THE FAILURE OF THE ENERGY TRANSITION

ROSNEFT - 08 June 2024 - Igor Sechin delivers a keynote speech on the Energy Panel of SPIEF-2024

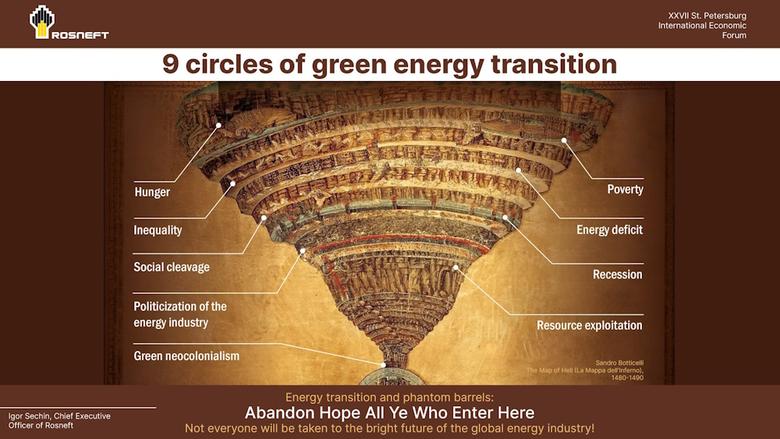

The Energy Panel organized with the support of Rosneft was held as part of the 27th St. Petersburg International Economic Forum. The keynote speech entitled “Energy transition and phantom barrels: Abandon hope, all ye who enter here. Not everyone will be taken to the bright future of the global energy industry!” was delivered by Igor Sechin, Chief Executive Officer of the Company.

Head of Rosneft presented an analysis of the current situation in the energy market, which is experiencing an imbalance.

Igor Sechin paid special attention to the energy transition, which Igor Sechin paid special attention to the energy transition, which, despite the efforts of its adherents, is failing. Huge investments made over the past decades in the development of alternative energy sources have not led to the displacement of fossil fuels from the energy market, and the green transition strategy in its current form cannot ensure the sufficiency, availability and reliability of energy sources.

Head of Rosneft also noted the need to search for new opportunities and ways to develop the global energy sector within the framework of a multipolar world.

The Energy Panel at SPIEF was also attended by the heads of major energy companies and leading market experts, who presented their vision of the energy transition issues and gave a forecast of oil prices in the near future.

Presentations were made by Zhang Daowei, Vice President of CNPC; David Gadzhimirzayev, General Director of AO Technologies OFS; Rovshan Najaf, President of the State Oil Company of Azerbaijan (SOCAR); Jose Felix Rivas, Venezuela's Sectoral Vice President of Economy; Martin Wiewiorowski, Chairman of the Board of Directors of Advantage Energy; and Nobuo Tanaka, Chairman of the Supervisory Board of the Japanese government's non-profit initiative for the development of low-carbon technologies.

The session was moderated by Alexander Dynkin, Academician of the Russian Academy of Sciences and President of the Institute of World Economy and International Relations of the Russian Academy of Sciences.

ALTERNATIVE ENERGY SOURCES CANNOT ENSURE RELIABILITY OF SUPPLY

In his speech, Igor Sechin recalled the research conducted in 1976 by the future Nobel Prize winner in Physics, Academician Pyotr Kapitsa. Based on basic physical principles, the scientist predicted the possibility of a global energy crisis due to insufficient efficiency of all types of alternative energy.

“As Kapitsa argued, the key characteristic of any type of energy is the density of its energy stream. By this parameter, such fossil fuels as oil (provides 195 W/m2) and gas (482 W/m2) are far ahead of solar energy (6.6 W/m2) and wind energy (1.8 W/m2) that, among other disadvantages, have an uneven or, to put it in more scientific terms, stochastic nature of energy generation,” Igor Sechin said.

Head of Rosneft noted that from the studies available at the moment, hydrogen is considered to be the most promising type of "clean" fuel.

However, there is still no commercially feasible production technology, logistics and, most importantly, sales markets for it. It is also necessary to take into account the low efficiency so far due to the fact that during hydrogen production the energy consumption spent for electrolysis is greater than the amount of energy obtained at the output. Thus, alternative energy sources are not yet able to ensure either the reliability of supply or optimum technical and economic performance,” Igor Sechin said.

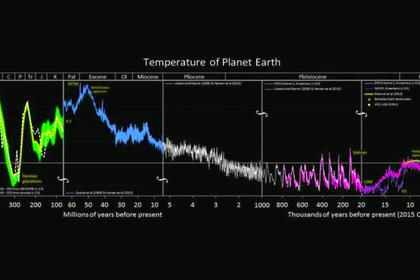

Head of Rosneft also said that the statement about the link between emissions and climate change requires an objective assessment, and without it giving priority to the anthropogenic factor in climate change has no grounds.

The Earth's climatic cycles develop according to the natural laws inherent in any cosmic body and are influenced by such basic factors as the condition of the atmosphere, the activity of the Sun, the distance of the Earth's orbit from it, the angle of inclination and position of other planets relative to our planet, and many others.

Climatic changes on the planet occur, among other things, as a result of fundamental natural phenomena. A prime example is "super volcanoes", whose eruption of lava and ash emissions exceed 1,000 cubic kilometers. These disasters can radically change the landscape and provoke sudden cold spells, the so-called "volcanic winters". For example, the eruption of the Indonesian super volcano Toba that occurred 74 thousand years ago, caused global temperatures to drop between 3.5 and 9 degrees Celsius as a result of the release of more than 2 billion tons of sulfur dioxide into the atmosphere. Comparable eruptions have occurred three times in the Yellowstone Province in the United States, and the last known supervolcanic eruption, Taupo, occurred in New Zealand about 25 thousand years ago.

“According to a number of reputable scientists, such as the Nobel Prize winner in physics John Clauser, the main cause of the Earth's climate change is the natural self-regulation mechanisms of the planet, not the "human factor”,” Igor Sechin said.

Atmospheric carbon dioxide concentration and air temperature have changed continuously over the past 600 million years, and almost all of these changes have occurred without the impact of fossil fuels or humans. Having reviewed information on temperature for ten thousand years, modern scientists concluded that since the end of the last ice age there have been nine warming periods and during seven of them temperatures were higher than today, noted head of Rosneft.

“The proponents of the anthropogenic factor theory present the energy transition to us as an illusion of saving the world. Now, when we have already accumulated some experience of the energy transition, it is clear that neither its goal nor, accordingly, the preparation for it have been elaborated in accordance with the tasks and needs of the mankind, such as infrastructure, financing, supply of raw materials and availability of the technologies needed for this,” Igor Sechin summed up.

ILLUSION OF “GREEN” TRANSITION

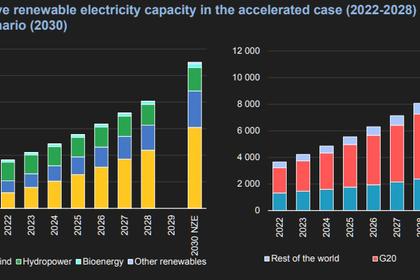

According to Rosneft CEO, despite about 10 trillion US dollars invested in the energy transition over the past two decades worldwide, alternative energy sources have failed to replace traditional fuels. Today, wind and solar power provide less than 5% of the world's energy production, and electric vehicles account for about 3%.

Over the same period, oil, gas and coal consumption grew by a cumulative 35%, while their combined share of the global energy mix remained unchanged. Moreover, oil and coal consumption and the use of gas in power generation reached a new record in 2023, Sechin noted.

“There are no profit-making sources for the “green” transition, and its implementation is an illusion, which leads to withdrawal of investments from the traditional energy sector. That is, there will be neither,” head of Rosneft summarized.

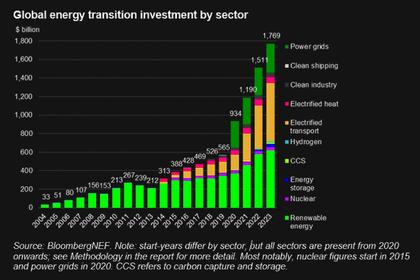

At the same time, the energy transition itself is clearly underfunded. In order to meet the Paris Agreement targets, by 2030 the global spending on climate change will need to be about $9 trillion per year, which is 5 times as much as was spent in 2023. This number equals almost 10% of global GDP and is more than 3 times higher than the annual investment in global energy. It is also equivalent to the combined GDP of France, the UK and Italy. In total, to meet the Paris Agreement targets by 2050 will require more than 270 trillion dollars of investments.

Igor Sechin noted that the climate agenda will require creating a new type of infrastructure, as has been the case many times before, when in the 19th century increasing coal production required huge investments in mines, canals and railroads; developing the oil industry in the 20th century required wells, pipelines and refineries; and generating power required constructing power plants and developing a sophisticated power transmission network system.

FRIENDS WE MIGHT BE, BUT WE KEEP OUR TOBACCO APART

Head of Rosneft believes that the idea of energy transition is about strengthening the unipolar structure of the world order. The concept of energy transition is based on the discrimination against the entire world, where the interests of allies can be sacrificed at any moment. "Friends we might be, but we keep our tobacco apart," he quoted a Russian saying.

“This was especially evident when implementing the project of "saving" Europe from purported dependence on Russian energy resources. In fact, by sacrificing its energy security, the EU also gave up its sovereignty,” Igor Sechin said.

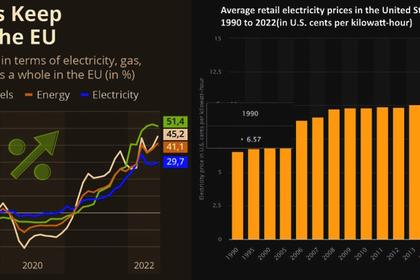

According to data provided by Chief Executive Officer of Rosneft, after having reduced its purchases of Russian energy, the European Union spent more than $630 billion on gas import from other countries in 2021 – 2023. This value is comparable to Europe's total gas spending over the previous eight years. European investments into “green” energy over the same period are nearing this amount. This figure is also comparable to the GDP of Sweden and Poland and almost four times higher than the combined GDP of the Baltic states.

According to Rosneft CEO, increased gas spendings are eating up the margin of such energy-intensive industries as steel making, fertilizers, chemicals, ceramics and glass. As a result, the manufacturing activity in the Eurozone has been on the decline since the middle of 2022, and 32% of German companies are already planning to relocate their manufacture capacity abroad.

EUROPEANS ARE GETTING POORER WITHOUT RUSSIAN ENERGY RESOURCES

For the first time in many decades, Europe is facing a new reality - Europeans have become poorer, stated Rosneft Chief Executive Officer. According to Sechin, despite government subsidies, the household gas prices in European Union almost doubled between 2021 and 2023, forcing “European households to reduce gas consumption by unprecedented volumes”.

“Because of the price shock, the gas demand in household and commercial sectors of Europe dropped by more than 20% in the past two years and continues its fall this year. As a result, for the first time in many decades, Europe is facing a new reality - Europeans have become poorer,” head of Rosneft stated.

Increased gas spendings are eating up the margin of such energy-intensive industries as steel making, fertilizers, chemicals, ceramics and glass. “As a result, the manufacturing activity in the Eurozone has been on the decline since the middle of 2022,” head of Rosneft said.

In effect, Europe is meeting its emissions reduction targets by directly cutting energy consumption and slowing down the economic growth. “The continuation of such policy may eventually destroy the European industry. As we all know, the lowest energy consumption is in the graveyard,” he added.

Head of Rosneft noted that Europe is lagging behind the US in terms of economic growth and average per capita income. According to the IMF, the European Union economy has grown by only 13% in US dollar terms over the past 15 years, whereas the growth of US economy has been 85% over the same period. According to Sechin, within the same time, the average per capita income in EU countries has fallen vis a vis most of the US states, and now it is 52% lower than the US average. “If this trend carries on, then already by 2035 the gap in GDP per capita between the US and the EU will be five-fold, meaning that it will be as between Japan and Ecuador today,” he summed up.

"GREEN" NEO-COLONIALISM

The "green" transition is a form of neocolonialism towards developing countries, head of Rosneft believes. “As for developing countries, the situation evolves even more unacceptably, when under the pretext of “green” transition in practice we see the construction of "green" neo-colonialism being implemented,” Igor Sechin said.

In expert estimates, within the period from 1990 to 2015, the "resource drain" from developing countries to developed countries exceeded $240 trillion. “Energy transition, i.e. the announced program of energy transition, is a powerful alias sanction barrier for 88% of the world's population, i.e. for all those who are not part of the "golden billion". These are essentially undeclared sanctions which are applied nonetheless,” Igor Sechin noted.

“The overall energy shortages, which resulted from the energy transition and a wide range of direct sanctions and unfair competition has driven the market off balance,” Rosneft CEO clarified, giving an example of sanctions imposed by the U.S. against Venezuela, Iran, and Russia. Sechin added that these sanctions have affected a total of nearly 18 million bpd of oil production and helped the U.S. capture a significant share of the market. As a result of these policies, energy resources have turned into the principal export commodity of the U.S.

Igor Sechin recalled other U.S. methods used after the invasion of Iraq in 2003. Since that time the country's oil export revenues, which used to make up to 95% of its budget, have been flowing to the U.S. “This provides the US administration with full control over Iraq's financial system,” head of the Company noted.

According to Rosneft CEO, the approach the White House is taking towards Russia is different: the United States seeks to reduce Russia's oil revenues, meaning “oustering Russian oil maritime exports from the world market”.

Rosneft Chief Executive Director stated that the unilateral actions of the U.S. regulator lead to volatility and unpredictability of the energy market. Under the situation, U.S. companies have chosen to consolidate the industry: the volume of transactions and acquisitions in the US oil and gas sector last year reached $200 billion. In this case, the goal is not to increase production, but the role of profit. “Over the past two years, the five largest Western oil and gas companies have spent a record $220 billion on payouts to their shareholders, which is 30 % more than their investments over the same period,” head of Rosneft said.

“PHANTOM BARRELS” VS. OPEC+

According to Igor Sechin, the stockpiling of reserves by both Western and Middle Eastern companies, including the buildup of production capacity, may be an expectation of major market changes.

“The presence of such phantom barrels that can have a large-scale impact on the market will offset the impact of the voluntary production cuts undertaken by major OPEC members. This is also shown by market quotations, which went down after the recent decision by the ministers of the member countries,” head of Rosneft elaborated.

He said that the Gulf countries are also actively ramping up spare production capacity, streamlining sales channels and investing in assets in consumer countries. The four key OPEC members - Saudi Arabia, UAE, Kuwait and Iraq - already have significant spare production capacity of around 5.6 million bpd, which is equivalent to 13% of current OPEC+ production.

“Some time ago these countries announced their plans to further increase their capacity. In expert estimates by 2027 their combined spare capacity will increase by almost 2 million bpd,” head of Rosneft added.

At the same time, Igor Sechin believes that energy market's volatility and unpredictability may increase due to the forthcoming presidential elections in the U.S., where election sentiment depends, among other things, on the increase in the cost of a gallon of gasoline. “Thus, an average price is $3.6/gallon, and in some states such as California - $5.4/gallon,” Igor Sechin noted.

According to him, regulation of the industry can change if a certain candidate wins the upcoming elections. “The emerging risks suggest that there may be a Plan B in case of a special period for each major participant,” head of the Company said.

Sechin also noted that major U.S. companies are carrying out merger deals with other producers and increasing their own production capacity in order to secure higher profits and dividends. Meanwhile, production growth remains behind the scenes, as it requires capital expenditures that must be supported by high prices.

“So, Exxon is completing its merger with Pioneer, Chevron is closing its merger with Hess, OPEC+ has already announced its plans for a gradual return of volumes starting in September, and Aramco is conducting its secondary public offering. I am confident that Aramco's secondary public offering will be successful, attractive and efficient, and will be a historic event in the global oil industry,” Igor Sechin said.

Rosneft CEO also believes that the budgets of most OPEC+ member countries are able to withstand a possible drop in oil prices, which could be partially or fully offset by an increase in supply.

“In theory, for the Russian oil industry, a price decrease can mean the possibility of removing all restrictions related to price cap, while the revenue part of the approved federal budget is based on the crude price of USD 60/bbl. In these conditions, the ability of OPEC+ to promptly response to new emerging factors of influence will be of fundamental importance for stabilizing the world markets,” head of Rosneft summarized.

GLOBAL DEDOLLARIZATION

One of the key reasons for the beginning of the gradual dedollarization of the architecture of world finance was its use as a tool for pressure and manipulation, head of Rosneft said.

He reminded that since 2001, the dollar's share in international foreign currency and gold reserves has fallen from 71% to 58%. Sechin noted that the crisis of confidence in the U.S. dollar as a reserve currency has caused central banks in developing countries to favor other protective assets, including gold. As a result, its share in foreign exchange reserves has almost doubled over the past ten years.

“In addition to increasing the share of gold in reserves, developing countries are withdrawing gold reserves from the vaults in the United States and the United Kingdom. In particular, the Reserve Bank of India moved more than 100 tons of gold out of the Bank of England, a quarter of its reserves stored abroad. A number of countries, such as Saudi Arabia, Nigeria, South Africa, Egypt and others have taken similar decisions to repatriate gold reserves,” Rosneft Chief Executive Officer noted.

Sechin said that at the same time, over the past 15 years, the share of developing countries among foreign holders of U.S. Treasury bonds declined from 51% to 28%.

According to Sechin, the growth of US national debt is one of the important factor undermining confidence in the dollar and shifting problems from the financial sector to the energy market and the rest of the world.

“Over the past 20 years, the US has aggressively used the special status of the dollar to finance large-scale borrowings. As a result of such policy, in the last year the ratio of US government debt to GDP came close to 100%. To address the liquidity bubble, the US Federal Reserve was forced to raise interest rates in record time from near zero to 5.5%,” elaborated Rosneft Chief Executive Officer.

Sechin noted that so far, no practical steps have been observed to limit the growth of the national debt. On the contrary, now the U.S. continues to increase its debt at a record pace - by USD 1 trillion every 100 days.

“Interest payments on the national debt have already exceeded USD 1 trillion, which is higher than government spending on defense and health care. Last year, total U.S. Social Security and Medicare liabilities exceeded USD 250 trillion, including more than USD 70 trillion not supported by future revenues. In a high-rate environment, the U.S. budget deficit is already at 9% of GDP, four times the average of the last eighty years,” Sechin said.

To exemplify the consequences of such growth, he reminded of the British pound that was the world's reserve currency before World War II. “The increase of the UK government debt to 130% of GDP became one of the factors that put an end to the pound's dominance in the world,” Sechin said.

U.S. TECHNOLOGICAL SUPERIORITY COME AT A HIGH COST TO ITS ALLIES

U.S. efforts to maintain its technological superiority come at a high cost to its allies, Rosneft CEO believes. “The estimated cost of eliminating Chinese components for 5G network deployment in the UK alone exceeds USD 5 billion. For Germany, the figure is much higher,” Igor Sechin said.

This is about the imposition by the U.S. of barrier duties on renewable energy goods and equipment from China, which is a world leader in this field. As the Chinese Foreign Ministry rightly pointed out, according to the US logics, the subsidies it provides are considered "essential industrial investment" and the subsidies from other countries are seen as "disturbingly unfair competition".

“The use of technology access bans is yet another sanctions barrier,” Sechin noted.

REVISION OF THE “GREEN” GOALS

Igor Sechin said that governments, businesses and investors in Western countries are beginning to revise their approach to the "green" agenda, which is too expensive.

According to him, Europeans are already noticing that their countries' climate policies are hitting their own pockets, driving up energy, real estate, transportation and food prices. As a result, Europe's green agenda bill will soon exceed half a trillion euros, and this is far from a final figure. According to the German Chamber of Commerce and Industry, the management of more than half of the companies in Germany have a negative attitude towards the energy transition.

“Some EU countries, such as Germany, France, Belgium, Sweden and others, are already willing to reconsider their approach to meeting the goals of the so-called Green Pact for Europe. The World Bank, in a recent report, pushed the deadline for achieving the green transition goals ten years further, to 2060. We are convinced that the emission targets will be revised many more times,” head of Rosneft stated.

Speaking of majors, Igor Sechin noted that in the context of the revision of its own attitude towards the “green agenda”, Shell has already abandoned its goal of reducing emissions by 45% by 2035 and plans to cut staff in its climate change divisions.

The green transition has had a negative impact on UK’s bp. The company's bet on leadership in this industry has not worked out, and since the announcement of the new strategy to achieve carbon neutrality in 2020, the company's stock price has fallen by 3%, while the European and American supermajors' performance has grown more than 20-60%. “Investors openly refer to BP shares as “dead money,” Sechin noted.

In this respect, the management of the UK company has already publicly stated that its 2030 production decrease target may be adjusted, and they do not rule out additional exploration activity or acquisition of new oil and gas reserves, at the same time writing off significant resource base in Russia.

Head of Rosneft noted that over the year, bp's total debt increased by 12% and exceeded USD 64 billion as of the end of the 1st quarter of 2024. This is the maximum value for the last two years; it exceeds the combined figure of Exxon and Chevron (for the two companies - USD 62 billion). This dynamic has caused the UK company's credit rating to fall to the lowest among the supermajors due to its high debt load and weak balance sheet.

At the same time, investors are disenchanted with the “green transition” too, according to Sechin. Thus, Blackrock, the largest financial market operator and an apologist for the green transition, finds other uses for its investments other than “green” technologies. This includes the U.S. defense industry.

“Its investments in the five largest defense industry companies alone exceed USD 20 billion, that were originally intended for the green transition,” stated Sechin.

Head of Rosneft noted that BlackRock has planted its representatives directly into the White House administration, such as Brian Deese - director of the National Economic Council, Adewale Adeyemo - first deputy secretary of the U.S. Treasury, and Mike Pyle - counselor to the U.S. Vice President.

LARGEST CONTRIBUTION TO THE CLIMATE CRISIS

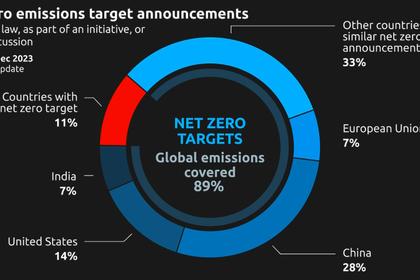

Igor Sechin believes that it is the developed countries, representing a minority of the world's population today, that have contributed most to the climate crisis.

Head of Rosneft cited data from the UN and non-governmental research institutes, which show that developed countries account for 65% of the cumulative emissions produced over the last 200 years, and that the world's 10% wealthiest population is responsible for half of all CO2 emissions. At the same time, the world's 1% wealthiest population accounts for twice as much carbon dioxide emissions as the poorest 50% of the world's population, and the entire African continent produces less than 4% of the world's emissions.

“The energy transition should be well-balanced and focused on addressing the interests of the majority that will ensure the growth of energy consumption in the coming years, i.e. developing countries,” Sechin emphasized.

He also noted that to achieve energy security, it is necessary to ensure the sufficiency, affordability and reliability of energy sources. Today's consumers are concerned not only about emissions, but also about the security of energy supply from new sources, as well as the reliability and convenience of using new technologies. “Unfortunately, the current green transition strategy does not address these needs,” Sechin said.

ELECTRIC VEHICLES ARE NOT A PANACEA

Rosneft Chief Executive Officer stated that declining demand for electric vehicles demonstrates the lack of planning and haste with which Western countries initially approached electrification of vehicles.

“It is obvious that, contrary to optimistic forecasts, electric vehicles are not a panacea for all environmental challenges. Demand for electric vehicles is slowing down worldwide, despite unprecedented efforts to support this industry on the part of the governments,” Sechin said.

He noted that revision of electric vehicle subsidy policies is currently underway. “While they succeeded in attracting buyers with high subsidies a few years ago, Western governments are now planning to impose taxes on electric vehicles to plug the emerged budget holes,” Sechin stated.

According to the IEA assessment cited by Rosneft Chief Executive Officer, by 2035, the shift to electric vehicles could result in a USD 110 billion shortfall in motor fuel taxes, which are allocated to maintain roads and improve transportation infrastructure.

Sechin reminded that to compensate the budget shortfall in revenue, a number of countries, including the UK, New Zealand, Israel and most North American states, are already imposing taxes on electric and hybrid vehicles, while Germany recently announced an end to incentives and accelerated removal of subsidies.

“As subsidies are reduced, it becomes clear that even in wealthy Western countries, buyers are not willing to overpay for an electric car. On top of the high price, there are a number of issues that should be addressed to ensure widespread deployment of electric vehicles. These include insufficient drive range, underdeveloped charging infrastructure, the need to recycle batteries, shortage of critical metals and environmental impact of their extraction, safety issues on the road, and much more,” Sechin stated.

Apart from charging station failures that, as Sechin noted, have jumped 50% in the U.S. alone over two years, the issue of traffic safety is also acute - recent studies show that hybrids and electric vehicles are two to three times more likely to hit pedestrians compared to internal combustion engine vehicles.

According to Rosneft CEO, the cost of full electrification of transport in a number of world’s megacities may exceed USD 0.5 trillion.

“For example, we estimate that electrification of transportation in such cities as Sao Paulo, Mumbai, New York, London, Johannesburg and Shanghai could cost more than half a trillion dollars,” said Igor Sechin.

Head of Rosneft also noted that on the way to achieving carbon neutrality by 2030 it will be necessary to increase production of copper by almost 1.5 times, nickel and cobalt by 2 times and lithium by more than 4 times. This could further increase pressure on land, water and resources in developing countries, where most of the mineral deposits critical to the green transition are located.

Igor Sechin separately noted copper, the consumption of which, excluding the green agenda, will exceed 900 million tons by 2050. “Furthermore, another 500 million tons will be needed to electrify the global vehicle fleet (apart from other energy transition targets). Thus, cumulative copper consumption by 2050 could double the amount of copper produced in all of human history. It is also 60% more than all recoverable reserves available today,” he said.

“I believe that at the first stage the emissions issue can and should be addressed by improving efficiency of energy production, rather than displacing traditional energy sources with alternative ones,” the Company CEO summarized.

POWER SYSTEM CAPACITY SHORTAGE IN WESTERN COUNTRIES

Igor Sechin believes that United States and Canada are now at risk of power shortages, as renewable energy has displaced a large amount of reliable power generation facilities from the North American energy market.

According to him, over the past decade, Western technology giants have worked hard to demonize fossil fuels, shut down power plants that provide reliable electricity supplies, and promote unreliable renewable energy. “However, as the massive energy crises in California and Texas have shown, neither solar batteries nor wind farms can replace conventional electricity,” head of Rosneft added.

“Thanks to years of aggressive PR campaigns and lobbying efforts, renewable energy has displaced a large amount of reliable power generation facilities from the North American energy market. As a result, large parts of the United States and Canada are now at risk of power shortages,” he said.

According to him, technology giants are reaping the fruits of their labors. The growing demand for electricity on the part of data centers (DCs) can no longer be met with existing capacity. While global electricity consumption in this segment barely grew until 2019, it has doubled over the last four years.

Investment bank Goldman Sachs estimates that global power consumption by data centers may grow two and a half times by 2030 per 1,000 terawatt hours, which is equal to the combined power consumption of Germany and France, Sechin said.

Igor Sechin believes that widespread introduction of artificial intelligence will further accelerate the growth of energy consumption.

“It now takes 10 times more electricity for a GPT chatbot to process a single query compared to a Google search engine. The current burst of artificial intelligence requires a separate analysis. It should be taken into account that artificial intelligence will increasingly use data from the degrading information environment, where everyone has the right to express his or her opinion, even if it is the opinion of a madman,” stated Sechin.

ENERGY WAR ON THE WORLD’S POPULATION

Aggressive promotion of the "green agenda" actually means declaring an energy war on the majority of the world's population; overcoming energy inequality is impossible without reliable supplies of oil and gas, Rosneft Chief Executive Officer stated.

On his opinion, demand for electricity will grow in the future driven by developing countries that have yet to overcome energy poverty. Thus, more than two out of eight billion of the world's population still use open fire for daily living needs today, and more than 700 million people live without any access to electricity.

“The gap in energy consumption between poor and rich countries is striking. Thus, for example, the per capita consumption in India, which accounts for about 20% of the global population, is eleven times lower than that in the United States. Overall, in the so-called G7 countries, accounting for less than 10% of the global population, energy consumption per capita is almost three times higher than the global average,” Sechin said speaking on the Energy Panel.

He reminded that it is in the developing countries of Asia and Africa that we are witnessing the greatest population growth and, consequently, a rapid increase in the need for energy resources. Obviously, in this situation, a reduction in global consumption of fossil resources would automatically mean that the problem of hunger and energy poverty would not only persist, but also worsen.

“Thus, aggressive promotion of the “green agenda” actually means declaring an energy war on the majority of the world's population,” head of Rosneft said.

On his opinion, overcoming energy inequality is impossible without reliable supplies of oil and gas. Those advocating a complete ban on fossil fuels, or even a phased withdrawal from them, do not take into account the role of oil in the modern world. In addition to manufacturing of petroleum products, oil is used for the production of a huge number of day-to-day goods, without which the life of modern humans can no longer be imagined.

“Giving up oil will also mean giving up the modern way of life. Conversely, for many countries, increased oil consumption means access to the benefits of civilization,” Igor Sechin summed up.

OIL DEMAND GROWTH

Head of Rosneft stated that global oil demand will continue to grow despite the expectations of its peak.

“It is not surprising that global oil demand continues to grow despite the expectations of the so-called "oil peak". I believe that OPEC's forecast paints quite a realistic picture of the future of the global energy industry,” he said. Sechin reminded that according to this forecast, primary demand for oil is to grow almost by 20% to the value of 116 million bpd by 2045. Oil is to continue to account for about 30% of the global energy mix.

Head of Rosneft opines that developing countries will be the main drivers of oil consumption in the coming decades. By 2030, demand growth in this group of countries is expected to account for 95% of global consumption growth in aggregate. The highest growth in oil demand is expected in Asian countries, which are Russia's main trading partners.

Igor Sechin drew special attention to India: “India's economy has made significant strides in recent years. Since 2010 energy demand has grown by 45%, making the country the third largest energy consumer in the world.” He also noted that over the next five years India is projected to continue its strong economic momentum and become one of the top three largest economies in the world with a GDP of USD 5 trillion, and to overtake the U.S. by 2050 in terms of the size of the economy. India's end-use energy consumption shall see a 90% growth by 2050 - one of the fastest growth rates in the world.

GLOBAL ENERGY LEADER

Russia is retaining its role as one of the leaders in the global energy sector, despite the growing sanctions pressure, said Rosneft Chief Executive Officer Igor Sechin. “Taking into account the influencing factors, Russia continues to realize its energy development potential and strengthen its position in the global energy market,” he noted.

Recently, the President of the Russian Federation Vladimir Vladimirovich Putin emphasized the importance of reorienting Russian exports to the fast growing APR markets.

Igor Sechin reminded that, the turnaround of Russian energy exports to Asia-Pacific markets began with the construction of the ESPO (East Siberia – Pacific Ocean trunk pipeline) and investments in India's oil and gas sector long before the European markets were closed to our country.

“At the moment, the Asia-Pacific region accounts for more than 80% of Russian oil exports, and it is already evident that the reorientation of supplies has fully justified itself,” Igor Sechin noted.

Head of Rosneft specially mentioned the development of the Northern Sea Route project, a new transportation artery that will enable connecting the powerful resource base of the Russian North with the markets of developing countries.

“This project will give energy consumers in Asia access to the richest resources of the Arctic shelf and Siberia. Let me remind you that 10% of the world's oil and 25% of its natural gas is produced in the Arctic as of today. At the same time, 80% of the global Arctic oil and gas reserves are concentrated in the Russian Arctic,” Sechin summarized.

CONDITIONS FOR RUSSIAN OIL EXPORTS

Igor Sechin said that trading in national currencies and development of alternative payment systems are prerequisites for the continuation of Russian oil exports. “Significant progress has already been made in this direction: over the past two years, the share of the ruble in export payments has more than tripled and exceeded 40%,” he emphasized.

Sechin noted the increasing the role of friendly currencies in international trade. “China's recent success in using yuan is a good illustration of de-dollarization. For example, in September last year, yuan overtook euro for the first time in trade settlements made via the SWIFT system,” he stated.

On his opinion, the dynamics of Russian-Chinese mutual settlements is also indicative. “Significant mutual commodity flows, as well as commodity flows of third countries, allowed our countries to promptly switch to settlements in national currencies, the share of which exceeded 90% by the end of 2023,” said head of Rosneft.

Igor Sechin emphasized that in order to further expand the use of national currencies both bilaterally and in settlements with third countries, it is necessary to create appropriate infrastructure and instruments to ensure clearing transactions and opening of correspondent accounts, use of swap lines, as well as the full range of systems for interbank messaging.

A NEW STRATEGY FOR RELIABLE ENERGY SUPPLY

A new energy supply strategy shall be developed with account for the needs of developing countries, stated Igor Sechin.

“Now that the failure of the "green transition" concept is evident, we have to develop a new strategy for a reliable and secure energy supply at fair prices tailored to the needs of developing countries,” head of Rosneft noted.

“We have no doubts about the ability of the Russian energy complex to provide the required volume of energy resources for Russian consumers, and nothing will prevent us from fulfilling our contractual obligations to all our partners,” Sechin summarized.

Head of the Company said that the Russian oil industry is self-sufficient in terms of resource base and technologies and is capable of meeting the challenges it faces. However, the economic environment in which it operates is characterized by a number of factors.

According to, Igor Sechin, these factors include the voluntary production curtailments under the OPEC+ Agreement, and the growing sanctions pressure, in that number the price cap set for Russian oil by Western countries, the ban on use of Western financial system, logistical barriers.

The Russian oil industry is also affected by internal factors. These include high tax burden. “The industry generates over RUB 12 trillion of budget revenues with a tax burden of an average of 75% of the financial result”, Igor Sechin noted.

Head of Rosneft also drew attention to the prohibitive interest rates and limited available liquidity in the financial market. “Despite a record RUB 103 trillion of liquidity within the perimeter of the Russian banking system, the industry is unable to raise financing”, Sechin stated.

“It is obvious that the high efficiency of deposits with the rate of 18-19% discourages investment processes in the real economy, which are necessary for sustainable development,” Igor Sechin said.

Head of Rosneft concluding his speech by quoting the words of the outstanding Chinese philosopher Confucius, who said: “Where patience ends, endurance begins”.

CHIEF EXECUTIVES OF MAJOR PETROLEUM COMPANIES TOOK PART IN THE ENERGY PANEL

Leading experts and representatives of major energy businesses also presented their views on the current state of the energy market.

Zhang Daowei, Vice President of CNPC, noted in his speech that today there is an acceleration of processes unprecedented before in the world, which have brought a number of changes in the world geopolitics and world economic activities.

"Following the new round of scientific and technological revolution, the energy market has undergone a radical restructuring and transformation of its structure," Daowei said. According to him, the share of fossil fuel sources in primary consumption is at 80%. CNPC Vice President expressed confidence that with the energy transition and within the framework of scientific and technological progress, the world's growing energy needs can be generally met.

