RUSSIAN GAZPROM WITHOUT EUROPE

REUTERS - May 16, 2024 - Gazprom (GAZP.MM), opens new tab CEO Alexei Miller was not on Russian President Vladimir Putin's state visit to China because he was holding talks with the Iranian leadership, the world's biggest natural gas company said on Thursday.

Gazprom, which holds about 16% of global gas reserves and employs 492,200 people, was once one of Russia's most powerful corporate empires - so powerful it was known as "a state within the state".

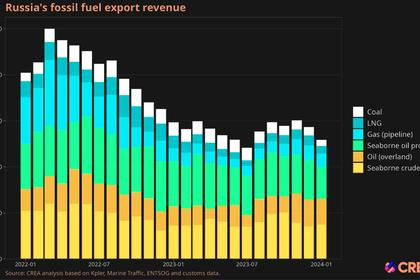

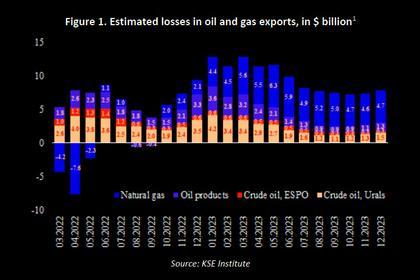

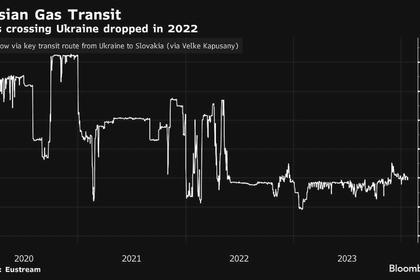

But the loss of a massive chunk of the European gas market due to Russia's war in Ukraine has hit it hard.

"Alexei Miller held talks with the Iranian leadership on the dates of Putin's visit to China," Gazprom said.

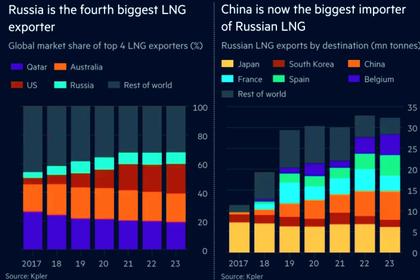

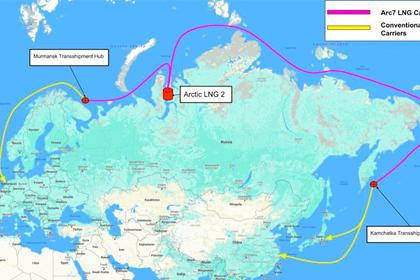

Russia is seeking to boost its pipeline gas sales to China, the world's largest energy consumer and top buyer of crude oil, liquefied natural gas (LNG) and coal.

Leonid Mikhelson, the boss of Novatek, Russia's largest LNG producer, was on Putin's China trip.

One source, who spoke to Reuters on condition of anonymity, said the fact that Mikhelson was in China but not Miller showed the growing importance of LNG and the influence of Mikhelson.

This highlights the interest in LNG projects, the source said. "The future, in general, belongs to LNG."

It was not immediately clear what Miller, 62, a close ally of Putin who has run Gazprom since 2001, was talking to Iran about.

Gazprom said on Wednesday that Miller was on a working visit to Iran, a major producer of natural gas, where he met Iran's First Vice President Mohammad Mokhber and Iranian Oil Minister Javad Owji.

Gazprom, thus far, is Russia's biggest corporate casualty of the war: deprived of many of the lucrative contracts to supply Europe, Gazprom has struggled to fill the gap with either sales to the domestic market or big-ticket exports to China.

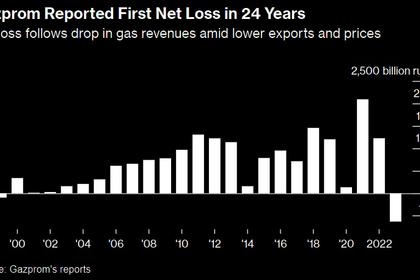

The company plunged to a net loss of 629 billion roubles in 2023, its first annual loss in more than 20 years, amid dwindling gas trade with Europe, once its main sales market.

GAS TRADE

After the Soviet Union discovered vast gas and oil reserves in Western Siberia in the 1950s and 1960s, Moscow and West Germany agreed in the 1970s to build pipelines to the West partly in exchange for high quality pipe from Germany.

The 50-year trade, which brought cheap gas from Western Siberia to European manufacturing, was crafted over decades and against fierce opposition from the United States.

After Putin sent troops into Ukraine in 2022, some of its biggest EU clients cut gas imports from Russia's Gazprom, whose boss in 2007 promised it would one day be a $1 trillion company. Its current market capitalisation is around $41 billion.

Turning the Russian gas trade towards China has been difficult: China is 2,800 km (1,700 miles) away - across swathes of Siberia's wild tundra - from Russia's "gas capital" of Novy Urengoy in the Arctic.

Natural gas supplies began via the Power of Siberia Pipeline in late 2019 and Russia aims to raise the annual exports to around 38 bcm from 2025.

Moscow also has an agreement with Beijing for another 10 bcm per year from a yet-to-be built pipeline from the Pacific island of Sakhalin.

Russia has been in talks for years about building the Power of Siberia-2 pipeline to carry 50 billion cubic metres of natural gas a year from the Yamal region in northern Russia to China via Mongolia.

-----

Earlier: