BRENT CRUDE : A POLITE GRIMACE

РЕЙТЕР -

-----

Раньше:

2018, March, 14, 11:45:00

REUTERS - U.S. West Texas Intermediate (WTI) crude futures CLc1 were at $60.77 a barrel at 0753 GMT, up 6 cents, or 0.1 percent, from their previous settlement. Brent crude futures LCOc1 were at $64.62 per barrel, down just 2 cents from their last close.

|

2018, March, 7, 15:00:00

РЕЙТЕР - К 9.17 МСК фьючерсы на североморскую смесь Brent опустились на 0,85 процента до $65,23 за баррель. Фьючерсные контракты на американскую лёгкую нефть WTI к этому времени торговались у отметки $62,07 за баррель, что на 0,85 процента ниже предыдущего закрытия.

|

2018, March, 7, 14:00:00

EIA - North Sea Brent crude oil spot prices averaged $65 per barrel (b) in February, a decrease of $4/b from the January level and the first month-over-month average decrease since June 2017. EIA forecasts Brent spot prices will average about $62/b in both 2018 and 2019 compared with an average of $54/b in 2017.

|

2018, March, 5, 11:35:00

РЕЙТЕР - К 9.28 МСК фьючерсы на североморскую смесь Brent поднялись на 0,33 процента до $64,58 за баррель. Фьючерсные контракты на американскую лёгкую нефть WTI к этому времени торговались у отметки $61,44 за баррель, что на 0,31 процента выше предыдущего закрытия.

|

2018, March, 4, 11:30:00

МИНФИН РОССИИ - Средняя цена нефти марки Urals по итогам января – февраля 2018 года составила $ 65,99 за баррель.

|

2018, February, 27, 14:15:00

РЕЙТЕР - К 9.18 МСК фьючерсы на североморскую смесь Brent опустились на 0,15 процента до $67,40 за баррель. Фьючерсные контракты на американскую лёгкую нефть WTI к этому времени торговались у отметки $63,80 за баррель, что на 0,17 процента ниже предыдущего закрытия.

|

2018, February, 27, 14:05:00

МИНФИН РОССИИ - Средняя цена на нефть Urals за период мониторинга с 15 января по 14 февраля 2018 года составила $66,26457 за баррель, или $483,7 за тонну.

|

BRENT CRUDE : A POLITE GRIMACE

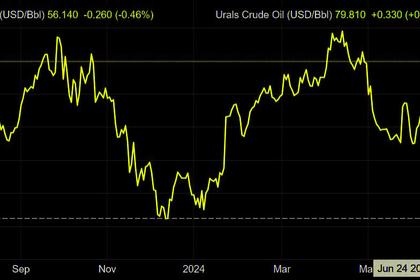

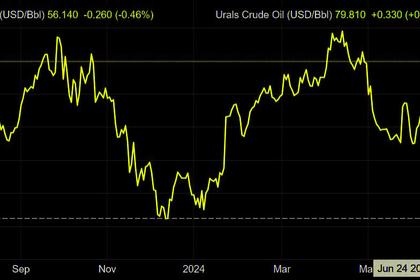

Its the start of a new month with presentations of fresh tidings across the board.Oil Markets have performed exceptionally well from the previous months publishing and bears relishing the glory as brakes were kept at the ready.Brent Crude fell below $80/bbl for the first time since June 10th.

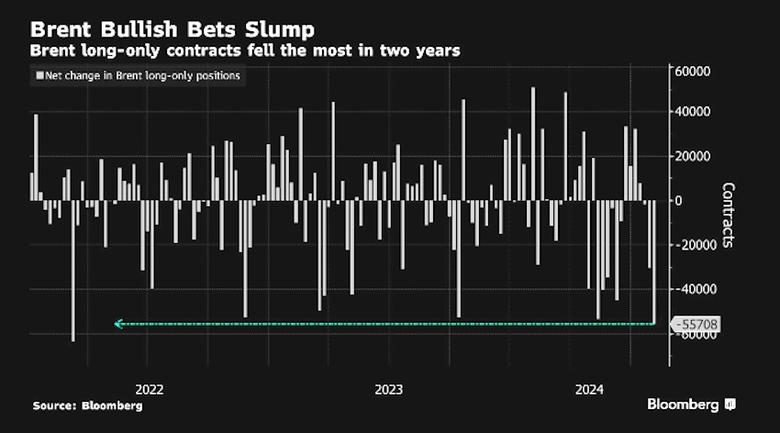

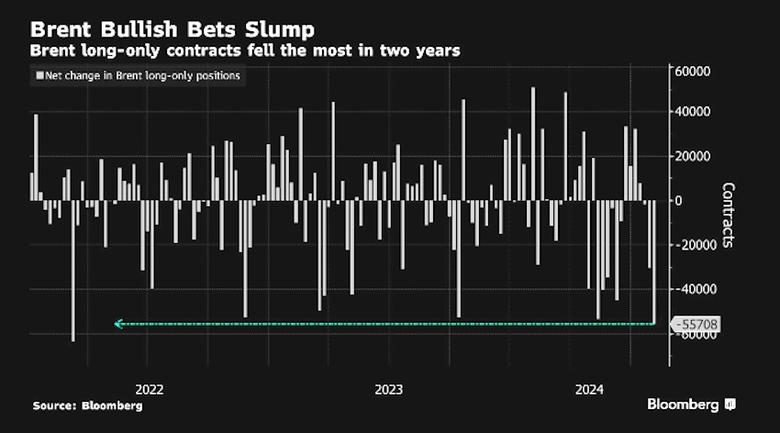

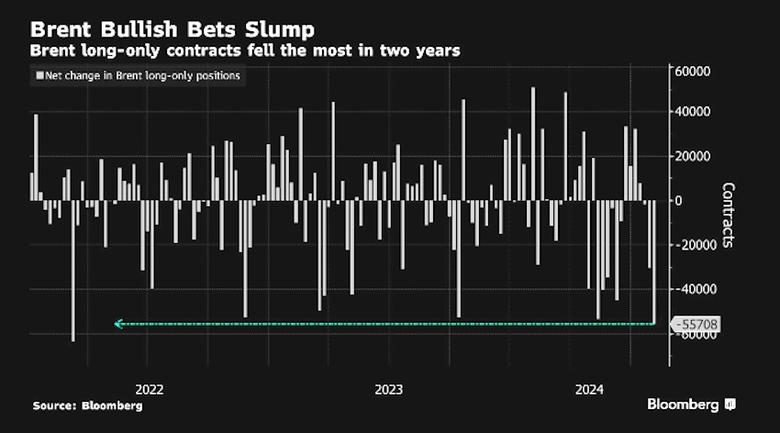

On the weeks #COT Reports: Funds cut bullish #Commodities bet to near a 5-yr low in the week to July 30 as the BCOM Index tumbled 2%. The energy sector was the hardest hit with #CrudeOil length cut by 25% to a seven-week low at 358k lots.The roughly 4 MMbpd of effective production cuts that OPEC+ is withholding from the market is worth ~$117 bln per year.

The rains shall keep beating until realized balances (ie inventories) improve.

BRENT Crude trading at the Globex Open on a $76.57/bbl & WTI Crude trading at $73.64/bbl.

This is after the US DOE finalised its purchase of 4.65m/bbl of Crude Oil for SPR to be delivered from October to December.ExxonMobil to also supply 3.9m/bbl,Macquarie Commodities trading to supply the rest at an average pricing of $76.92/bbl.

Natural Gas #NG prices have been on the gyrations with faux pas relations towards the low contract print prices of $2.05/mmBtu,

psychological support area of $2.00/mmBtu could bring a retest of the $1.85/mmBtu pricing.Currently at Globex Open,we are at $1.920/mmBtu as we unroll the week.

On the FX Front ; We do see sustainability on cross currency pairs such as the GBPMXN,EURMXN,USDNOK & AUDUSD.Keep your eyes peeled on good opportunities here during the month especially after the incoming RBA Meeting.

Japan's Nikkei posts biggest two-day drop in its history,subsequently,the Yen swept through the critical pivot price of 152 and had its floor shattered,currently trading at 145.Topix also took a hit on the start of the weeks Asia session.

Japan's Chief Cabinet Secretary Hiyashi states that the markets are being watched with a sense of urgency.No comments on the daily share moves.

On matters health of the economy,a rejection of the 150 Day MA on Copper Futures(#HGW00) presented a Deadcat on the trampoline scenario after the FED data.Key price point is the $4.35/pound for further guidance for the monthly channel movement.

Let us keep our focus as we enter the bumper season for the markets.Weather can change without a moments's notice.This week should be interesting with Tropical Storm Debby on its way as it barrels towards the Florida coast.

Remember,Chance is a name for law that's not recognised.

Andy Warr,

TophatFinanceGroup.

-----

Earlier:

2024, July, 30, 06:55:00

RUSSIA + INDIA: UP TO $100 BLN

According to Russian customs data, the Russia-India bilateral trade volume hit a record US$23.1 billion in the first four months of the current year, marking a 10% rise versus the same period in 2023.

2024, July, 30, 06:50:00

ЭНЕРГЕТИЧЕСКОЕ СОТРУДНИЧЕСТВО РОССИИ, КИТАЯ

Стороны обсудили широкий круг вопросов развития кооперации в нефтяной, газовой, угольной, атомной и электроэнергетической сферах, а также в области возобновляемых источников энергии и декарбонизации энергетики.

2024, July, 3, 06:55:00

INDIA, RUSSIA COOPERATION

The agenda includes a logistics supply agreement to bolster cooperation between the two militaries, restarting discussions on the joint development of a fifth generation fighter aircraft, and collaboration on nuclear power, the people said.

2024, June, 26, 06:55:00

RUSSIAN OIL GAS REVENUES +50%

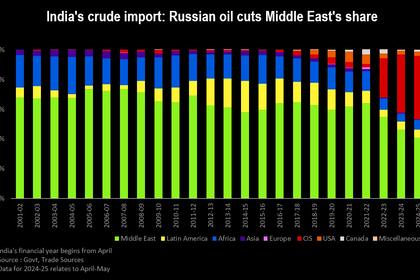

Russia was able to divert oil exports away from Europe to India and China, securing the much-needed financial flows for its budget, which is in deficit as Moscow spends heavily on defence and security.

2024, June, 26, 06:50:00

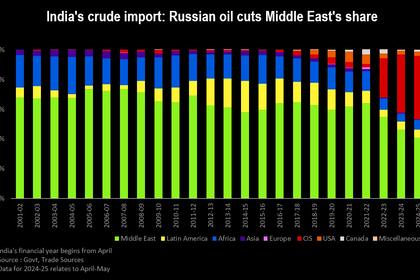

RUSSIAN OIL FOR INDIA UP

That boosted Russia's share in the world's third largest importer and consumer to nearly 41% last month, the data showed.

2024, June, 19, 06:45:00

РОССИЯ: НАДЕЖНЫЙ ЭНЕРГОПЕРЕХОД

Для ускорения энергетического перехода в России уже внедрены механизмы привлечения инвестиций в строительство объектов ВИЭ, действует программа развития микро-генерации на ВИЭ у граждан и в домашних хозяйствах, внедрена система добровольного изменения объемов потребления потребителями, а также реализуется дорожная карта по развитию систем накопления энергии.

All Publications »

Tags:

OIL,

PRICE,

BRENT,

WTI,

OPEC,

RUSSIA,

SANCTIONS