POSSIBILITIES FOR GRID INVESTMENT

By MICHAEL SMITH Principal, KLN Group

ENERGYCENTRAL - Apr 8, 2024 - The sweeping changes that all of us in the utility industry have been observing and been a part of over the last decade or more have been thoroughly research and well-documented: renewables are exploding, energy storage is key, the role of the customer is changing, utilities need to leverage new data sources, role of the grid itself needs to change…and of course a lot more.

In this limited space, it would be impossible to address the many challenges for this industry as it moves deeper into the energy transition. We can, however, as an industry be asking ourselves some difficult questions and addressing the concerns that these questions raise. Below is an attempt to ask questions around two critical areas around how utilities should be investing and focusing their efforts to continue to meet their core mission of delivering safe, reliable, affordable, sustainable energy for the next 100 years.

The Role of Utility-Scale Renewables…Or Not

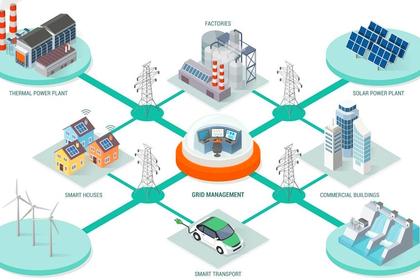

As state regulators and utilities themselves announce renewable energy goals, often more questions are raised than are answered, at least initially. For starters, what will the mix of renewables look like, particularly utility-scale vs local or customer-based energy sources (typically called distributed energy resources, or DERs)? And what is the best way to balance these two very different approaches to delivering renewable energy?

Looking at utility-scale renewables, there is an argument to be made that economies of scale make this the go-to for rolling out renewables at a large scale. Industry analysts are forecasting a massive growth of utility-scale renewables. One source, Canary Media, reports that U.S. has nearly 160 gigawatts of installed solar capacity, more than half of which is utility-scale. More than double that amount of new solar — 358 gigawatts — is forecast to be installed in the U.S. by the end of 2030. This begs more questions about transmission infrastructure, back-up generation , and energy storage, the answers to which are all very expensive.

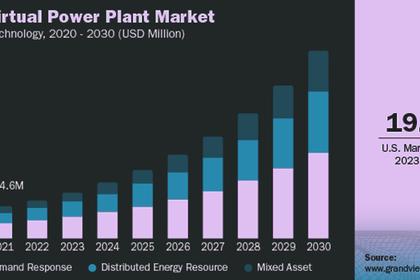

In the case of local or customer-based renewable energy/DERs, there are a few data points that point to continued massive growth. Research and advisory firm Wood Mackenzie forecasts 19% annual growth of microgrids in the US through 2027. Similarly, the Solar Energy Industries Association reported in March 2024 that in 2023 the US solar capacity grew 51% overall, and that residential solar grew 12%.

While there is probably no single answer to the “utility-scale vs DERs” question, there needs to be thoughtful consideration around the impacts of either on rates and reliability, which begs discussions about how quickly either scenario can be implemented while maintaining reliability. A second consideration is the need for a very holistic look at costs (transmission infrastructure, siting costs, and the need for back-up generation and/or energy storage, for instance). Even with massive federal subsidies and tax incentives (that won’t last forever) this is a very costly proposition that our industry finds itself confronting.

Looking at an energy future that is centered at the distribution level begs its own challenges, but here the possibilities are intriguing. As solar and storage costs continue to decrease, at what point will having stand-alone power for customers of all types be a reality? What about microgrids that can use fuel cells and emerging green or even blue hydrogen technologies.

It could be argued that considering reliability and costs are just the beginning of calculating the optimal mix of energy sources; regulatory and political implications, and technology improvements come to mind. Recent leaps in energy rates and grid failures serve as a reminder that in the rush to renewables, ensuring and reinforcing stable rates and reliability needs to be “job one” for the utility industry.

Net Load Forecasting for Utility Survival

While this section title might sound a little dramatic, the necessary changes in utility forecasting methodologies cannot be overstated. The traditional “top down” approach to forecasting in the era of centralized power generation and predictable market conditions served the utility industry well for decades. Today, however, the growth DERs has quite literally turned the industry on its head, calling for a “bottom up” forecasting approach.

The growth of residential solar is noted above. Add in the growth of electric vehicles (EVs), which Cox Automotive reports reached record levels in 2023, and the critical need for EV charging infrastructure with the Biden Administration’s goal of 500,000 of these to be installed across the country by 2030, and the need for forecasting at the distribution level becomes very apparent.

Net Load Forecasting (NLF) refers to the difference between true load — the total electricity demand of the loads — and the electricity generation in the distribution system from resources such as solar and other distributed generators (US DoE). NLF helps utility planners, forecasters, and engineers prepare for a very different, distributed future.

Consider a large utility with a service territory that is diverse geographically and demographically, and how building the right infrastructure will be as critical as it is complex. There could very likely be areas of the service territory that are conducive to building out wind farms, requiring robust transmission infrastructure. Or another area of the service territory could be relatively wealthy with a typically higher percentage of EVs. Here, there could be a call for targeted distribution transformer upgrades.

A NLF that factors in load, economic forecasts, demographic information, asset data, weather, and more will go a long way towards providing answers to these challenges as we all move deeper into the energy transition.

It is An Interesting Time to be in the Utility Industry!

After 34 years in the utility industry, this writer can confirm that, indeed, it is an interesting time to be in the utility industry! For an industry that saw incremental change for many decades, recent years have seen massive shifts as the industry answers the call to transition energy sources, redefine energy delivery, and engage customers as partners in this new energy environment.

-----

This thought leadership article was originally shared as part of the Energy Central Special Issue - Navigating the Future: Investing in the Grid - March/April 2024 SPECIAL ISSUE. The communities are a place where professionals in the power industry can share, learn and connect in a collaborative environment. Join Energy Central today and learn from others who work in the industry.

-----

Earlier: