign Assets Control that allowed the winding down of transactions involving Arctic LNG 2 expired at 12:01 am ET (0501 GMT) on Jan. 31.

Following the latest fulfillment, however, JOGMEC's remaining loan guarantee for JARC appears to be around the same level originally approved in June 2019.

Since JOGMEC's approval of approximately Yen 290 billion of equity financing and about Yen 45 billion of loan guarantee in June 2019, the amount of equity finance has been reduced to around Yen 150 billion-160 billion, with the loan guarantee having been increased to Yen 175 billion-185 billion.

With the fulfillment of the Eur814 million loan guarantee equating to about Yen 130 billion, JARC's remaining loan guarantee appears to remain around Yen 45 billion-55 billion.

JOGMEC provides equity capital and liability guarantees for Japanese companies' participation in oil and gas E&P projects, as well as for LNG receiving terminals/transshipment projects to secure stable supply.

JOGMEC last fulfilled its loan guarantee for Japan Canada Oil Sands in March 2022, following the pullout of Japan Petroleum Exploration's operated Canadian oil sands project in 2021.

US opposition

The US is opposing Russia's Arctic LNG 2 project "coming online," a State Department spokesperson told S&P Global Commodity Insights just hours after the country's sanctions waiver for winding down transactions involving the project company expired Jan. 31.

"We oppose the Arctic LNG 2 project coming online, as it is meant to significantly expand Russia's LNG production and export capacities, an expansion we have committed to blocking," the State spokesperson said.

"We are committed to degrading Russia's ability to expand its future energy production and export capacities."

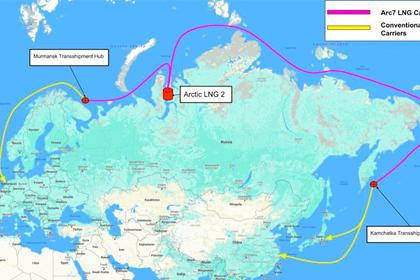

Russia's Novatek, which has a 60% stake in Arctic LNG 2, planned to begin LNG production at the first of three 6.6 million mt/year trains before the end of 2023 and to ramp up output through the first quarter of 2024.

"Along with the designation of Limited Liability Company Arctic LNG 2, OFAC also issued General License 76A, authorizing the wind-down of transactions involving the project company, and any entities owned 50% or more by the company, through Jan. 31, 2024," the State spokesperson said.

"Through all our sanctions designations, we maintain close coordination with our partners, and we will continue to do so moving forward," the spokesperson added.

The remaining Arctic LNG 2 shareholders comprise France's TotalEnergies (10%), China's CNPC (10%) and China's CNOOC (10%).

-----

Earlier: