CHINA NEED GAS & COAL

BLOOMBERG - May 13, 2024 - China is taking advantage of lower international prices for coal and natural gas to replenish stockpiles of power fuels ahead of another long, hot summer.

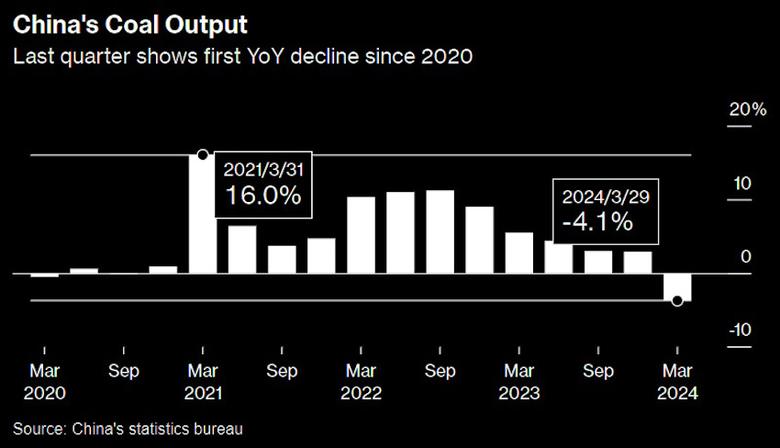

Gas imports through the end of April jumped 21% from the previous year, while coal purchases climbed 13%. The increase in coal in particular has defied predictions that imports would moderate from last year’s record-setting pace, and comes after domestic production posted its first quarterly drop since the third quarter of 2020.

Coal miners are wrestling with heightened scrutiny on safety after a spate of fatal accidents, as well as depleting quality after the rush to expand capacity in recent years. Producers of China’s mainstay fuel are also putting limits on output growth as Beijing’s deadline to peak coal consumption by 2025 approaches.

That’s forcing utilities to lean more heavily on imports, an advantage given relatively lower fuel costs on the global market. The Japan-Korea marker for liquefied natural gas, Asia’s benchmark, averaged just over $9 per million British thermal units in the first quarter, down from $18 in the same period in 2023. Newcastle coal futures in major exporter Australia averaged $127 a ton, from $236 in the prior year.

Ensuring power supplies has been a priority for policymakers since a series of embarrassing shortages in 2021 and 2022 forced widespread factory shutdowns. Meanwhile, another unusually hot summer in the northern hemisphere is forecast, which is likely to raise demand for airconditioning in coming months.

Even as China has dramatically ramped up wind and solar in recent years, its power demand, including from electric vehicles, continues to outpace new supply, creating an ever greater need for fossil fuels. This year China’s power consumption is expected to increase 8% in the first half, with peak demand expected to surpass last year’s record by 100 gigawatts — the equivalent of adding Australia to the grid.

Still, there are signs the country may have reached a tipping point where new clean energy installations are enough to meet additional usage, which will push fossil fuels and their emissions into a long-term decline. Gas and coal prices have also inched up in recent weeks, leading some gas buyers to offer to resell summer cargoes, suggesting that the surge in imports may cool.

-----

Earlier: