U.S. LNG FREEZE

BLOOMBERG - Mar 15, 2024 - The Biden administration’s pause on new licenses for liquefied natural gas exporters is already stalling progress for projects that were aiming to come online later this decade.

Several LNG buyers have delayed signing new long-term contracts with US producers until there is more clarity, according to people with knowledge of the matter. Malaysian state oil and gas company Petroliam Nasional Bhd. is in talks with Cheniere Energy Inc. and other firms, but is reluctant to commit until licenses are approved, said the people, who didn’t want to be named due to the sensitivity of discussions.

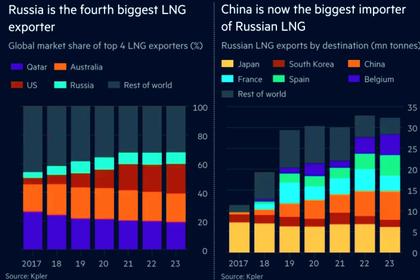

The US — the world’s biggest exporter of the power-station and heating fuel last year — stopped approving new licenses in January to study the potential effects of increased gas production and exports on climate change, the economy and national security. The process could last months, a Department of Energy official said last week, making it tough for American producers who need to lock-in deals before they can get financing from banks.

Venture Global LNG Inc.’s upcoming CP2 project in Louisiana doesn’t have the required approvals to move forward and is at risk of pushing back its final investment decision, a necessary step before major construction can begin, the people said.

The “first LNG is expected in 2026, should the Federal government act without further delay to approve the project,” said Shaylyn Hynes, a spokeswoman for Venture Global, reaffirming the company’s previously stated target for commencing production.

Sempra, meanwhile, has already deferred its investment decision on its planned Cameron facility in Louisiana, and Commonwealth LNG has delayed construction of an export terminal in the state.

“The longer the pause lasts, the more problematic it is,” said Paul Varello, Commonwealth’s chairman and founder. Project developers aren’t able to secure an offered price from a contractor, and commitments to buyers for certain delivery dates could also slip, he said.

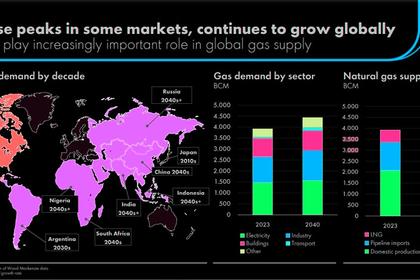

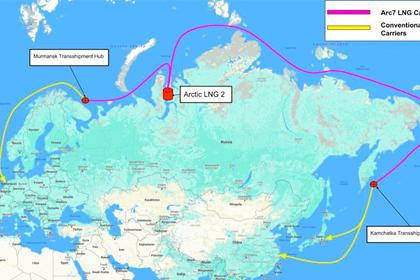

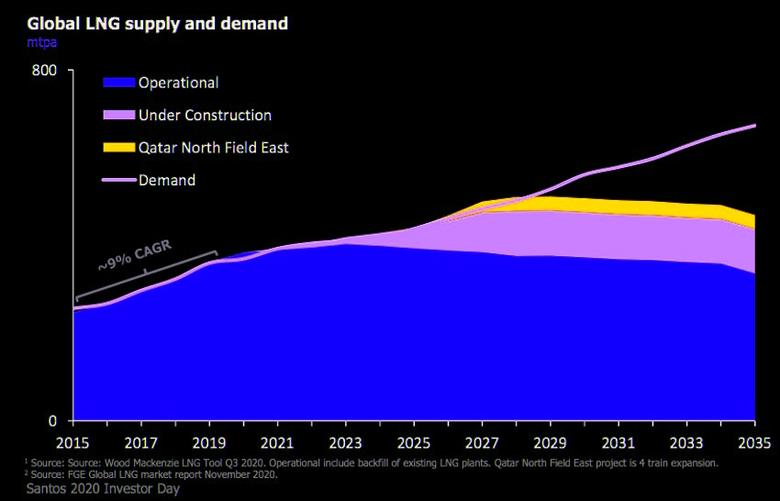

Another issue is that US exporters are unable to secure necessary debt financing commitments from banks unless they have been cleared by the Department of Energy. All of the delays are putting multi-billion dollar projects that are vying to grab a slice of booming global demand at risk. Other developments — in Qatar and the United Arab Emirates — are progressing rapidly and threatening to steal market share from the US.

There haven’t been any major deals in the first quarter of 2024, except for a small agreement signed by Delfin LNG, which has all of the required licenses. By comparison, nearly 8 million tons per year of long-term deals were signed in in the first quarter of last year from projects in the US or Mexico.

-----

Earlier: