OIL: CAVEAT EMPTOR

РЕЙТЕР -

-----

Раньше:

2018, March, 14, 11:45:00

REUTERS - U.S. West Texas Intermediate (WTI) crude futures CLc1 were at $60.77 a barrel at 0753 GMT, up 6 cents, or 0.1 percent, from their previous settlement. Brent crude futures LCOc1 were at $64.62 per barrel, down just 2 cents from their last close.

|

2018, March, 7, 15:00:00

РЕЙТЕР - К 9.17 МСК фьючерсы на североморскую смесь Brent опустились на 0,85 процента до $65,23 за баррель. Фьючерсные контракты на американскую лёгкую нефть WTI к этому времени торговались у отметки $62,07 за баррель, что на 0,85 процента ниже предыдущего закрытия.

|

2018, March, 7, 14:00:00

EIA - North Sea Brent crude oil spot prices averaged $65 per barrel (b) in February, a decrease of $4/b from the January level and the first month-over-month average decrease since June 2017. EIA forecasts Brent spot prices will average about $62/b in both 2018 and 2019 compared with an average of $54/b in 2017.

|

2018, March, 5, 11:35:00

РЕЙТЕР - К 9.28 МСК фьючерсы на североморскую смесь Brent поднялись на 0,33 процента до $64,58 за баррель. Фьючерсные контракты на американскую лёгкую нефть WTI к этому времени торговались у отметки $61,44 за баррель, что на 0,31 процента выше предыдущего закрытия.

|

2018, March, 4, 11:30:00

МИНФИН РОССИИ - Средняя цена нефти марки Urals по итогам января – февраля 2018 года составила $ 65,99 за баррель.

|

2018, February, 27, 14:15:00

РЕЙТЕР - К 9.18 МСК фьючерсы на североморскую смесь Brent опустились на 0,15 процента до $67,40 за баррель. Фьючерсные контракты на американскую лёгкую нефть WTI к этому времени торговались у отметки $63,80 за баррель, что на 0,17 процента ниже предыдущего закрытия.

|

2018, February, 27, 14:05:00

МИНФИН РОССИИ - Средняя цена на нефть Urals за период мониторинга с 15 января по 14 февраля 2018 года составила $66,26457 за баррель, или $483,7 за тонну.

|

OIL: CAVEAT EMPTOR

As we approach the nook and cranny of the summer season,there has been a renewed hope on summer demand with respect to the Oil Markets.

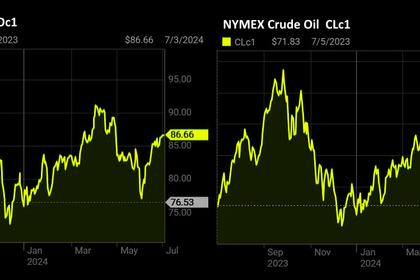

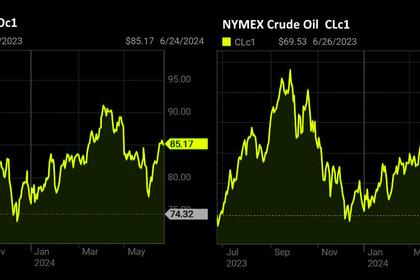

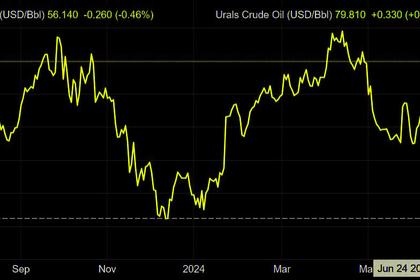

Evidence being shown by the lower numbers of the in the US Crude,Gasoline and Diesel inventories respectively.ICE BRENT ended the previous week on the gains trading shy of the $87/bbl high print price,currently at the $85.80/bbl at the European Close.

WTI Crude trading at $82.60/bbl and Natural Gas at $2.36/mmBtu after a maintenance bullish candle($2.205/mmBtu) kept the bear claws at bay.

It should be noted that the high flying bulls on the Oil Market may be sublime in the long-run perspective of things as demand is drawing down inventories globally and refinery margins have come off.

Stockpiles have moved to drawdown levels whereas the potential driving season is upon us creating a spanner in the works scenario.

Hurricane season is one to watch out for also as weather is a crucial factor.Hurricane Beryl slowed down as it approaches US,this is after wrecking havoc in Jamaica however it has been shifted to a category 2 hurricane,experts suggest that minimal damage will be inflicted on the US Gulf platform.

Implications of Gulf of Mexico storms shutting Oil producing fields & Texas remain within the risk baskets especially on gasoline therefore caution shouldn't be thrown to the wind.

Our main concern within the broth is ;Can US mitigate risks of SPR draws,perhaps the lever shall be pulled pre-election, a lot of resilience in US system with regard to Gasoline however.Heating demand in summer is also going up,production draws & values were low in spring hence demand gets higher.This trickles down to levels of utility bills & electricity.

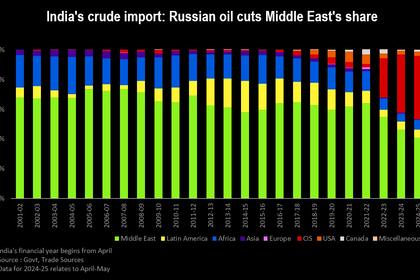

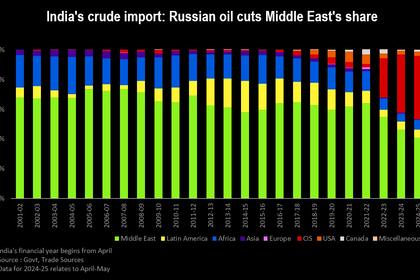

On the Geopolitics landscape;India is consuming more Crude as harmonious bilateral talks are in place with Russia.This brings about key powerhouses for global development cross borders. More progressive developments to be aired at the conclusion of the fruitful event.

In the Middle East;Saudi Arabia Targets 60% Rise in Gas Output.Saudi Aramco plans to ramp up its natural gas production by 60% by the end of this decade, currently producing around 11 billion cubic feet/day, thanks to the $100 billion Jafurah project but also investments into LNG operations abroad.

There is bread and butter in the Copper Futures Market(#HGW00) as the horns keep growing further towards the $5.20/pound target,expecting some turbulence at the $4.67/pound price zone for a healthy booking of profit & rebuys on the dips at $4.35/pound would be my bias.

We do adhere greatly to the devil in the details as we move towards the better half of the year,treading prudently is key.Remember,you are the trove of human knowledge,make your path successful.Will you be Penny-wise or Pound-foolish ?

Andy Warr,

TophatFinanceGroup.

-----

Earlier:

2024, July, 3, 06:55:00

INDIA, RUSSIA COOPERATION

The agenda includes a logistics supply agreement to bolster cooperation between the two militaries, restarting discussions on the joint development of a fifth generation fighter aircraft, and collaboration on nuclear power, the people said.

2024, June, 26, 06:55:00

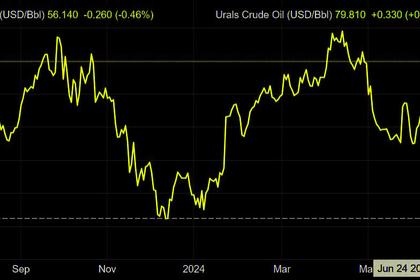

RUSSIAN OIL GAS REVENUES +50%

Russia was able to divert oil exports away from Europe to India and China, securing the much-needed financial flows for its budget, which is in deficit as Moscow spends heavily on defence and security.

2024, June, 26, 06:50:00

RUSSIAN OIL FOR INDIA UP

That boosted Russia's share in the world's third largest importer and consumer to nearly 41% last month, the data showed.

2024, June, 19, 06:45:00

РОССИЯ: НАДЕЖНЫЙ ЭНЕРГОПЕРЕХОД

Для ускорения энергетического перехода в России уже внедрены механизмы привлечения инвестиций в строительство объектов ВИЭ, действует программа развития микро-генерации на ВИЭ у граждан и в домашних хозяйствах, внедрена система добровольного изменения объемов потребления потребителями, а также реализуется дорожная карта по развитию систем накопления энергии.

All Publications »

Tags:

OIL,

PRICE,

BRENT,

WTI,

OPEC,

RUSSIA,

SANCTIONS