EUROPEAN GAS PRICES WILL RISE

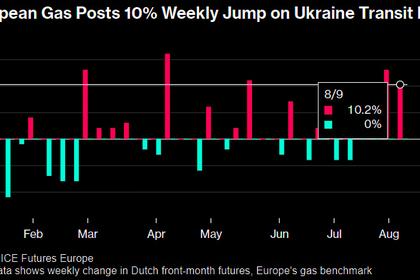

PLATTS - 28 Aug 2024 - European consumers will have to pay a "higher price" for gas from next year if the Russia-Ukraine gas transit deal is not extended, Kremlin spokesperson Dmitry Peskov said Aug. 28.

Peskov, cited by Russian news agency Tass, also said there were alternative routes for Russian gas to reach Europe, pointing to work to create a gas supply hub in Turkey.

The five-year gas transit deal between Russia and Ukraine is due to expire at the end of 2024 and is set to directly impact a number of countries that still import Russian gas via Ukraine, with Austria and Slovakia chief among them.

Ukrainian officials have repeatedly said Kyiv would not be party to talks to extend the agreement, while the European Commission has said the EU would cope with the loss of transit by sourcing alternative supplies.

"Such a decision of the Ukrainian side will obviously damage the interests of European consumers as well," Peskov was quoted as saying, adding that Europe would pay a "higher price" for gas, impacting competitiveness.

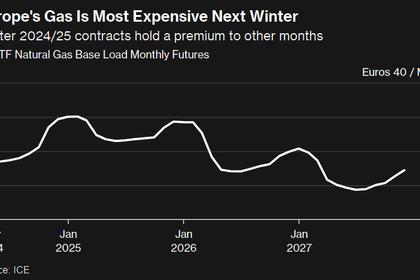

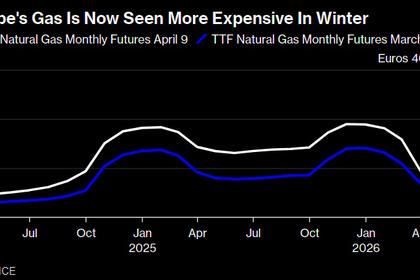

Gas prices for delivery in January and February next year are currently the most expensive delivery periods along the entire TTF curve.

Platts, part of S&P Global Commodity Insights, assessed the January 2025 TTF contract on Aug. 27 at Eur42.53/MWh and the February 2025 contract at Eur42.58/MWh, compared with a day-ahead assessment of Eur38.33/MWh.

Alternative routes

Peskov said Russia had other options for supplying gas to Europe. "There are alternative routes and there are plans to create a hub in Turkey. This work is in progress," he said.

Russian gas is delivered to Turkey via the Blue Stream and TurkStream pipelines, while a number of countries in southeast and central Europe still import Russian gas via TurkStream and onshore pipeline infrastructure.

In October 2022, Turkey and Russia agreed to work together to realize a proposal to create a gas hub in northwest Turkey.

Russian President Vladimir Putin said in September 2023 that Gazprom had delivered a draft roadmap to Turkish state company Botas on the implementation of the hub.

"We are ready to export gas in transit through Turkey to consumers to third countries — where the partners are interested in this," Putin said at the time.

It remains unclear exactly how such a hub would work in practice and whether European buyers would take the gas.

Austria's OMV, for example, has repeatedly said its contract with Gazprom had the Slovakian-Austrian border as the supply location.

"We continue to assume that the contractual handover point will be that border crossing point," OMV CEO Alfred Stern said at the end of July.

"We will not make a transit contract through Ukraine but insist on the contractually agreed supply location," he said, adding that OMV was prepared in the event of an interruption in Russian gas supplies.

EU consortium

In May, Slovakia's SPP told Commodity Insights that it considered the creation of a European consortium to take delivery of gas at the Russia-Ukraine border as "feasible" to ensure continued supplies of Russian gas via Ukraine post-2024.

In addition, Azerbaijan has said it has held talks with Ukraine, the EU and Russia on the potential to facilitate continued transit of gas via Ukraine.

Russian gas transit via Ukraine was as high as 117 Bcm in 2008 but fell to just 14.65 Bcm last year.

Gazprom is contracted to send 110 million cu m/d of Russian gas to Europe via Ukraine in 2024 — or a total of 40 Bcm — before the contract expires at the end of the year.

But since May 2022, Gazprom has been flowing less gas than agreed in the contract and paying less than the agreement provides.

It came after Ukraine declared force majeure on its ability to transit Russian gas entering at an alternative entry point at Sokhranivka, saying it no longer had operational control of infrastructure in parts of eastern Ukraine.

-----

Earlier: