HIGH SPOT LNG PRICES

PLATTS - 21 Aug 2024 - High spot LNG prices and ample pipeline gas supply have dampened early winter LNG procurement by Chinese importers despite declining stocks at some domestic LNG terminals, according to trade sources.

Asian spot LNG markets recently moved into the October delivery window, a time when key importers like Japan, South Korea, China and Taiwan typically begin their winter heating purchases, kickstarting the peak demand season for LNG.

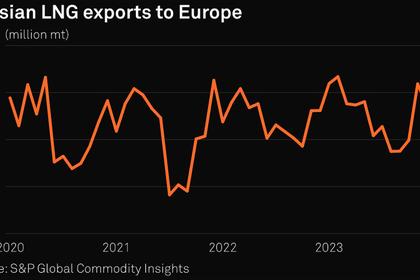

Early winter procurement has become increasingly competitive since Europe started replacing its pipeline gas imports with LNG following the Ukraine crisis. This shift has led to Asia competing with Europe for gas stocking, a trend that emerged as early as mid-year in recent years.

This year, however, high spot LNG prices and fewer demand pressures have resulted in a lack of buying interest from big importers, including China, which has been a major driver of spot market activity.

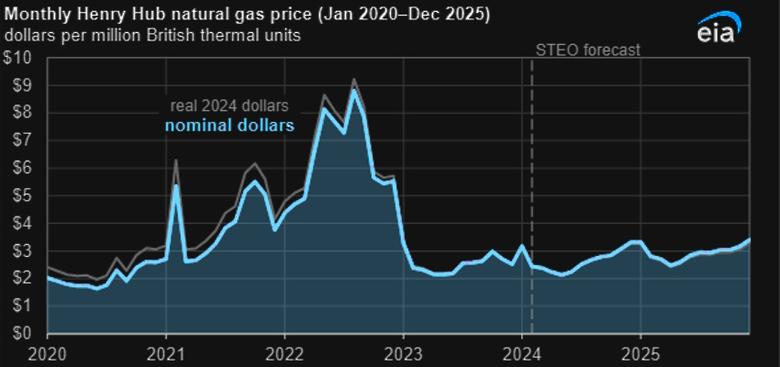

Spot LNG prices rose to over $14/MMBtu in mid-August from around $12/MMBtu in mid-July, driven by escalating geopolitical risks amid worsening situations in the Middle East and Europe. Platts assessed JKM -- the benchmark price reflecting LNG delivered to Northeast Asia -- at $14.366/MMBtu for October delivery on Aug. 19.

The unexpected price increase has led to delays in procurement activity. Chinese buyers are now predominantly cautious and remain in a wait-and-see mode regarding winter cargo procurement, according to traders at Securing Energy for Europe, or SEFE.

A market source from a Chinese national oil company expects restocking to begin around early October, with deliveries in late November or early December. Meanwhile, a source from a Japanese trading house anticipates increased active demand coverage from China for November shipments.

However, a market source from a trading house said that China's replenishment and winter purchases might start soon and that buyers are likely waiting for the current price spike to ease as there has yet to be any actual impact on trade flows.

Demand from China is expected to be less active this winter, with limited additional demand for purchases from international markets, a source with a state-owned gas distributor said.

Robust piped gas supply

Besides higher LNG prices, a healthy supply of domestic and imported pipeline gas has delayed spot LNG imports. China's natural gas production and pipeline gas inflows have been rising while LNG import growth has been muted.

Pipeline gas is expected to be a key resource for the upcoming winter season in China due to its robust supply and lower prices compared with imported LNG.

The average cost of pipeline gas imported by China in July was estimated at around $7.47/MMBtu excluding taxes and fees, about 30.5% lower than that of imported LNG, data showed.

Many end-users have contracted their annual pipeline gas supply at around Yuan 2.90-3.10/cu m this year, which is equivalent to around $11.50-12/MMBtu. If domestic trucked LNG prices rise in line with spot LNG, buyers can still switch to term supplies and pipeline gas from NOCs for winter before resorting to spot LNG imports.

Chinese buyers have been bidding at around $12.50/MMBtu in the Asian spot market recently, indicating their preferred price level.

"We are not planning to buy any spot LNG at the moment, which is out of our affordability, and we believe end-users in China hardly can afford $14/MMBtu," a source with Shanghai Gas said.

Low inventory

Inventory at LNG terminals in southern Guangdong province is expected to be relatively low as LNG imports in the region dropped 6.5% on the year over June-July, domestic gas distributor ENN Group said in a report Aug. 15.

This was due to subdued gas demand from power plants in southern China in the past two months, thanks to the ample supply of hydropower, coal-fired electricity and renewables.

LNG terminal inventory in northern China is also expected to be around 50%, which could prompt stock replenishment if the low levels persist, a trade source with one of the NOCs said.

However, the source said some procurement was already done in the second half of July when LNG prices were around $11.50-$12/MMBtu, and these cargoes could be sufficient when they are discharged over August-September.

The key concern is that buyers will remain inactive for LNG prices above $12.70-$12.80/MMBtu unless there is an urgent need to restock, the source added.

Trucked LNG prices are also too low to encourage imports.

The average trucked LNG price at 98 domestic LNG plants and receiving terminals -- which are not regulated and reflect the tradable price of natural gas in the spot market -- was pegged at around Yuan 5,107/mt ($715.87/mt) on Aug. 19, data from ENN showed.

This is equivalent to around $11.50-$12/MMBtu after taxes and fees, which is lower than spot LNG prices of around $14.4/MMBtu.

-----

Earlier: