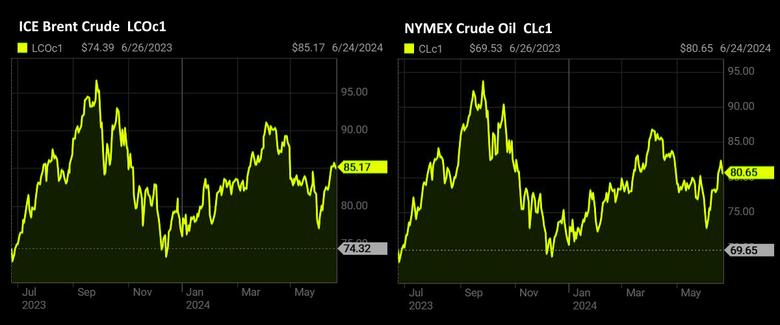

OIL PRICE: BRENT NEAR $85, WTI ABOVE $80

РЕЙТЕР -

-----

Раньше:

2018, March, 14, 11:45:00

REUTERS - U.S. West Texas Intermediate (WTI) crude futures CLc1 were at $60.77 a barrel at 0753 GMT, up 6 cents, or 0.1 percent, from their previous settlement. Brent crude futures LCOc1 were at $64.62 per barrel, down just 2 cents from their last close.

|

2018, March, 7, 15:00:00

РЕЙТЕР - К 9.17 МСК фьючерсы на североморскую смесь Brent опустились на 0,85 процента до $65,23 за баррель. Фьючерсные контракты на американскую лёгкую нефть WTI к этому времени торговались у отметки $62,07 за баррель, что на 0,85 процента ниже предыдущего закрытия.

|

2018, March, 7, 14:00:00

EIA - North Sea Brent crude oil spot prices averaged $65 per barrel (b) in February, a decrease of $4/b from the January level and the first month-over-month average decrease since June 2017. EIA forecasts Brent spot prices will average about $62/b in both 2018 and 2019 compared with an average of $54/b in 2017.

|

2018, March, 5, 11:35:00

РЕЙТЕР - К 9.28 МСК фьючерсы на североморскую смесь Brent поднялись на 0,33 процента до $64,58 за баррель. Фьючерсные контракты на американскую лёгкую нефть WTI к этому времени торговались у отметки $61,44 за баррель, что на 0,31 процента выше предыдущего закрытия.

|

2018, March, 4, 11:30:00

МИНФИН РОССИИ - Средняя цена нефти марки Urals по итогам января – февраля 2018 года составила $ 65,99 за баррель.

|

2018, February, 27, 14:15:00

РЕЙТЕР - К 9.18 МСК фьючерсы на североморскую смесь Brent опустились на 0,15 процента до $67,40 за баррель. Фьючерсные контракты на американскую лёгкую нефть WTI к этому времени торговались у отметки $63,80 за баррель, что на 0,17 процента ниже предыдущего закрытия.

|

2018, February, 27, 14:05:00

МИНФИН РОССИИ - Средняя цена на нефть Urals за период мониторинга с 15 января по 14 февраля 2018 года составила $66,26457 за баррель, или $483,7 за тонну.

|

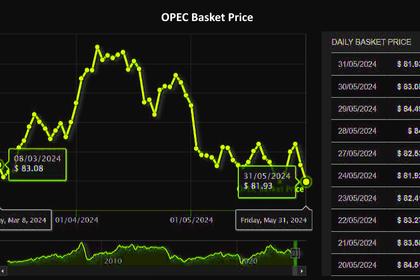

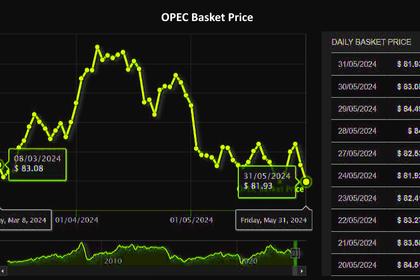

OIL PRICE: BRENT NEAR $85, WTI ABOVE $80

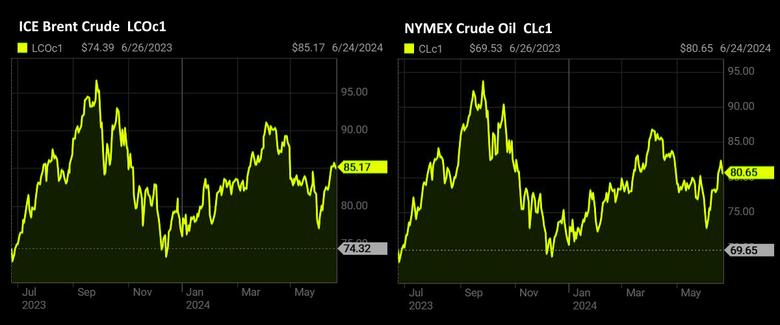

REUTERS - June 24, 2024 - Oil prices fell in early Asian trade on Monday for a second straight session, weighed down by a stronger dollar after concerns of higher-for-longer interest rates resurfaced and cooled investors' risk appetite.

Brent crude futures slid 40 cents, or 0.5%, to $84.84 a barrel by 0036 GMT, after settling down 0.6% on Friday. U.S. West Texas Intermediate crude futures were at $80.34 a barrel, down 39 cents, or 0.5%.

"The U.S. dollar has opened bid this morning and appears to have broken higher following better U.S. PMI data on Friday night and political concerns ahead of the French election," said Tony Sycamore, a Sydney-based markets analyst at IG.

A stronger greenback makes dollar-denominated commodities less attractive for holders of other currencies.

However, both benchmark crude contracts gained about 3% last week on signs of stronger oil products demand in the U.S., world's largest consumer, and as OPEC+ cuts kept supply in check.

U.S. crude inventories fell while gasoline demand rose for the seventh straight week and jet fuel consumption has returned to 2019 levels, ANZ analysts said in a note.

Geopolitical risks in the Middle East from the Gaza crisis and a ramp-up in Ukrainian drone attacks on Russian refineries are also underpinning oil prices.

In Ecuador, state oil company Petroecuador has declared force majeure over deliveries of Napo heavy crude for exports following the shutdown of a key pipeline and oil wells due to heavy rains, sources said on Friday.

In the U.S., operating oil rigs fell three to 485 last week, their lowest since January 2022, Baker Hughes opens new tab said in its report on Friday.

-----

Earlier:

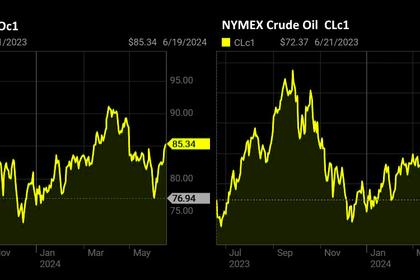

2024, June, 19, 06:45:00

РОССИЯ: НАДЕЖНЫЙ ЭНЕРГОПЕРЕХОД

Для ускорения энергетического перехода в России уже внедрены механизмы привлечения инвестиций в строительство объектов ВИЭ, действует программа развития микро-генерации на ВИЭ у граждан и в домашних хозяйствах, внедрена система добровольного изменения объемов потребления потребителями, а также реализуется дорожная карта по развитию систем накопления энергии.

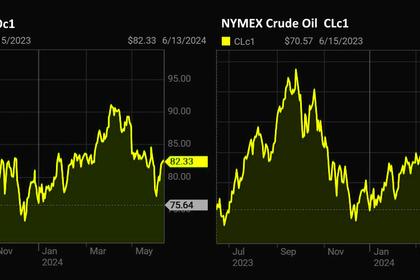

2024, June, 13, 06:55:00

ГЛОБАЛЬНАЯ ЭНЕРГЕТИКА РОССИИ

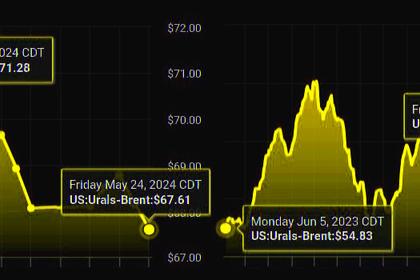

Около 80% энергетических ресурсов перенаправлено на дружественные рынки, в основном в Азиатско-Тихоокеанский регион, Африку, страны Латинской Америки.

2024, June, 13, 06:50:00

ГЛОБАЛЬНАЯ НЕФТЬ: ВЫШЕ ОЖИДАНИЙ

Согласно прогнозам ОПЕК+, спрос на нефть в 2024 году вырастет на 2,2 млн баррелей в сутки (б/с), до 102 млн б/с. «В перспективе до 2030 года, а это всего 6 лет, сегодняшние 102 млн б/с могут превратиться в 110 млн б/с или даже 115 млн б/с», – отметил Александр Новак.

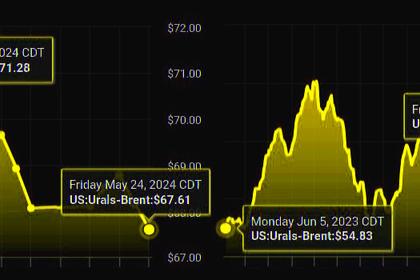

2024, June, 5, 06:35:00

ОПЕК + РОССИЯ: 2025

Участники ОПЕК+ приняли решение продлить действующие в 2024 году целевые уровни по добыче нефти на весь 2025 год. При этом принято решение о частичном поэтапном восстановлении добровольных сокращений добычи начиная с октября 2024.

2024, June, 5, 06:30:00

OPEC+ RUSSIA: 2025

Extend the level of overall crude oil production for OPEC and non-OPEC Participating Countries in the DoC as per the attached table starting 1 January 2025 until 31 December 2025.

All Publications »

Tags:

OIL,

PRICE,

BRENT,

WTI,

OPEC,

RUSSIA,

SANCTIONS