BRICS ENERGY EXPANSION

PLATTS - 25 Sep 2024 - Some of the world's biggest commodities producers and suppliers are set to discuss energy markets during a meeting of BRICS energy ministers scheduled to take place during Russian Energy Week Sept. 26.

Since expanding to include OPEC members Iran and UAE at the beginning of 2024, BRICS' energy footprint has increased significantly. Saudi Arabia was also invited to join but has yet to confirm membership. The group accounts for 41% of global oil production and 35% of global oil consumption, if Saudi volumes are included.

Analysts see de-dollarizing trade, including of oil, as a potential growth area for cooperation within the group. Some member countries have identified this as a strategic priority, but non-dollar denominated crude trading faces barriers, including which alternative currency to choose, issues relating to currency convertibility, and exposure to currency exchange rate fluctuations.

"The one policy issue that unites the nine current members of BRICS and the up to 40 additional members of BRICS...is a common desire to escape dollar dominance," David Lubin, a senior research fellow at the Global Economy and Finance Programme at Chatham House, said.

Analysts see other areas of trade cooperation within the group as complicated by significant differences in member countries' economies and existing international partnerships.

One potential non-dollar trading growth area is oil exports from Saudi Arabia to China, which have jumped in recent years.

"The potential for more renminbi-based oil trade depends on oil exporters' willingness to accept the currency for payment, which depends on their ability to use the resulting proceeds," Charles Chang, Greater China Country Lead for Corporates at S&P Global Ratings, said.

Non-dollar trade in oil products may develop faster than crude.

"The question is whether crude oil is such a large volume, liquid commodity that it's difficult to incrementally increase that. What we've seen so far is that non-crude products seem to be occurring before crude," Chang said.

New BRICS member the UAE is also considering an increase in non-dollar trade, recently signing memorandums of understanding with fellow BRICS members India and Ethiopia to explore trade in local currencies.

"I don't see currencies of smaller economies like the dirham as being able to gain global scale over time because the trade volume is not really there, that's where the renminbi carries more potential," Chang said.

For Russia, the importance of reducing its exposure to the US dollar has increased since its full-scale invasion of Ukraine in February 2022 triggered punishing Western sanctions. It has been preparing to be cut off from Western financial markets and the US dollar since 2014, when its initial invasion of Ukraine and annexation of Crimea triggered sanctions.

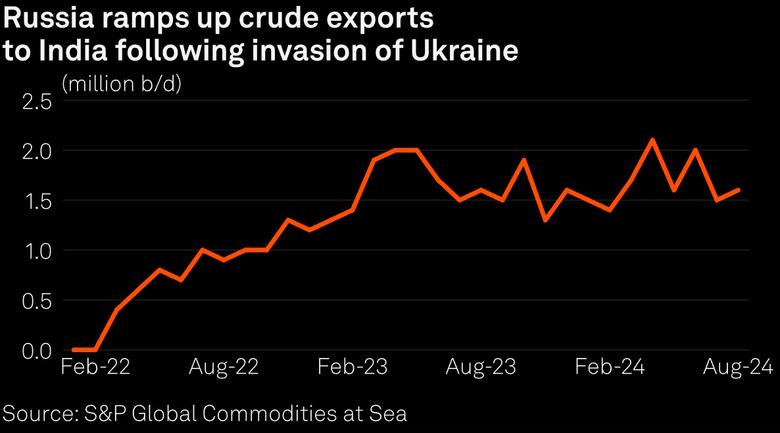

Fellow BRICS members India and China have played a significant role in Russian efforts to mitigate the impact of this on its economy, with crude exports to the two countries softening the blow of a massive fall in supplies to Europe.

Russian crude exports to India have been as high as 2.1 million b/d since the invasion began, according to S&P Global Commodities at Sea.

Currency issues have intermittently disrupted these flows, however, demonstrating the challenges of de-dollarized trade.

Expanding influence

Russian President Vladimir Putin has made increasing the influence of BRICS, as well as other alternatives to Western institutions, a priority. It holds the rotating presidency of BRICS for 2024 and is eyeing further expansion of the group when leaders meet in the Russian city of Kazan Oct. 22-24.

Putin said Sept. 12 that 34 countries are considering some form of cooperation with BRICS.

Officials from Turkey and Venezuela have expressed interest in joining the group, which would further increase its energy footprint.

Turkey is an important conduit for oil and gas flows between Russia, the rest of Europe, Central Asia and the Middle East. It has balanced its relations with Russia and the West since Russia invaded Ukraine – increasing its importance in global energy trade.

Meanwhile Venezuela holds the world's biggest oil reserves, already cooperates with Russia through OPEC+, and is under sanctions.

Bringing these two countries into the fold would increase the group's combined control over global energy markets, but member countries' differing priorities and the challenges to de-dollarizing trade will continue to frustrate efforts to boost group-wide cooperation and influence.

-----

Earlier: