RUSSIAN ENERGY SANCTIONS 2024

February 7, 2024 - The International Working Group on Russian Sanctions

Working Group Paper #18

Energy Sanctions: Four Key Steps to Constrain Russia in 2024 and Beyond

The International Working Group on Russian Sanctions aims to provide expertise and experience to governments and companies around the world by assisting with the formulation of sanctions proposals that will increase the cost to Russia of invading Ukraine and that will support democratic Ukraine in the defense of its territorial integrity and national sovereignty. Our working group is comprised of independent experts from many countries. We coordinate and consult with the Government of Ukraine and those governments imposing sanctions. This consultation process helps to inform our views, but our members express independently held opinions and do not take direction from or act at the behest of the government of Ukraine or any other government, person, or entity. All members of this working group participate in their individual capacity.

EXECUTIVE SUMMARY

We believe that a new sanctions push in the energy sphere can constrain Russia’s ability to continue its war of aggression on Ukraine in 2024—and that the time to act is now, with the full-scale war about to enter its third year. Three findings lead us to this conclusion:

(i) Russia remains highly dependent on exports of oil and gas, both in terms of inflows of foreign currency as well as budget revenues;

(ii) Russia’s oil and gas revenues fell dramatically in 2023, exposing its fragility;

and (iii) sanctions and related measures have been a key driver of these developments.

In recent years, oil and gas accounted for around 60% of Russia’s total goods exports and 40% of the federal government’s revenues. This means that both in terms of access to foreign currency as well as funding of the budget, the country remains highly dependent on oil and gas revenues. And while Russia benefited from an extraordinarily supportive external environment in 2022—marked by soaring energy prices—this changed dramatically in 2023 as oil and gas prices normalised and sanctions on hydrocarbons were phased in.

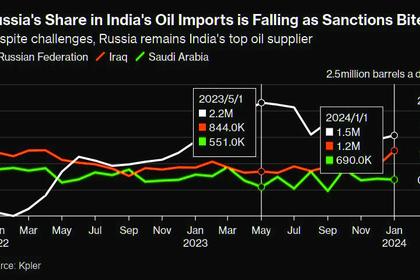

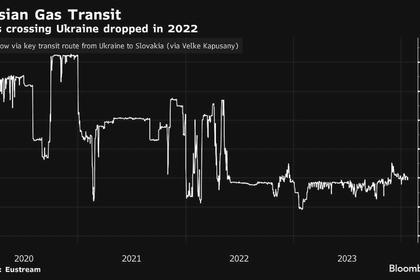

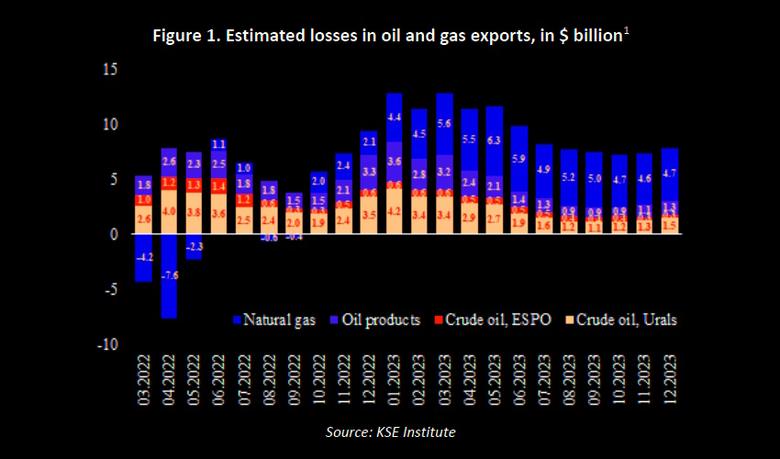

We estimate that sanctions on Russian oil—in particular the EU embargo and G7 price caps—have cost the country $113 billion in export earnings since the start of the full-scale invasion (see Figure 1). The key driver here is the discount on prices for its oil that Russia has had to accept in order to secure firm demand from new, large-scale buyers. In addition, the Putin regime’s attempts to weaponize natural gas flows to Europe in 2021-22 backfired. European countries were able to diversify suppliers and cut demand, resulting in prices returning to mid-2021 levels. The result: Russia’s primary gas export market is gone for good. We estimate the cumulative loss in gas export earnings since February 2022 is around $55 billion.

Altogether, markedly lower oil and gas exports have weighed on Russia’s external accounts: total exports dropped by 29% in 2023 vs. 2022 to $423 billion, the trade surplus by 63% to $118 billion, and the overall current account balance by 79% to $50 billion. Putin’s regime now faces an entirely different macro environment where policy space is limited as a result of the $190 billion decline in the current account surplus in 2023 vs. 2022. In 2022, Russia’s record surplus protected the economy, allowing the authorities to simultaneously pursue monetary stability (i.e., strengthen the ruble and fight inflation)—by hiking interest rates—and financial stability (i.e., ensure health of the financial system)—by providing banks with liquidity to continue to lend to the private sector and fund the government. That protection has now gone.

As lower inflows of foreign currency have led to a sharp depreciation of the exchange rate—around 40% vs. the U.S. dollar and euro since the fall of 2022—and, in turn, created upward pressure on inflation, the Bank of Russia was forced to hike its key interest rate by a cumulative 850 basis points since mid-2023. This will weigh on the economy by tightening financial conditions and drive up the cost of financing the government.

The reimposition of capital controls and the declining quality of reserves—now largely in gold and unconvertible yuan, with barely any accessible reserves in dollars, euros, or other G10 currencies—are also significant constraints.

With Russia in a more fragile macro situation, the time for additional action is now. In the past, we focused on advocating for a downward ratchet in the oil price caps.2 Specifically, we argued that cutting the oil price cap to as low as $30/barrel would still preserve the Russian incentive to supply, given the low lifting cost of Russian oil, while reducing export earnings to a level which would severely constrain Russia, and bring the war to an early end. To that aim, we proposed to start with an immediate $10/barrel cut in the caps, and set the ultimate objective of reducing the cap on Russian crude to $30/barrel.

We believe this argument remains valid. However, in this paper, we focus on the immediate next steps, which we see as strengthening enforcement, implementing an initial downwards ratchet in the price caps and completing the EU embargo on Russian hydrocarbons. Effective enforcement is a necessary condition for the price cap to be effective to prevent it being undermined by circumvention, in particular by the expansion of Russia’s shadow fleet of tankers (see Figure 2). On paper, these vessels are not subject to the price cap since they are supposed to be disconnected from any restricted G7/EU shipping services. In practice, however, many have failed to sever all service ties.

For crude oil, the shadow fleet’s share of Russia’s exports has risen from around one-third in the first half of 2022 to 65-70% in the second half of last year. It has also increased for oil products, but the change is much less pronounced because of a shortage of suitable product tankers in Russia’s shadow fleet. Consequently, during the second half of 2023, some 40-50% of seaborne oil exports—crude and product—was still exported with sanctions-compliant vessels. In addition, there is clear evidence that many mainstream vessels using G7/EU services have also likely transported cargoes priced above the caps.

Despite this circumvention, Russia’s oil has been sold at a deep discount to market prices, highlighting the potential of the policy: Urals crude oil sold for an average $62/barrel in 2023 while the benchmark North Sea Brent averaged $83/barrel. The price fell below the $60/barrel price cap in December for the first time since the first half of 2023, and the discount to Brent widened once again (see Figure 3), in response, we think, to recent enforcement actions by the G7, including the blocking by OFAC of 25 tankers active in Russia’s shadow trade.

With Russia’s brutal war on Ukraine now about to enter its third year, it is time to further increase pressure on the aggressor. The significant deterioration of Russia’s external balance, which has been partially driven by sanctions on Russian energy exports, provides Ukraine’s allies with an opportunity to drive foreign currency inflows below a critical level and also impact budget revenues that are needed to pay for the planned sharp increase in military spending. Specifically, we believe that Russia’s capacity to wage its war on Ukraine would be severely impaired if its export earnings were reduced by a further $50 billion. This would wipe out the current account surplus and significantly widen the budget deficit, in a situation where Russia faces major restrictions on access to foreign currency and to financing. To achieve this end, we propose to strengthen the oil price cap regime and ratchet the oil price caps to $50/barrel on crude, to ban Russian LNG and gas flows to Europe, and to cut Russian oil and gas off from access to Western technology and services.

First, we propose a two-step strategy on the oil price cap of strengthening enforcement and then lowering the price caps:

1. Stop the Russian shadow fleet, which circumvents the price cap and threatens the marine environment. By expanding the number of shadow tankers under sanctions and enforcing existing mandatory oil spill insurance requirements for all tankers passaging through coalition waters, we can force Russia to rely much more heavily on the mainstream fleet once again, which falls under price cap restrictions. Further, step up investigations and penalties to alter trade participants’ risk calculations. By requiring greater transparency around price cap compliance, conducting comprehensive investigations into suspect transactions, and increasing penalties for violations, service providers and importers will demand higher fees (such as freight rates) and deeper price discounts from Russia to compensate for their risks.

2. Once the price cap’s efficacy is ensured and enforcement challenges addressed, ratchet down the price caps to deprive Russia of critical foreign currency inflows. We propose initially to reduce the crude oil price cap and the discount product price cap by $10/barrel each, and to reduce the premium product price cap of $100/barrel more substantially, which has generally been above the market price for over the last year. This would cost Russia an additional $25-30 billion per year.

Second, we propose two further steps to reduce oil and gas earnings, to isolate the Russian oil and gas sector, and to send a clear signal on the second anniversary of the full-scale invasion:

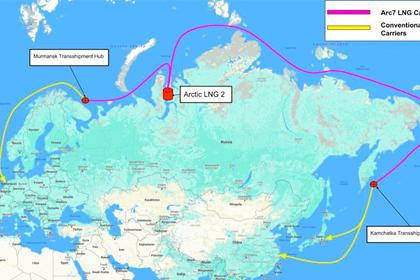

1. Complete the EU/G7 ban on Russian hydrocarbons by eliminating all purchases of LNG and banning Russian gas flows to Europe. Such a measure would demonstrate the coalition’s commitment to a permanent decoupling from Russian energy and deprive the aggressor of important future export earnings. This ban should be phased in over the next one to two years, as other gas supply comes onto the market, to avoid any sharp market tightening and rising prices.

2. Target oil and gas-related services that Russia relies on for production and exports. Russia’s hydrocarbon sector has had restricted access to western technology since 2014, resulting in a negative impact on new developments. Many foreign companies also exited after February 2022. However, a significant number continue to operate in Russia. Cutting off such services completely could restrict future LNG production, while pushing up costs for oil production by eroding technology-driven efficiencies.

Figure 4 summarizes the impact that we estimate these proposed measures to have on Russia’s export earnings per year. Altogether, this package of energy-related actions would cost Russia more than $50 billion per year (compared to 2023) and bring foreign currency inflows down to a critically low level. Proper enforcement of the existing price caps—coupled with actions to address the challenges emanating from the growing shadow fleet—would cost Russia $8.0 billion per year. Lower price caps—$50/barrel for crude oil, $35/barrel for discounted products, and $60/barrel for premium products—would amount to a loss of $27.5 billion. And measures targeting Russian LNG and remaining pipeline gas flows to Europe would reduce exports by another $16.6 billion per year.

-----

Earlier: