EUROPEAN GAS PRICES UP

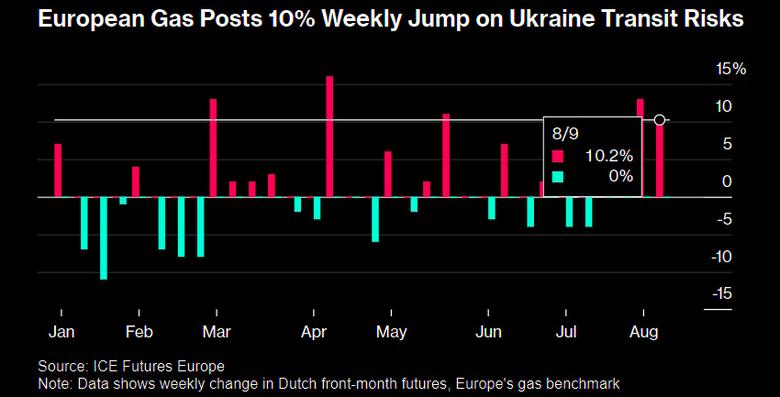

BLOOMBERG - Aug 9, 2024 - European natural gas prices posted a double-digit advance for a second consecutive week after fears of possible disruptions to Russian fuel supplies crossing Ukraine.

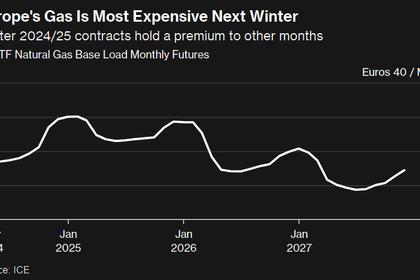

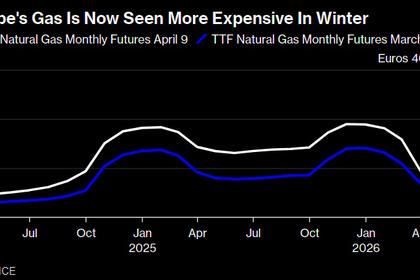

Benchmark futures advanced 10% for the week, after trading on Friday at the highest level since December. Prices have risen 48% since the beginning of the stockpiling season as numerous disruptions have coincided with traders’ efforts to source fuel for winter.

An incursion by Ukraine into Russia’s bordering Kursk region this week put a key gas transit point at risk. While flows through the Sudzha point continue for now, traders have braced for a possible halt, which would hurt European economies that still depend on those supplies. Moldova put its gas sector on “early alert” Thursday.

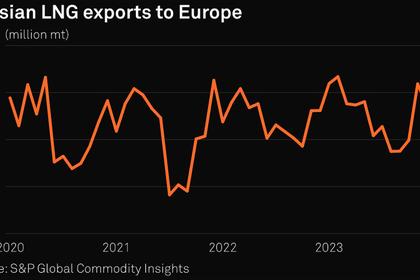

This summer has been volatile for Europe’s gas market even before the latest developments, as heat waves boosted global competition for liquefied natural gas and several producers faced outages.

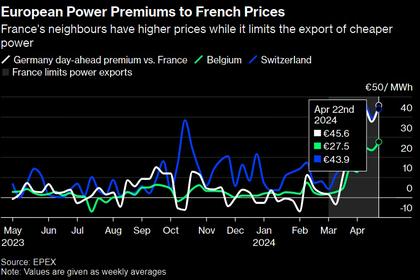

While most of Europe has sought alternatives to Russian gas since the invasion of Ukraine, some countries, including Austria and Slovakia, continue to take Gazprom PJSC supplies. Much of that passes through Ukraine, but a five-year transit agreement ends in December, and European officials have been exploring other options, including possibly sourcing fuel from Azerbaijan.

“Fears of supply shortages continued to shape gas-price developments this week,” Rystad Energy analyst Christoph Halser wrote in a note. “The latest attack could jeopardize ongoing talks between Azerbaijan, Ukraine and the European Union for the continued flow of gas through Ukraine after the current transit agreement expires.”

Upward Trend

Gazprom on Friday said recent price hikes were driven by “events in the Sudzha region” and potentially by upcoming maintenance in key supplier Norway. “Analysts also believe that the upward trend in gas prices will continue,” spokesperson Sergey Kupriyanov said on the company’s Telegram channel.

A sudden halt in flows before the scheduled expiry of the transit deal would come as a shock for nations such as Slovakia and Austria, which could see higher prices for companies and consumers if gas is cut off.

The bullish sentiment this week has also played out in options contracts. Implied volatility — a measure of how expensive the derivatives are — has risen since the end of July, signaling a rush by traders to protect themselves against a potential tightening of supply.

For now, a seasonal slowdown in demand and lower injections into Europe’s already ample stockpiles may help ease supply concern. Data from S&P Global Commodity Insights show that despite recent signs of recovery, gas consumption in European industry continues to lag behind forecasts.

Dutch front-month futures, Europe’s gas benchmark, settled 0.8% higher at €40.40 a megawatt-hour, advancing for four weeks in a row. Gas prices rose last week amid geopolitical risks in the Middle East.

------

Earlier: