CHINA GRID INVESTMENT $83 BLN

РЕЙТЕР -

-----

Раньше:

2018, March, 14, 11:45:00

REUTERS - U.S. West Texas Intermediate (WTI) crude futures CLc1 were at $60.77 a barrel at 0753 GMT, up 6 cents, or 0.1 percent, from their previous settlement. Brent crude futures LCOc1 were at $64.62 per barrel, down just 2 cents from their last close.

|

2018, March, 7, 15:00:00

РЕЙТЕР - К 9.17 МСК фьючерсы на североморскую смесь Brent опустились на 0,85 процента до $65,23 за баррель. Фьючерсные контракты на американскую лёгкую нефть WTI к этому времени торговались у отметки $62,07 за баррель, что на 0,85 процента ниже предыдущего закрытия.

|

2018, March, 7, 14:00:00

EIA - North Sea Brent crude oil spot prices averaged $65 per barrel (b) in February, a decrease of $4/b from the January level and the first month-over-month average decrease since June 2017. EIA forecasts Brent spot prices will average about $62/b in both 2018 and 2019 compared with an average of $54/b in 2017.

|

2018, March, 5, 11:35:00

РЕЙТЕР - К 9.28 МСК фьючерсы на североморскую смесь Brent поднялись на 0,33 процента до $64,58 за баррель. Фьючерсные контракты на американскую лёгкую нефть WTI к этому времени торговались у отметки $61,44 за баррель, что на 0,31 процента выше предыдущего закрытия.

|

2018, March, 4, 11:30:00

МИНФИН РОССИИ - Средняя цена нефти марки Urals по итогам января – февраля 2018 года составила $ 65,99 за баррель.

|

2018, February, 27, 14:15:00

РЕЙТЕР - К 9.18 МСК фьючерсы на североморскую смесь Brent опустились на 0,15 процента до $67,40 за баррель. Фьючерсные контракты на американскую лёгкую нефть WTI к этому времени торговались у отметки $63,80 за баррель, что на 0,17 процента ниже предыдущего закрытия.

|

2018, February, 27, 14:05:00

МИНФИН РОССИИ - Средняя цена на нефть Urals за период мониторинга с 15 января по 14 февраля 2018 года составила $66,26457 за баррель, или $483,7 за тонну.

|

CHINA GRID INVESTMENT $83 BLN

BLOOMBERG - Jul 29, 2024 - China’s main grid operator will raise spending to a record to ease transmission bottlenecks, underscoring Beijing’s push to boost renewable-energy usage and potentially benefiting metals including copper.

State Grid Corp. of China, which covers more than 80% of the country, will increase spending 13% to 600 billion yuan ($83 billion) this year, the Economic Information Daily reported, citing a budget plan. That follows an announcement from smaller peer, China Southern Power Grid Co., that it will lift capital spending for network upgrading by more than half by 2027.

China — which is still heavily reliant on coal-fired power generation — is in the throes of an unprecedented shift toward renewables to deliver on climate pledges. Still, the move has been hobbled by a lack of grid capacity to get solar and wind power from where it’s produced to users. Expanding that infrastructure typically requires using copper and aluminum.

State Grid — the world’s single-biggest buyer of copper — said it would beef up the network of ultra-high-voltage lines that carry power from China’s vast renewables bases, which are mostly located in remote desert regions, far from the main centers of consumer and industrial demand. In addition, connections between counties along trunk lines would also be targeted, it said.

-----

Earlier:

2024, June, 19, 06:40:00

CHINA'S CLEAN ENERGY

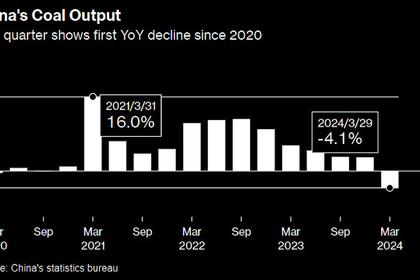

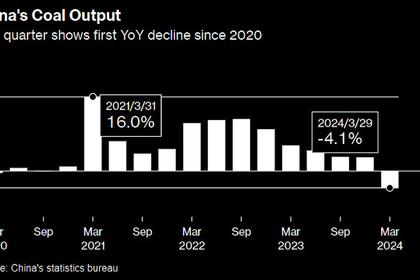

Thermal power, which accounts for the bulk of China’s carbon footprint, fell 4.3% in May from the previous year, the biggest drop since 2022, the statistics bureau reported on Monday.

2024, May, 15, 06:25:00

CHINA, FRANCE NUCLEAR COOPERATION

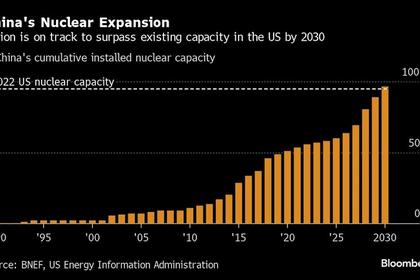

China and France are two of the world's biggest generators of nuclear energy, with both having large-scale plans to expand capacity in the coming years.

2024, May, 14, 06:35:00

CHINA NEED GAS & COAL

Even as China has dramatically ramped up wind and solar in recent years, its power demand, including from electric vehicles, continues to outpace new supply, creating an ever greater need for fossil fuels.

2024, May, 3, 06:45:00

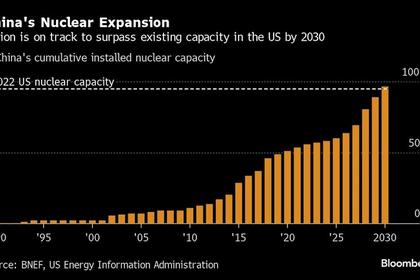

CHINA'S NUCLEAR ACCELERATING

China has the world’s largest nuclear fleet and aims to produce 10% of its electricity from nuclear power by 2035 and 18% by 2060 to enhance energy security and advance decarbonisation goals.

2024, April, 17, 06:50:00

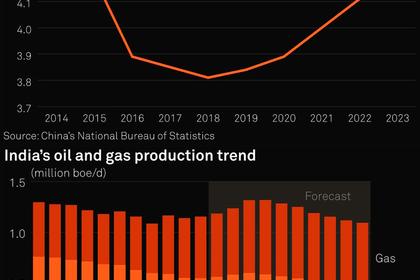

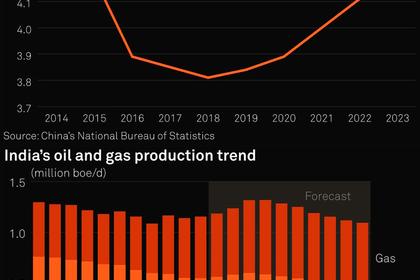

CHINA, INDIA OIL & GAS PRODUCTION UP

India's overall oil and gas output rose 1.3% on the year to 1.15 million boe/d in 2023. China's upstream story sounds relatively more promising at this stage.

2024, April, 3, 06:40:00

CHINA'S NUCLEAR OPENING

The opening of these research facilities and testing platforms by China to the world is expected to promote the development of nuclear technology worldwide.

2024, February, 26, 06:45:00

CHINA'S COAL ELECTRICITY

China saw a robust increase in its peak power demand in 2021-2022 due to an increase in the prevalence of air conditioners amid exceptionally intense heat waves. This prompted an enhancement of more coal-based power generation capacity as a "costly and suboptimal solution,"

All Publications »

Tags:

CHINA,

ENERGY,

ELECTRICITY,

GRID,

INVESTMENT