OPEC+ OIL WILL DOWN

BLOOMBERG - Mar 3, 2024 - OPEC+ extended its oil supply cutbacks to the middle of the year in a bid to avert a global surplus and shore up prices.

The curbs — which on paper total roughly 2 million barrels a day — will remain in place until the end of June, according to statements from members such as Saudi Arabia, which accounts for half of the pledged reduction. Russia promised to strengthen its role by focusing more on cuts to production than exports.

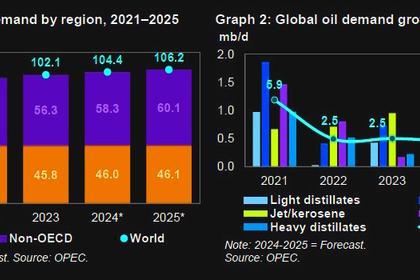

Traders and analysts had widely expected the extension, seeing it as necessary to offset a seasonal lull in world fuel consumption and soaring production from several of OPEC+’s rivals, most notably US shale drillers. An uncertain economic outlook in China is adding to the need for caution.

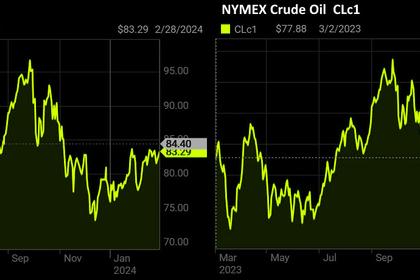

Ample supplies have anchored international oil prices near $80 a barrel this year, even as conflict in the Middle East disrupts regional shipping. While that offers some relief for consumers after years of rampant inflation, prices may be a little low for many in the Organization of Petroleum Exporting Countries and its partners.

Riyadh needs a crude above $90 a barrel as it spends billions on an economic transformation that spans futuristic cities and sports tournaments, according to Fitch Ratings. Its largest partner in the alliance, Russia, also seeks revenue to continue waging war on Ukraine.

These latest output curbs, which deepen reductions made last year, will be “returned gradually subject to market conditions” after the second quarter, the countries said on state-run media.

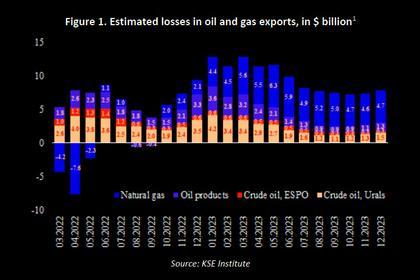

Russia — which has a unique exemption to split its curbs between production and exports of crude oil and refined products — will put greater emphasis on cuts to crude production during the coming quarter, Deputy Prime Minister Alexander Novak said.

That promise may offer some satisfaction to Riyadh. Saudi Energy Minister Prince Abdulaziz bin Salman expressed disappointment last year that Moscow hadn’t agreed cut production, which more directly impacts global market balances than changes to exports.

In April, Russia’s cut will comprise 350,000 barrels a day of output and 121,000 barrels a day from exports. In May, it will be 400,000 barrels a day of production and 71,000 of exports, while in June the curbs will come from production only.

Still, Russia and others in the group haven’t so far delivered fully on their commitments.

Moscow only recently fully implemented the production cutbacks it promised to make almost a year ago. In January, the nation reduced its exports of crude oil as agreed by roughly 300,000 barrels a day, but promised curbs to shipments of refined fuels were less clear.

Iraq and Kazakhstan collectively pumped several hundred thousand barrels a day above their quotas in January, but promised to improve compliance and even compensate for any initial overproduction.

The group’s decision to extend its curbs for the second quarter may have been widely expected, but OPEC+ will likely face a tougher choice at its next scheduled meeting on June 1, when ministers will set policy for the second half of the year.

Forecasts from the International Energy Agency in Paris suggest that, with growth in global oil demand slowing and new supply from the Americas soaring, OPEC+ will need to persevere with its cuts all year.

“You don’t want to bring barrels back in too early,” Saad Rahim, chief economist of commodity trading giant Trafigura Group, told Bloomberg television last week.

It’s unclear whether all members would be willing to subscribe to that policy. While Saudi Arabia has often urged the need for caution, its neighbor the United Arab Emirates has been keen to make use of recent investments in new production capacity.

Some forecasters believe that won’t be a problem, as strengthening demand will allow the group to relax its curbs and add more barrels later in the year.

There has been “an improvement in overall market fundamentals,” said Paul Horsnell, head of commodities research at Standard Chartered Bank Plc. “OPEC could increase output” without flooding world inventories.

-----

Earlier: