AUSTRALIAN COAL IS NEEDED

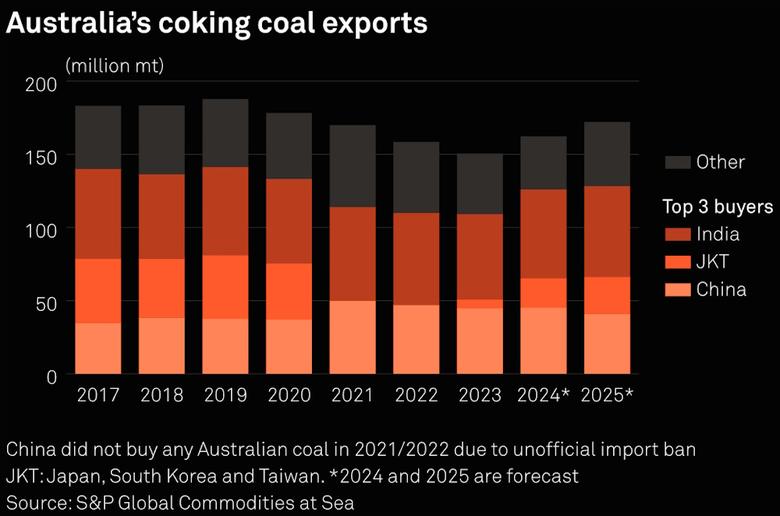

PLATTS - May 08, 2024 - India's rise as the world's top coking coal consumer and China's surging imports from Down Under are set to boost Australia's lead as the world's biggest producer of the steelmaking ingredient in the coming years.

Australia's total coking coal exports are expected to increase by 14% from 2023 levels to 171.9 million mt in 2025.

The world's second largest supplier Mongolia is forecast to boost exports only by 2.3 million mt, or 3%, during that period while Russian exports are on the decline.

India overtook China as the top coking coal buyer of both global and Australian supplies in 2018. Now India's decarbonization is set to supercharge its demand for metals.

Australian coking coal exports to China are bouncing back after Beijing lifted its unofficial ban in January 2023, and CAS forecast a quadrupling by 2025 from 2023 levels despite an expected 26% decline in China's overall met coal imports to 52.5 million mt during the same period.

India's total coking coal imports, meanwhile, are expected to rise to 83.9 million mt in 2025, from 73.8 million mt in 2023, according to CAS.

"Coking coal demand will be strong in coming years because the world's decarbonization will need high-grade coking coal and Australia is the source for it, and the buyers are many," Pranay Shukla, head of dry bulk freight and commodities research at S&P Global Commodity Insights, said in an interview.

"In China, 85% of its steel production still uses blast furnaces, which use coking coal, and China can't just switch to electric arc furnaces within a couple of years. It will take a long time," Shukla said. "Even the steel mills in Vietnam want Australia's high-quality coal, as do those in Europe despite players there working toward using hydrogen as a replacement for metallurgical coal in the longer term."

India on the move

India will be a major demand driver for coking coal as the country aims for 300 million mt of crude steel capacity by 2030, or nearly double the 2022 levels, said Paul Bartholomew, senior analyst for metals and mining research at S&P Global Commodity Insights.

Bartholomew, however, said India might struggle to achieve its target production.

"We think Indian steel capacity could reach around 200 million mt by 2025 based on new projects from companies such as JSW Steel and Tata Steel. Then there will be a second tranche of capacity increases over the second half of this decade which could get overall capacity up to closer to 240 million mt."

India is still "almost completely reliant on imported coking coal and will continue to do so, and much of that will come from Australia, even though there are plans to develop more domestic coking coal. That's always been a challenge because some of its key coking coal regions have populations living in them," Bartholomew said.

BHP Group CEO Mike Henry said in a February media call that India is "a country that's on the move, and you certainly see that coming through in the demand for coking coal ... with India being our largest market now for metallurgical coal."

Diversifying beyond China

Australia is producing less coking coal than it did in 2018 because of a lack of investment during low price periods, higher strip ratios and some logistical and labor challenges, Bartholomew said.

Yet exports are stronger this year over 2022, when a La Niña weather event had impacted Queensland coal mining operations over a two- to three-year period.

Following China's unofficial ban on coal from Down Under, Australia was able to find other customers to replace the lack of Chinese buyers in 2021 and 2022 by selling more to the mature existing customers like Japan, South Korea and India, the analyst said.

"Australia was also taking a greater market share of the Atlantic markets, including Europe -- markets which would have typically taken US or Canadian coal," Bartholomew said.

Upside price risk

Also working in Australia's favor is the fact that metallurgical coal is "fairly tight, and prices are not coming below the $200/t mark," Shukla said, referring to the Platts-assessed premium hard coking coal Australian FOB price. Platts is part of S&P Global Commodity Insights.

Supply disruptions therefore loom as "the major upside risk" to coking coal pricing, according to Vivek Dhar, mining and energy commodity research director at Commonwealth Bank of Australia.

"Modest disruptions risk pushing coking coal prices to $250/t to $300/t, while more severe disruptions can see prices track above $300/t like we have seen over the last six months," Dhar said. A small drop in China's coking coal supply can also "materially boost imports" given it supplies over 90% of its own needs, according to Dhar.

A return to La Nina weather conditions later this year would "worsen the wet season disruptions for Queensland," sending coking coal prices higher in the December 2024 and March 2025 quarters, Citi Research said in an April 15 note.

-----

Earlier: