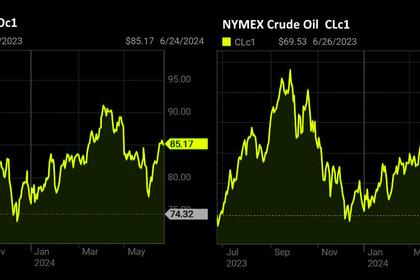

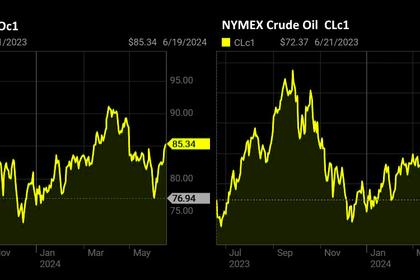

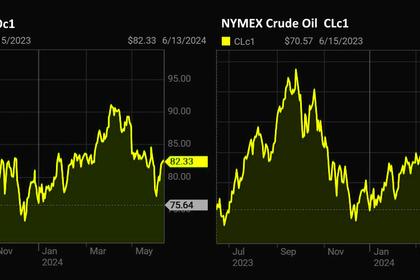

OIL PRICE: BRENT ABOVE $85, WTI ABOVE $81

REUTERS - June 26, 2024 - Oil prices inched up during Asian trade on Wednesday despite a surprise jump in U.S. stockpiles, driven by geopolitical risks from the Middle East conflict and forecasts of an eventual inventory drawdown during the third quarter peak demand season.

Brent crude oil futures rose 40 cents, or 0.5%, to $85.41 a barrel by 0406 GMT. U.S. West Texas Intermediate crude futures gained 43 cents, or 0.5%, to $81.26 per barrel.

"It seems the market is shrugging off demand concerns for now, anticipating inventory drawdowns in peak third quarter demand season. Official Energy Information Administration (EIA) inventory numbers today will provide the market further pointers on the trend," said Suvro Sarkar, energy sector team lead at DBS Bank.

The American Petroleum Institute (API) reported U.S. crude oil stocks rose by 914,000 barrels in the week ended June 21, according to market sources briefed on the data. Analysts polled by Reuters expect crude stocks to have declined by nearly 3 million barrels last week.

Official U.S. government data from the EIA on oil and fuel stockpiles is due at 1430 GMT.

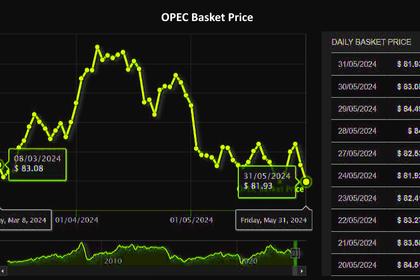

Despite the near term pressure of a stronger dollar and bearish U.S. crude oil stocks data, the market is likely to find support on the back of continued OPEC+ cuts and stronger seasonal demand during the third quarter, said Warren Patterson, head of commodities strategy at ING.

"Our balance suggests the (global) market will be in a roughly 1.5 million barrels per day deficit in the third quarter due to continued OPEC+ cuts and stronger seasonal demand usually seen in the third quarter. We are already seeing signs of tightening with a stronger North Sea physical market."

Additionally, increasing geopolitical risks with Houthi attacks in the Red Sea and mounting Israel-Hezbollah hostilities in Lebanon are also bullish for oil prices, DBS' Sarkar said.

Yemen's Iran-aligned Houthi group has been launching drone and missile strikes in shipping lanes since November, saying they are in solidarity with Palestinians in Gaza in the Israel-Hamas war. This has disrupted shipping in the Red Sea corridor, stoking concerns over freight flow.

-----

Earlier: