2024-05-14 06:25:00

U.S. ENERGY TRANSITION TASK

By ED REID Vice President, Marketing (Retired) / Executive Director (Retired) /

President (Retired), Columbia Gas Distribution Companies / American Gas Cooling Center / Fire to Ice, Inc.

Earlier:

2024, May, 7, 06:30:00

U.S. ELECTRIC GENERATION TO 13,000 TWH

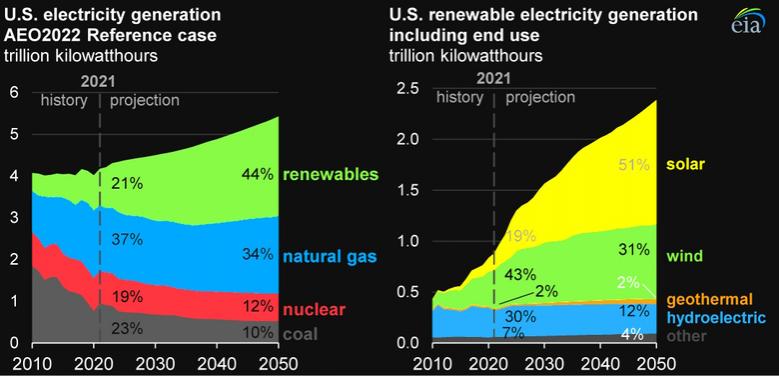

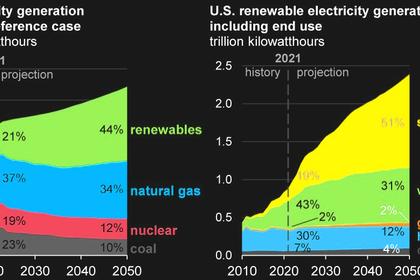

The transition to all-electric everything would require an increase in electric generation to approximately 13,000 TWH from a storage supported predominantly intermittent generation fleet of approximately 6,000 GW with a capacity factor of approximately 30%, depending on the mix of wind and solar in the generation fleet.

2024, May, 7, 06:25:00

U.S. ELECTRICITY DEFICIT

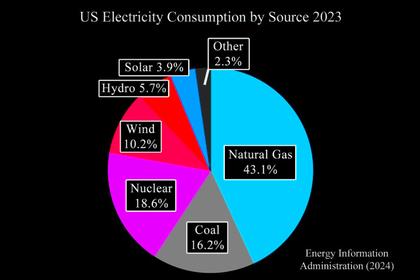

For 20 years, US electrical power policy has been dominated by efforts to try to “mitigate” global warming, believed to be caused by human greenhouse gas emissions.

2024, May, 6, 06:40:00

U.S. ENERGY SAVINGS $7.6 BLN

Over 30 years of shipments, these updated standards are expected to save Americans $124 billion on their energy bills and reduce 332 million metric tons of dangerous carbon dioxide emissions—equivalent to the combined annual emissions of nearly 43 million homes.

2024, April, 23, 06:40:00

U.S. CLEAN ENERGY INVESTMENT $1.93 BLN

The projects announced today are addressing critical needs across the clean energy economy, including grid components (e.g., transformers), electric vehicle components and chargers, solar components, clean steel, critical materials processing and recycling, and other clean energy products.

2024, April, 8, 06:40:00

U.S. CLEAN ENERGY TAX CREDITS $4 BLN

Projects selected for tax credits under the Qualifying Advanced Energy Project Tax Credit (48C), funded by President Biden’s Inflation Reduction Act, span across large, medium, and small businesses and state and local governments, all of which must meet prevailing wage and apprenticeship requirements to receive a 30% investment tax credit.

2024, March, 13, 06:55:00

U.S. ENERGY INVESTMENT 2025: $44 BLN

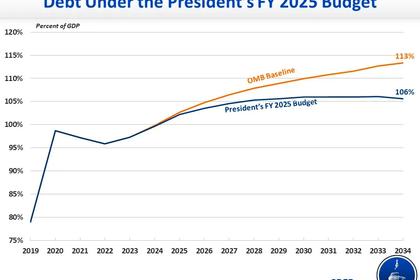

The DOE Budget requests $51 billion in discretionary budget authority for 2025, a $3.6 billion or 7.5 percent increase from the 2023 level.

2023, November, 23, 06:35:00

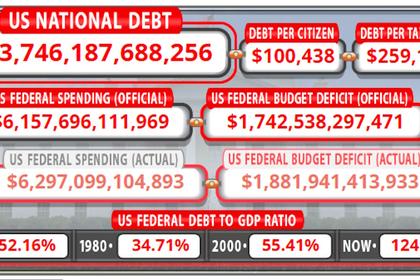

U.S. DEBT $33.7 TLN

There is no rocket science to the three basic choices for grappling with a national debt that has doubled in just the last decade and stands at $33.7 trillion, around 124% of GDP: raise taxes, cut spending or do a combination of the two.