OPEC+: HARD DECISION

FT - Mar 5, 2024 - The decision by Opec+ members to extend voluntary oil production cuts to July has merely delayed the difficult question of how long Saudi Arabia is willing to bear the weight of lower global output, say analysts.

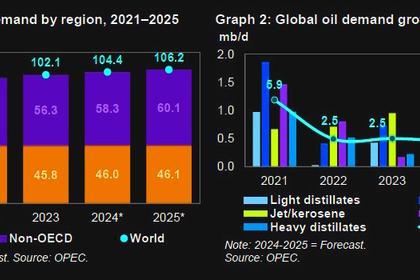

The series of cuts, which began in November 2022 in the face of vehement US opposition, has crimped production of crude by some 5.3mn barrels a day, or about 5 per cent of global supply.

These curbs on supply have helped prop up the price of crude for the past 18 months but left Saudi Arabia, which has cut its production by 2mn barrels a day, shouldering most of the cost.

In doing so it has ceded market share to non-Opec producers, including the US and Canada, which are expected to pump at record levels this year, according to the International Energy Agency.

“For Saudi Arabia, which has consistently invested tens of billions of dollars per annum in its upstream [activities] over the past decade, idled capacity comes at a daily cost — it needs to come back on-stream,” said Ben Hoff, global head of commodity strategy at Société Générale.

The kingdom “can relatively promptly, and at a time of their choosing, bring back roughly 3mn barrels a day of idled supply [and] this potentiality is hanging over the market like the sword of Damocles”, he said.

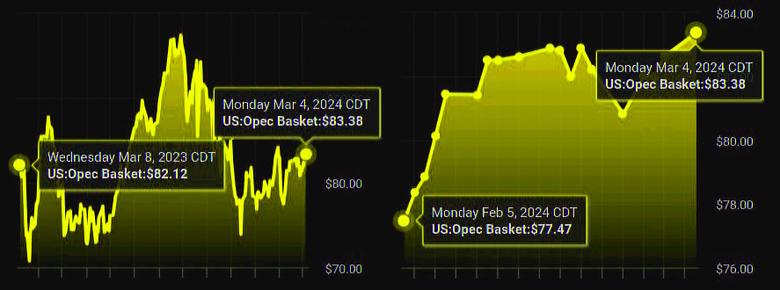

For the present, investors are sanguine about the threat. The price of crude oil was little changed on Monday. Brent, the global benchmark, was down 0.3 per cent while WTI, the US equivalent, fell 0.8 per cent.

Brent has also been becalmed since the cuts were first announced in late November, trading at between $73 and $84 a barrel, despite the war in Gaza and disruption to tanker traffic through the Red Sea.

But Saudi Arabia is caught between international competition and domestic ambitions. The country has stood by as the US and Iran upped their output last year.

US production rose by roughly 1.5mn b/d to a record 13.5mn b/d in 2023 while that of Iran increased to an average of roughly 3.9mn b/d from about 3mn b/d a year earlier, said Claudio Galimberti, North America research director at Rystad Energy. “These are two of Saudi Arabia’s sworn enemies when it comes to petrol production,” he said. “It’s difficult for them to watch.”

At the same time, analysts say that a move by Saudi Arabia to rejoin the competition could further depress the oil price, and potentially curtail its ambitious domestic projects.

The country has embarked on a series of big spending programmes, from new cities to football, to diversify its economy. It requires a high oil price to help pay for it. Without the country’s aggressive production cuts, the price of crude could have fallen to as low as $65 per barrel, Galimberti said. “Saudi Arabia is basically shouldering the entire market and it’s painful, but without them it would be even more painful,” he said.

In January, state-run Saudi Aramco paused a plan to expand the kingdom’s oil production capacity, in a move that some experts viewed as a recognition that it already has ample unused potential.

Nitesh Shah, head of commodities and macroeconomic research at ETF provider WisdomTree, said Riyadh hoped that the US and other producers would soon slow their rates of production.

“Core Opec countries will see [their] market share restored over time, but Saudi Arabia needs to take care of maintaining fiscal spend in the short-term first. That is important for its own political stability,” he said.

Riyadh has used its political and economic muscle to force some Opec+ members to share the burden of the cuts. But while Russia’s commitments equate to a cut of approximately 1mn b/d, other members have reduced by much less and compliance with the lowered production targets has been mixed. Angola quit the cartel in December over the issue.

“I feel like the market is pricing it at somewhere between a zero and 5 per cent probability that [Saudi Arabia] just gets fed up with all the other countries riding on their cuts [but] we think the odds are more than 20 per cent,” said Vikas Dwivedi, global energy strategist at Macquarie.

Helima Croft, head of commodities research at RBC Capital Markets, who visited Riyadh last month, said Saudi energy officials were relaxed about maintaining the cuts for longer. “They will bring it back when it doesn’t send prices south,” she said.

The Saudi energy ministry on Sunday said that after June its so-called voluntary cut of 1mn b/d would be reduced “gradually subject to market conditions”.

Escalation of the war in Gaza remains an ever-present threat to the relative tranquility of the crude market but the move to continue voluntary production cuts has shifted traders’ attention to the next Opec+ meeting at the start of June.

Christyan Malek, global head of energy strategy at JPMorgan, expects Opec+ to begin removing the supply cuts from July as demand from Asia returns in the second half of the year. “We’re now looking at not if but when do they add back the barrels,” he said.

However, such forecasts assume Saudi Arabia will be able to maintain cohesion among Opec+ members and guide a gradual return of the missing barrels to the market.

“There’s a thin line between being a hero and being a sucker,” said Macquarie’s Dwivedi. “I think they’re right on it and they know it.”

-----

Earlier: