OIL PRICE COULD BE $100

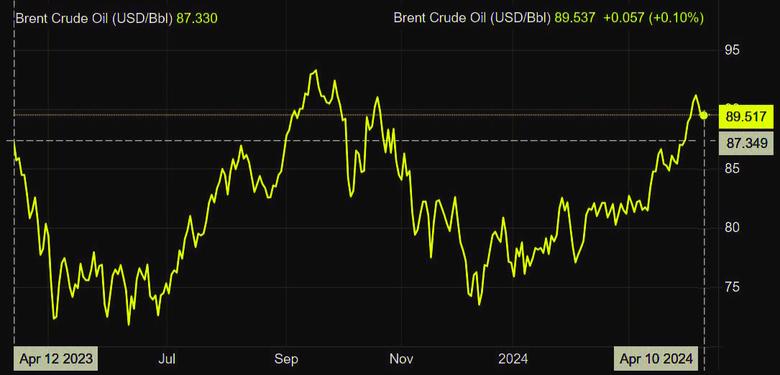

PLATTS - 09 Apr 2024 - Spot crude prices could hit $100/b this year if OPEC+ maintains its production discipline and continues to withhold crude from the global markets, Russell Hardy, the CEO of independent commodity trading group Vitol, said April 9.

Brent crude futures on April 8 traded above $91/b for the first time since October, an increase of almost 20% since the start of the year, as fears of widening conflict in the Middle East disrupting supplies face growing expectations of robust economic fundamentals.

OPEC+ has also taken some 5 million b/d of crude off the market under voluntary production cuts since late 2022 to help support oil prices as concerns over the pace of global economic growth dragged on demand forecasts.

"It's really a supply-constrained market but we've averaged about $83/b so far this year, so $80 to $100/b feels like a sensible range for the market given OPEC's control of inventories around the world," Hardy told the FT Commodities Global Summit in Lausanne.

On the demand side, Hardy said Vitol is expecting global growth of 1.9 million b/d this year, similar to 2023, with China, India and jet fuel from increased air travel continuing to underpin growth.

Speaking at the same event a day earlier, the head of commodities at fund manager Citadel said he expects oil markets to become "extremely tight" in the second half of this year, in part due to OPEC+ output cuts. Citadel's Sebastian Barrack said OPEC+ has "definitely regained control" of the oil market over the last few years.

$100 oil

Predictions that oil prices will hit $100/b this year have been growing of late, fueled by escalating tensions between Israel and Iran over the OPEC producer's support for Hamas in Gaza and stronger-than-expected demand data.

In a note on March 28, oil analysts at S&P Global Commodity Insights said they expect Dated Brent prices of around $90/b on a monthly average basis in the second to third quarters but said there is an upside risk if OPEC+ holds on to its cuts.

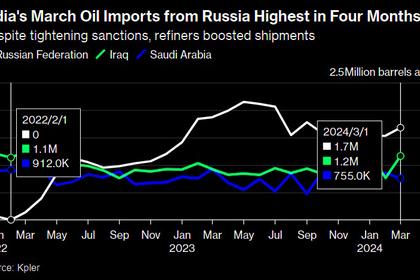

"The risk for higher prices...has increased owing to the extension of production cuts, originally announced in November 2023 by the "OPEC+ Six" — Iraq, the United Arab Emirates, Kuwait, Algeria, Kazakhstan and Oman. Also, more damage to Russian oil infrastructure from Ukrainian drone attacks could tighten the global balance and push prices higher," oil analysts at S&P Global said, noting that Ukrainian drone attacks on Russian refineries posed another an upside risk to both crude and product prices.

Platts, part of S&P Global Commodity Insights, assessed the physical Dated Brent benchmark at $92.2/b on April 8, the highest since Oct. 23.

Although OPEC+ could loosen its voluntary cuts if the oil price increases too much, talk about an increasingly tight oil market in the second half of 2024 "will lead the oil price higher and it will most likely end up towards $100/b, SEB's chief commodities analyst, Bjarne Schieldrop, said in a note.

OPEC discipline

Last week, OPEC+ said it would maintain its voluntary cuts until July. The cartel is expected to decide on its continued production cuts beyond then at its next full ministerial meeting scheduled for June 1.

Although Iraq, the UAE, Kuwait and Kazakhstan have recently been producing above their quotas, the two largest OPEC+ producers, Russia and Saudi Arabia, both have been pumping in line with pledged cuts. Riyadh has done the heavy lifting when it comes to cutting output since last year, with production falling to levels not seen since the coronavirus pandemic.

"We do have to recognize that OPEC has been doing a good job in managing oil prices in the last few years," the acting head of Socar Trading, Taghi Taghi-Zada, told the FT event. "So with the price at $90/b, they might be interested in acting in line with that and maintaining the price. They have been successful and I don't see a reason why they should not continue the trend as a group."

If oil prices continue to climb over $90/b, the US will likely put pressure on OPEC kingpin Saudi Arabia to pump more oil ahead of the June OPEC+ meeting, according to Frederic Lasserre, the head of research at independent commodity trader Gunvor.

"If we are close to $95/b I think that there will be a huge pressure at least to bring back some of the voluntary cuts, maybe half a million b/d [from Saudi Arabia]... We feel that it's likely that we're going to see some production coming back from Iraq and Saudi Arabia," he said.

Amrita Sen, head of research group Energy Aspects, said she doesn't expect Saudi Arabia to bow to US pressure to wind back output cuts as the US-Saudi relationship is "quite broken". However, she said she expects Riyadh to bring back "some volumes... in an incremental way rather than everything at once."

-----

Earlier: