COMMODITIES : RUNNING AMOK

The Qatar Economic Forum week is ongoing in Doha & issues driving global boardroom conversations and spotlight the Gulf’s rising prominence are being laid out on the global table.

A deluge of data coming out of China this Friday brings about the topic on SemiConductors and efficiency on fintech to the spotlight yet again.

With an adress on fiscal stimulus on the European markets ongoing,the Yen rally is still steepening with intervention tools being subject to heavy activities throughout the week.

A reduction of JGB purchases on offer by the BoJ in the 5-10 year category from the previous 475bln Yen to 425bln Yen is one of the activities that have been occurring in the Japanese Bond Markets.

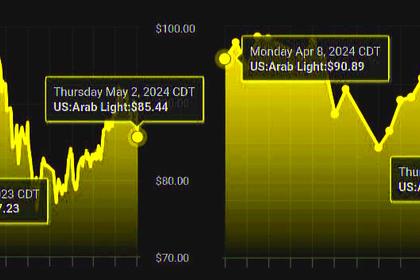

Oil risk remains on the balance,somewhat muted on risk as the weight on geopolitics in the vast commodities sector is starting to pinch,with WTI Crude trading at $79/bbl average with a solid floor of $77/bbl & BRENT trading at $83.22/bbl.OPEC Basket stands at $83.60/bbl.

On the FX Front ; We have seen sustainable moves on the Norwegian Krone #NOK vis a vis the Oil Markets correlation.This should be bread and butter for the month.

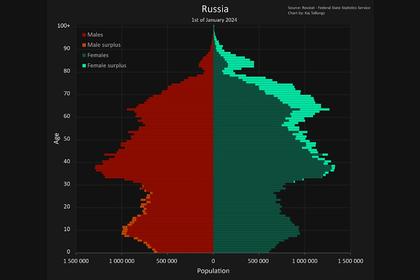

OECD raised its GDP growth forecast for Russia for 2024.

According to the OECD's new report, global GDP growth is expected to be steady at 3.1% in 2024, up from a February estimate of 2.9%, with a slight increase to 3.2% projected for 2025 (previously projected at 3%). However, recovery rates will vary significantly by region, with weaknesses in certain Western economies such as Germany, Japan, and the United Kingdom being offset by growth in the USA, India, China, and Russia.

The OECD's growth forecast for Russia has been significantly revised upward—from 1.8% to 2.6% for this year, placing it sixth globally.

Expectations for 2025 remain unchanged at 1% growth. Previously, the IMF updated its forecast for Russia for 2024 from 2.6% to 3.2%, and for 2025 from 1.1% to 1.8%.

The Russian Ministry of Economic Development expects growth of 2.8% and 2.3% for 2024 and 2025, respectively.

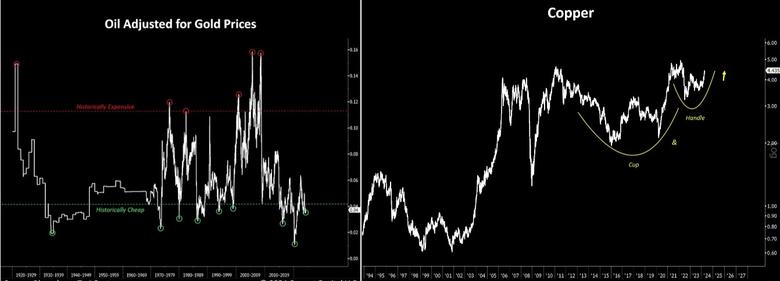

Dr.Copper has been interesting especially on the mining front,specifically on BHP(trading at 43.15(-1 60%) YTD)as it needs a deal for copper output.This creates an entropy with non linear development in the commodities markets as Anglo-American (trading at 2615.50(+9.89% YTD)) has their cards stacked to the river in terms of long term risk baskets.

Massive restructuring to fend off its rivals (BHP) seems to be the agenda for the latter.Anglo has a lot of components to its operations & by streamlining,it creates efficiency.

Copper is an essential mineral for energy transition.

Still on commodities;Tin Rallies as Key Price Spread Twists Into steep backwardation.

Three-month futures jumped as much as 3.6% to hit the highest level since June 2022, taking the soldering metal’s gain this year to 32%.May contracts spiked to close at a $340 premium to June Futures.

On the US Front ;

FED has the inflation data on a periscope,Core inflation is running at 4%, that's a double the target & a probable hike would be surprising to the markets with respect to the CPI Data coming through on Wednesday.

An imposition of a levy on Chinese Semiconductors occurred,stating that certain minerals to are to face a 25% tariff by year end.

The levy has been imposed on Chinese chips,minerals & EVs. It seems that high geopolitical risk is reshaping US Economic policy.

From the US perspective as quoted by Janet Yellen : Target is on US concerns and not broad based.

They say that the Road to hell is paved with good intentions,will a policy tug of war ensue amongst these prolific trading nations ?

Progress is the driver,efficiency is the fuel,the road is the success.Investment for the next generation is the backbone of global economies.Think about it.

---

Andy Warr,

TophatFinanceGroup.

-----

Earlier: