RUSSIAN COAL FOR S.KOREA

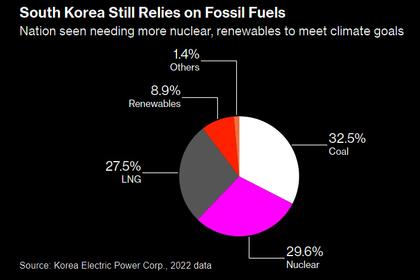

PLATTS - 26 Jul 2024 - Russian July thermal coal exports to South Korea outpaced Colombian supply for the first time in two months as elevated freight costs and supply disruption hampered Colombian exports.

Following the South Korean government's decision to restrict state-owned power-generating companies from importing Russian thermal coal from the spot market towards the end of 2023, Russian exports lost ground to Colombian thermal coal supply in recent months.

However, heavy rainfall in Colombia since last month, which disrupted production, along with elevated freight costs between the Atlantic and the Asia-Pacific region led to Russian supplies regaining its market share from Colombia during the month, market participants said.

In July, South Korea imported 2 million mt of Russian thermal coal while Colombia only managed to ship 700,000 mt of material during the month, S&P Global Commodities at Sea data showed.

"Colombian exports to South Korea had lost momentum recently," a Colombia-based producer said. "Mine sites in Colombia have seen a good amount of rain recently, negatively impacting production and straining inventory."

Some market participants said price may have also played a crucial role in the changing preference of South Korean buyers, being relatively cheaper on a delivered basis to import Russian high-calorific value thermal coal than Colombian material.

The removal of the export tariff on thermal coal by the Russian government at the end of April came as a relief to the country's suppliers, who were finding it tough to compete with material from Australia, Colombia and South Africa in the high-CV space, market participants said.

"I would think [since this is the last month when Russian coal is cheaper before tariffs may come back] to be a primary factor because it's not just a shift from Colombia, as we saw India shifting their coal imports to Russia from Australia," a Singapore-based freight operator said.

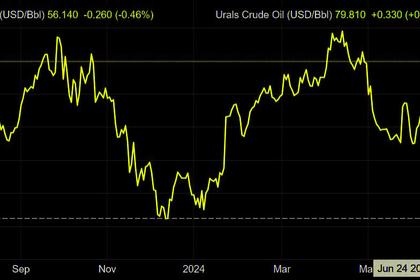

Platts, part of S&P Global Commodity Insights, assessed FOB Russia Pacific 6,000 kcal/kg NAR coal at an average of $92.80/mt since the tariffs were removed at the beginning of May, down from an average of $94.45/mt between February and April.

The average price of Colombian high-CV thermal coal in July rose from the previous month, along with an uptick in freight costs from Colombia to South Korea.

Platts assessed FOB Colombia 6,000 kcal/kg NAR coal an an average of $80.85/mt so far in July, up from an average of $79.50/mt in June. Additionally, Platts assessed the cost to move 150,000 mt of thermal coal from Puerto Bolivar to Pohang, South Korea, at an average of $34.15/mt in July, compared with $33.15/mt in June.

Typically, freight between Far East Russia and South Korea is around $23/mt, market participants said. Far East Russia is responsible for the bulk of supply out of Russia to South Korea.

"South Korean IPPs [import-based power plants] and gencos are buying Russian coal a lot, which is somewhat supporting the price," an Indonesia-based trader dealing with the South Korean market said. "Although most volumes are being exported under long-term contracts, since Colombian freights have jumped significantly, which has made the CFR prices expensive [for South Korean buyers]."

-----

Earlier: