GLOBAL MARKETS : TRIFLE TAWDRY

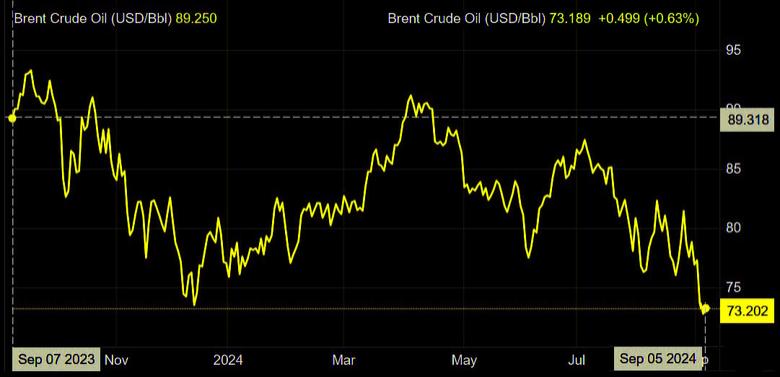

Hold on to your horses,grimaces are turning into frowns! This is how murky we are in the Oil Markets,a lot of fragility across the board.Our benchmark BRENT has slipped in further escalating talks of SPR replenishment vis a vis supply conversations amidst the Chinese Data and US PMI data.We are at the confluence of both head and tail winds friends.

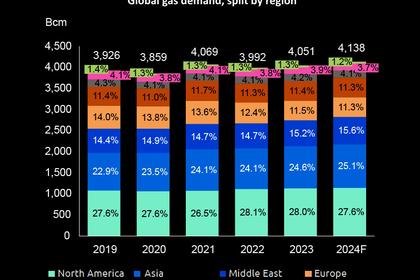

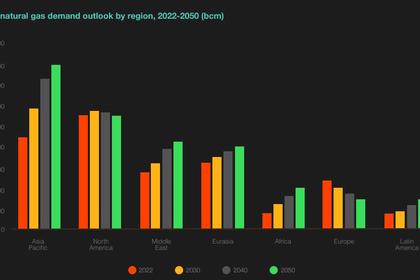

OPEC+ Supply data is on the microscope for geopolitical plays as we look into dynamics of demand and supply.Discussions by OPEC+ on a much needed delay to its planned oil production hike.

Brent crude tumbled more than 4% to below $75 a barrel after weak manufacturing data from China and US.

As I write,we are trading mid London session at $69.70/bbl on WTI Crude & $73.23/bbl on the BRENT.Support-turned-resistance at $71.70/bbl is the pivot.NaturalGas trading at $2.145/mmBtu.

For S&P 500 Tech sector, yesterday was largest 1-day move since May 25, 2023; Nvidia’s 10% drop equated to ~$279b decline in market cap; yesterday’s bearish move of 4.43% by Tech was last beaten on May 25, 2023 when sector rose 4.45% after the earnings data forecast from Nvidia.

Friday is Non Farm Payrolls data as the cream of the month start.Sense of caution with the cliff exposure on the bull run,looking into technology plays would be good riddance.Bond traders raise their bets on rate cut.

More caution than pessimism is the routine for the month.CTAs are having a more contrarian opinion despite hedge fund positions in play.

Gold Futures rise on the display of weak US Jobs Data improving rate cut optimism.

As we delve into the Asia side specifically Japan,we have seen different perspectives somewhat sustainability is yet to made the fulcrum as speculators and positional traders are riding the wave of the Yen unwinding.

Also in the East,ongoing is the African-China Summit as strengthened relations are key for effective growth and sustainance.

On the FX Watchlist: MexicanPeso has been having consistency within the broth of cross currency EM in comparison to the Yen Carry Trade.

Will lightning strike twice on the Yen trade ?

A target of 143 is on the cards for end of September, however,strictly dependent on FED rate-cut cycle& BoJ statement.

This month's start statement was hawkish,policy stance remains consistent with the Deputy Governor,moves on BOJ dependent on market stability as we look towards the neutral level.(1% to 2.5% rate).Implicit goal on going for 1%.

Wage & Service inflation,despite the subdued activities for past 20-year timeframe.Flexibility of policy is very much dependent on December rate hike projections.

Bias would be on a No strong urgency of intervention on 145/6 according to current pricing level.

A balance is what we are looking for,picking pennies in front of a steam roller isn't a sport,good thing Libra season is upon us.Many blessings.

-----

Andy Warr,

TophatFinanceGroup.

-----

Earlier: