OIL PRICE: BRENT NEAR $84, WTI ABOVE $79

РЕЙТЕР -

-----

Раньше:

2018, March, 14, 11:45:00

REUTERS - U.S. West Texas Intermediate (WTI) crude futures CLc1 were at $60.77 a barrel at 0753 GMT, up 6 cents, or 0.1 percent, from their previous settlement. Brent crude futures LCOc1 were at $64.62 per barrel, down just 2 cents from their last close.

|

2018, March, 7, 15:00:00

РЕЙТЕР - К 9.17 МСК фьючерсы на североморскую смесь Brent опустились на 0,85 процента до $65,23 за баррель. Фьючерсные контракты на американскую лёгкую нефть WTI к этому времени торговались у отметки $62,07 за баррель, что на 0,85 процента ниже предыдущего закрытия.

|

2018, March, 7, 14:00:00

EIA - North Sea Brent crude oil spot prices averaged $65 per barrel (b) in February, a decrease of $4/b from the January level and the first month-over-month average decrease since June 2017. EIA forecasts Brent spot prices will average about $62/b in both 2018 and 2019 compared with an average of $54/b in 2017.

|

2018, March, 5, 11:35:00

РЕЙТЕР - К 9.28 МСК фьючерсы на североморскую смесь Brent поднялись на 0,33 процента до $64,58 за баррель. Фьючерсные контракты на американскую лёгкую нефть WTI к этому времени торговались у отметки $61,44 за баррель, что на 0,31 процента выше предыдущего закрытия.

|

2018, March, 4, 11:30:00

МИНФИН РОССИИ - Средняя цена нефти марки Urals по итогам января – февраля 2018 года составила $ 65,99 за баррель.

|

2018, February, 27, 14:15:00

РЕЙТЕР - К 9.18 МСК фьючерсы на североморскую смесь Brent опустились на 0,15 процента до $67,40 за баррель. Фьючерсные контракты на американскую лёгкую нефть WTI к этому времени торговались у отметки $63,80 за баррель, что на 0,17 процента ниже предыдущего закрытия.

|

2018, February, 27, 14:05:00

МИНФИН РОССИИ - Средняя цена на нефть Urals за период мониторинга с 15 января по 14 февраля 2018 года составила $66,26457 за баррель, или $483,7 за тонну.

|

OIL PRICE: BRENT NEAR $84, WTI ABOVE $79

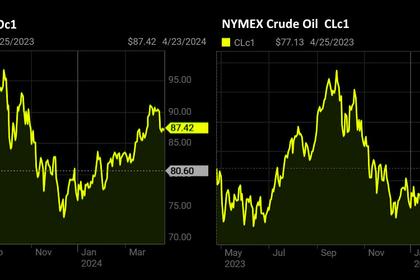

REUTERS - May 3, 2024 - Oil prices edged up in early trade on Friday on the prospect of OPEC+ continuing output cuts, but the crude benchmarks were headed for weekly losses on U.S. economic uncertainty and limited crude supply disruptions caused by the Israel-Hamas war.

Brent crude futures for July rose 16 cents to $83.83 a barrel by 0008 GMT. U.S. West Texas Intermediate crude for June was up 19 cents to $79.14 per barrel.

Still, both benchmarks were on track for weekly losses as investors worried about the prospect of higher-for-longer interest rates curbing growth in the U.S., the top global oil consumer, while the war in the Middle East showed little sign of disrupting global oil supplies.

Brent headed for a 6.3% weekly decline, while and WTI moved towards a loss of 5.6% on the week.

The drop comes just weeks ahead of the next meeting of the Organization of the Petroleum Exporting Countries and allies led by Russia, together called OPEC+.

Three sources from OPEC+ producers said the group could extend its voluntary oil output cuts of 2.2 million barrels per day beyond June if oil demand fails to pick up, but the group has yet to begin formal talks ahead of the June 1 meeting.

The market is now looking towards U.S. economic data and indicators of future crude supply from the world's top producer.

On Friday, the U.S. Bureau of Labor Statistics releases its monthly nonfarm payroll report, which is a measure of the strength of the country's job market and is considered by the Federal Reserve when setting interest rates. Higher rates typically weigh on the economy and that can reduce oil demand.

Also on Friday, energy services firm Baker Hughes (BKR.O), opens new tab is due to release its weekly count of oil and gas rigs, an indicator of future crude output.

-----

Earlier:

2024, April, 26, 06:55:00

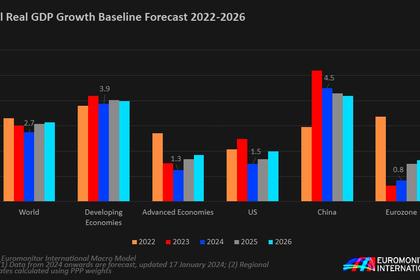

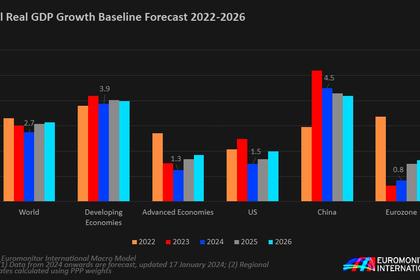

РОСТ МИРОВОЙ ЭКОНОМИКИ

В ходе заседания было отмечено, что мировая экономика демонстрирует рост, но он сегментирован, а основной вклад в глобальный рост обеспечивают страны с формирующимися рынками, проводящие ответственную макроэкономическую политику.

2024, April, 26, 06:40:00

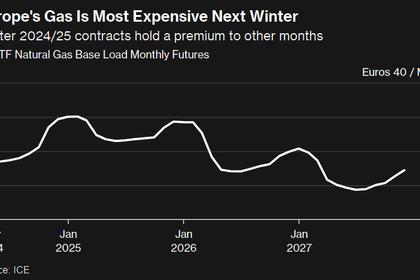

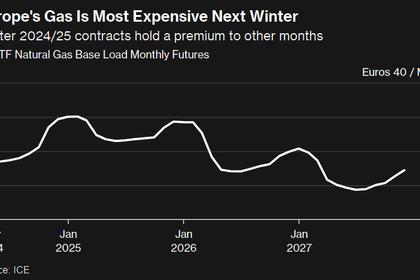

EUROPEAN ENERGY UNCERTAINTY

Worries include uncertainty over remaining Russian flows through Ukraine and rebounding gas demand in Asia. A colder-than-normal winter spurring consumption at home is also seen as more likely after two consecutive mild ones.

2024, April, 26, 06:35:00

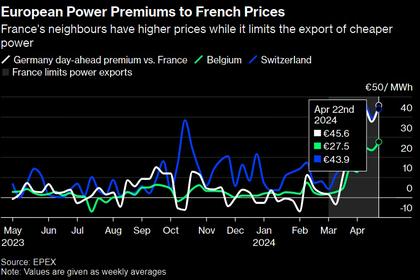

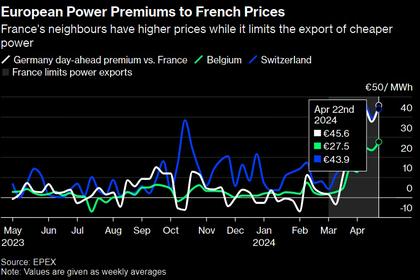

EUROPEAN ELECTRICITY PRICES UP

The capacity for transmitting electricity to Belgium, Germany, Switzerland and Italy has been reduced since early March, according to French power-grid operator RTE. That’s depriving those nations of exports of cheaper French nuclear power and boosting wholesale prices across the region.

2024, April, 23, 06:55:00

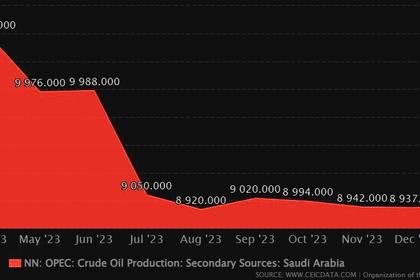

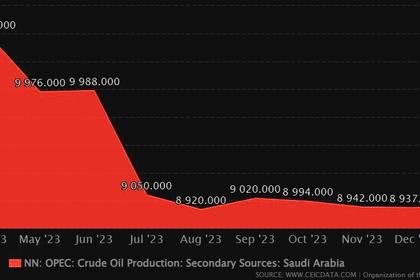

SAUDI'S CRUDE PRODUCTION UP

The data indicated that the Kingdom’s crude exports rose to 6.32 million bpd, reflecting a monthly increase of 0.32 percent.

2024, April, 17, 06:50:00

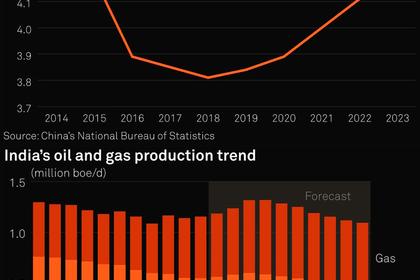

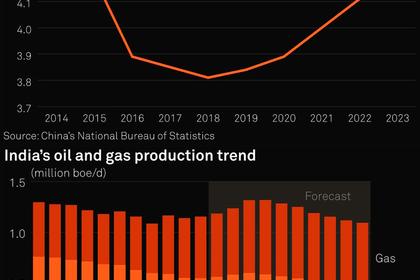

CHINA, INDIA OIL & GAS PRODUCTION UP

India's overall oil and gas output rose 1.3% on the year to 1.15 million boe/d in 2023. China's upstream story sounds relatively more promising at this stage.

All Publications »

Tags:

OIL,

PRICE,

BRENT,

WTI,

OPEC,

RUSSIA,

SANCTIONS