Zhang Daowei agreed with the conclusions Igor Sechin made in his speech on the Energy Panel. "We believe that as part of the overall movement towards energy transition, the right response to such challenges is to commit to our joint concerted development of conventional and new energy, respecting the characteristics and capabilities of our countries," CNPC senior executive said. Oil and gas will long remain a solid foundation for a number of states to build up their competitive capabilities, as well as for the key area of energy security, Zhang Daowei emphasized.

Jose Felix Rivas, Venezuela's Sectoral Vice President of Economy, said in his speech that globalization as it appeared in the 1990s and the ideology of free trade have failed. "We see that sanctions are a new form of limiting the productive capacity needed for countries to develop," he said.

Jose Felix Rivas also expressed the view that the construction of green neocolonialism is being realized under the pretext of the green energy transition. "As for the green economy or this green extremism here - the only thing green there is the green dollar. It's a form of maintaining its dominance and its hegemony," Venezuela's Vice President said confidently. "To counter this dangerous propaganda that is harmful to our potential, we must act together," Jose Felix Rivas said.

Martin Wiewiorowski, Chairman of the Board of Directors of Advantage Energy, who has more than 40 years of experience in the oil and gas industry, including in Russia, in turn agreed with the thesis from the speech of the head of Rosneft about the lack of investment in new projects in the global oil and gas industry.

"We observe that it is the sector of oil, gas and traditional energy sources that is experiencing a severe shortage of investment," Wiewiorowski noted. All of this comes at a time when global demand for oil continues to grow, the Chairman of the Board of Directors of Advantage Energy emphasized.

"Demand is determined primarily by increased consumption from the Global South. As a result of underinvestment in priority areas, as well as reduced exploration activity, we are seeing a decline in production. This is particularly true for non-OPEC countries," Wiewiorowski summarized.

According to David Gadzhimirzaev, General Director of АО Technologies AFS, the innovation potential of the Russian oil industry is high and despite sanctions restrictions and pressure from the West, the task of increasing the production of high-tech equipment will be accomplished.

Gadzhimirzaev noted that cross-industry collaboration between oilfield service companies, metallurgical companies and electronics manufacturers is necessary for the development of the industry. "The country has all the resources for this - this is the most important thing. Therefore, I would like to emphasize that despite the sanctions restrictions, despite the pressure of the West, we will accomplish this task," said the head of AO Technologies OFS.

Nobuo Tanaka, Chairman of the Supervisory Board of the non-profit initiative of the Government of Japan for the development of low-carbon technologies, called for increased use of LNG and the development and active deployment of carbon capture and storage technologies, which are essential for the energy transition.

Nobuo Tanaka expressed confidence that Rosneft can make a significant input on the supply of energy resources to consumers and the development of capture and other technologies.

PRICE STEADINESS FOR ENERGY SECURITY

Igor Sechin, Chief Executive Officer of Rosneft, assessed the possible mid-term cost of oil during the Energy Panel.

The head of Rosneft reminded that the recent OPEC+ decision was not followed by stabilization of oil prices and its growth, but, on the contrary, its decline.

“This shows that the market takes into account other factors that affect the global industry. Still, whatever the price is, it should ensure return on invested capital, and take into account the interests of both consumers and producers,” Igor Sechin said, answering a question from the Energy Panel moderator.

In this case, the stability required for energy security will be guaranteed, summarized the head of Rosneft.

“But one should also understand what the alternative is. The alternative is expressed in the quote we put on the slide from Dante's Divine Comedy: “Abandon hope, all ye who enter here”. It is written on the gates of hell,” Igor Sechin noted. “Therefore, we need to be act responsibly and seek compromise and consensus based on unbiased approaches,” he added.

Venezuela's Sectoral Vice President of Economics, Jose Felix Rivas, believes that oil prices this year will be linked to the amount of supply. "First of all, we are talking about the supply that is created by the growth of the countries of the South. International conflicts will also have an impact on prices," said the Venezuelan Vice President.

Martin Wiewiorowski, Chairman of the Board of Directors of Advantage Energy, said that we need to look at the outlook for supply and demand trends in the oil market. “We just talked about the important role the Global South plays in the oil market. Demand on the part of the region will continue to grow in the coming decade,” Wiewiorowski said, adding that the price will stay in the $80-$100 per barrel range and will approach the upper limit as the economy grows.

Nobuo Tanaka, Chairman of the Supervisory Board of the Japanese government's non-profit initiative for the development of low-carbon technologies, is confident that in the long term, oil prices will gradually come down. “If our goal of zero-carbon emissions is achieved in 2050, it is absolutely inevitable that there will be a decline,” he said.

In turn, David Gadzhimirzaev, General Director of AO Technologies OFS, expressed the opinion that oil prices will probably be stable.

“As Igor Ivanovich emphasized in his report, oil consumption will reach the level of 116 million barrels per day by 2045. Today this figure is 102.8 million barrels per day, which is 1.6 million more than last year. Moreover, by 2025, this figure will already reach 104.3 million barrels. Therefore, my brief answer is that oil prices will be stable, because the world needs oil, and we should not forget about it,” said the head of AO Technologies OFS.

-----

Earlier: