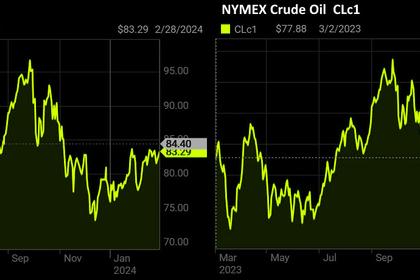

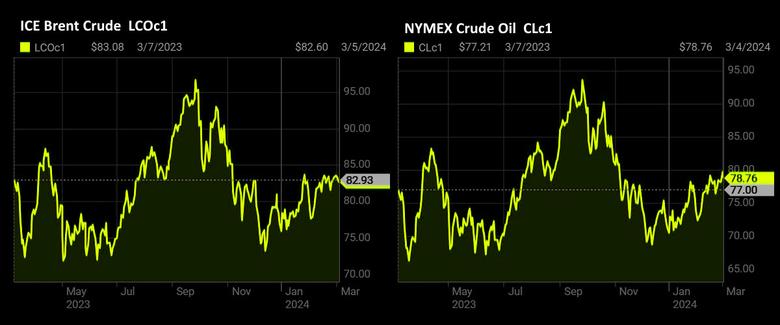

OIL PRICE: BRENT NEAR $83, WTI NEAR $79

REUTERS - March 5, 2024 - Oil prices fell for a second day on Tuesday as pledges by China, the world's biggest crude importer, to transform its economy amid stuttering growth since the COVID pandemic failed to impress investors concerned about slower consumption.

Brent futures for May fell 3 cents to $82.77 a barrel by 0159 GMT, while U.S. West Texas Intermediate (WTI) fell 11 cents, to $78.63.

Brent settled 75 cents lower at $82.80 a barrel on Monday, while WTI settled down $1.24 at $78.74 a barrel.

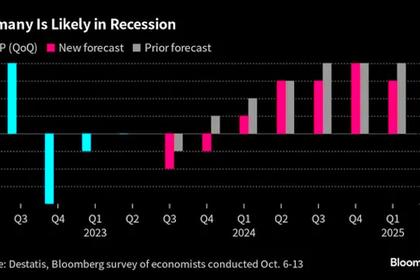

China vowed to "transform" its economic development model and curb industrial overcapacity while setting an economic growth target for 2024 of around 5%, similar to last year's goal and in line with analysts' expectations, according to an official work report released on Tuesday as part of this week's meeting of the National People's Congress.

Achieving that goal should provide a boost for fuel consumption but the target will be harder to reach this year compared with 2023, which benefited from the favourable base effect of a COVID-hit 2022, analysts said, and this could in turn weigh on investor sentiment.

Also released in the work report, China pledged to step up the exploration and development of oil and natural gas resources but at the same time vowed to tighten control over fossil fuel consumption.

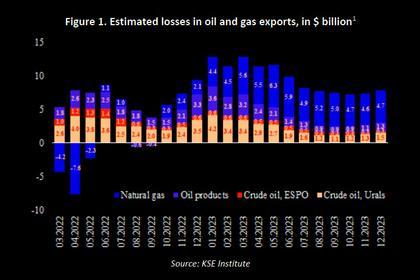

While concerns over the Chinese demand outlook pressured prices lower, supply factors stemming from major producers reducing output and geopolitical worries from the Israel-Gaza war underpinned crude.

The Organization of the Petroleum Exporting Countries and its allies (OPEC+) on Sunday extended their voluntary oil output cuts of 2.2 million barrels per day (bpd) into the second quarter to support prices amid global growth concerns and rising output outside the group.

The physical oil market has started to tighten, rising spot prices show, according to a note from ANZ analysts, owing in part to supply disruptions.

"While tensions in the Middle East have yet to directly impact supply, the Red Sea disruptions have increased the time oil is unavailable to the market", ANZ analysts said, referring to the longer voyages tankers carrying oil must take to avoid the area.

U.S. crude oil inventories are expected to have increased last week, according to a preliminary Reuters poll on Monday, while distillates and gasoline stockpiles were forecast lower.

Four analysts polled by Reuters estimated on average that crude inventories rose by about 2.6 million barrels in the week to March 1.

-----

Earlier: