OPEC+ RUSSIA VS SANCTIONS

PLATTS - May 13, 2024 - Deputy Prime Minister Alexander Novak is being given a new, broader economic role including combating sanctions in Russia's new government, adding to his previous brief overseeing relations with the OPEC+ oil producer group.

Novak is taking on additional responsibility for economic development and anti-sanctions measures after former economic development minister Andrey Belousov was named new defense minister in a dramatic change of guard during the third year of full-scale war in Ukraine.

"Beside the energy sphere, Alexander Novak will manage the economic sphere (questions of economic development and anti-sanctions measures)," the government's website said.

Novak "has the necessary management experience," government spokesman Boris Belyakov said.

The announcement underlines Novak's growing importance under President Vladimir Putin, who has praised his handling of ties with oil producer group OPEC+, which is spearheaded by Russia and Saudi Arabia.

Novak was energy minister when Russia, Azerbaijan, Kazakhstan and other smaller producers came together with OPEC in 2016 to form OPEC+, going on to help orchestrate production cuts when prices collapsed in 2020 in response to the pandemic.

Nikolai Shulginov is being replaced in the role of energy minister by Sergei Tsivilyov, formerly governor of the Siberian coal mining region of Kemerovo. Tsivilyov will "ensure further development" of the coal sector, Belyakov said, implying Novak will remain pre-eminent in oil and gas.

At a weekend meeting in the Duma parliament, Novak laid out plans for a "national project" to boost economic competitiveness and make Russia the world's fourth-largest economy by 2030, according to Russian media. Rhetorically, he has long emphasized the view that US and EU-led sanctions can spur an economic reorientation by Russia that was already needed.

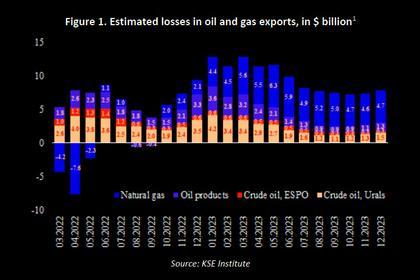

The war in Ukraine and subsequent sanctions have spurred a major shift in Russian logistics, with oil being sent to new destinations such as India on a growing fleet of "shadow" tankers intended to overcome financial and other restrictions. Simultaneously, Russia has been trying to overcome curbs on technology imports from the EU and US, particularly in its refining sector.

The expansion of his role "is further proof of Putin's trust in Novak," said Paris-based Russia analyst George Voloshin. "Based on what we know, Novak will from now on also be responsible for economic mobilization, which practically means countering the effect of Western sanctions, making sure that the defense industry gets all it needs including the tackling of backlogs, and coordinating economic policies more broadly," he said.

Logistics, refining

Voloshin added that Tsivilyov has family ties to Putin and predicted that the refining sector would continue to be largely overseen by first deputy energy minister Pavel Sorokin and other officials.

Other nominations include the elevation of former transport minister Vitaly Savelyev to deputy prime minister with responsibility for transport and logistics. The role of transport has become especially important as Russia tries to reorient its commodity exports to Asia and increase the effectiveness of the so-called Northern Sea Route through the Arctic.

Overcoming bottlenecks is also seen as vital for ensuring domestic fuel supply in the face of Ukrainian attacks on Russian refineries. Savelyev as transport minister already "ensured the continuity of the sector ...in the face of Western sanctions," Belyakov said, adding that he would be tasked with creating "new logistical corridors and realization of major projects."

The shake-up comes as the next meeting of OPEC+ ministers is due June 1, with tensions expected over a number of countries failing to fulfil production cuts, including Russia.

The latest Platts OPEC+ survey by S&P Global Commodity Insights shows Russia began to implement a deeper output cut in April, potentially linked to attacks on its refineries, but still missed its target.

Russia lowered production by 130,000 b/d to 9.29 million b/d, missing its target of 9.099 million b/d, the survey found. Still, this is its lowest level since May 2022, shortly after the invasion of Ukraine shocked markets.

The Platts Dated Brent benchmark was assessed at $83.08/b on May 10, down 37 cents on the day. Platts is part of Commodity Insights.

-----

Earlier: