RUSSIAN OIL EXPORTS UP

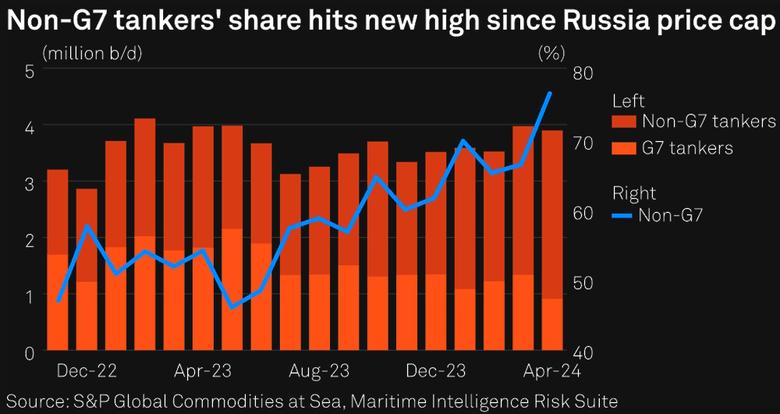

PLATTS - May 10, 2024 - Russian crude exports by non-G7 tankers hit a new high in April since the price cap came into effect, with Russia's state carrier, Sovcomflot, returning to India after New Delhi reportedly moved to address payment and insurance issues.

Data from S&P Global Commodities at Sea and Maritime Intelligence Risk Suite shows that nearly 3 million b/d, or 76.6%, of Russian exports last month were lifted by tankers not flagged, owned or operated by companies based in the G7, the EU, Australia, Switzerland and Norway, and not insured by Western protection and indemnity clubs.

This compared with 2.6 million b/d, or 66.4%, of the OPEC+ member's exports on non-G7 tankers in March. April's volume and share were both the highest monthly reading since December 2022, when the G7 and its allies banned maritime services firms subject to their jurisdictions from facilitating Russian crude exports unless the oil was sold for no more than $60/b.

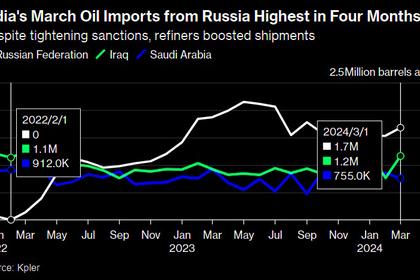

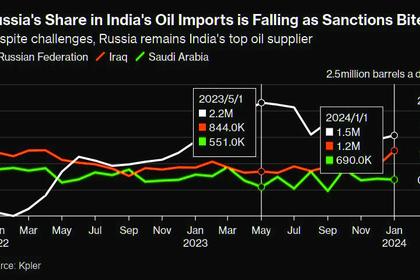

The non-G7 fleet, mainly comprising shadow tankers, was responsible for loading 45.7 million barrels in India-bound shipments in April -- also the highest since the price cap and a jump from 34.2 million barrels in March -- according to the preliminary data, which reflected a recent CAS methodology change to count more CPC Blend as Russian exports.

Last month, 14 Sovcomflot-owned Suezmax and Aframax tankers were shipping 11.3 million barrels of Russia's flagship Urals crude to India, which has emerged as the largest Russian crude buyer, compared with two ships with 1.5 million barrels in March.

Nikesh Shukla, a tanker analyst with S&P Global Commodity Insights, said the dramatic return of Russia's largest tanker firm reflected Indian's willingness to continue purchases of Russian crude even though there could be "minor hiccups" occasionally amid Western sanctions.

After the US sanctioned Sovcomflot in February to undermine Russia's war chest against Ukraine, Indian refiners decided to reject Russian oil delivered by the company in the following month.

But the Indian central bank recently amended financial rules to allow Russia to use rupees accumulated via oil sales in vostro accounts to invest in equity, debt, government securities and infrastructure projects in India, according to media reports. This could incentivize freight payments to Sovcomflot in the Indian currency to bypass the US sanctions.

Separately, India's Directorate General of Shipping is now allowing four Russian companies to provide marine insurance to tankers, which could enhance third-party liabilities coverage for ships operating outside of the price cap.

"India will find a way ... to continue to buy Russian oil," Shukla said, referring to the payment and insurance issues.

Shipping capacity

Latest CAS data shows total Russian seaborne crude exports reached 3.9 million-4 million b/d in March and April, boosted by multi-month high shipments to India, and around the highest since Russia invaded Ukraine in February 2022. Industry participants attributed the high volumes to more export availability amid refinery repairs following Ukraine's drone attacks, as well as sufficient shadow tanker capacity.

The shadow fleet operated by sanctioned state interests and new, opaque owners expanded to 591 crude and product tankers as of April, according to a joint study by Commodity Insights and S&P Global Market Intelligence. This compared with 443 such ships in February 2023 in a similar study by Market Intelligence.

With a different methodology and scope of analysis, shipbroker BRS estimated the number of "grey" tankers, which could help Russia trade above the cap, increased to 787 as of early May from 675 in end-2023.

"As we have stated periodically throughout the past 18 months, analysis suggests that there is enough grey dirty capacity tonnage for Russia," BRS said in a note.

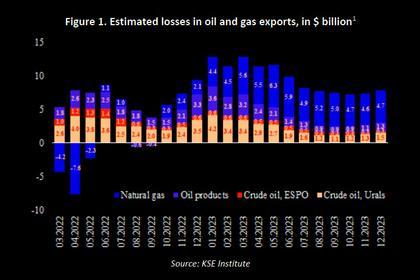

Urals -- Russia's main crude export grade -- traded above $60/b on an FOB Primorsk basis for most of this year and averaged $72.552/b in April, according to Commodity Insights data.

The price strength, coupled with tighter sanctions enforcement, led to a continued withdraw by G7-linked tankers from Russia in recent months, even as crude shipments by Greek operators marginally rose to 16.7 million barrels in April from 15.6 million barrels in March.

Preventing maritime firms from assisting Russia in circumventing the G7's price cap remains a key target for Western policymakers, and there have been reports that the EU is proposing further clampdown measures on shadow tankers in its 14th sanctions package.

But excluding the tankers from global trade could "send tanker markets into an upward spiral" and cause "an unwanted economic shock," BRS said.

"We argue that if any further regulation was to occur, it would have to be gradual and targeted to impact only the units representing the highest risk" of breaching the cap, according to its note.

-----

Earlier: