GLOBAL NUCLEAR FINANCIAL SUPPORT

WNN - 23 September 2024 - A group of 14 global financial institutions have expressed their support for the call to action to triple nuclear energy capacity by 2050.

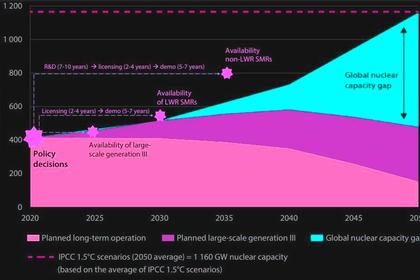

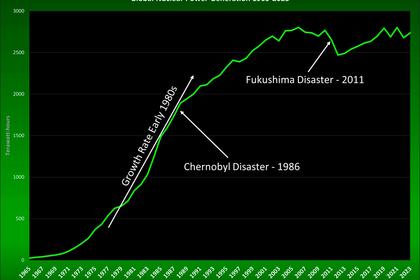

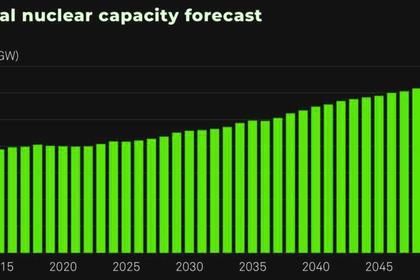

Last December, the United Nations Climate Change Conference (COP28) in Dubai saw the 198 signatory countries to the UN Framework Convention on Climate Change call for accelerating the deployment of low-emission energy technologies including nuclear power for deep and rapid decarbonisation, particularly in hard-to-abate sectors such as industry. In addition, 25 countries at COP28 pledged to work towards tripling global nuclear power capacity to reach net-zero by 2050.

At New York Climate Week, a group of 14 financial institutions on Monday stated their recognition that global civil nuclear energy projects have an important role to play in the transition to a low-carbon economy. They further expressed support for long-term objectives of growing nuclear power generation and expanding the broader nuclear industry to accelerate the generation of clean electrons to support the energy transition.

The institutions include: Abu Dhabi Commercial Bank, Ares Management, Bank of America, Barclays, BNP Paribas, Brookfield, Citi, Credit Agricole CIB, Goldman Sachs, Guggenheim Securities LLC, Morgan Stanley, Rothschild & Co, Segra Capital Management, and Societe Generale.

"Capital markets and financing can play a critical role in developing and growing nuclear energy projects worldwide. Financial institutions can provide experience, global presence, services and solutions to support the industry," according to World Nuclear Association.

Opening the event, John Podesta, Senior Advisor for International Climate Policy to President Biden, said: "Our collective mission is clear - nuclear energy is clean energy, and if we are to ensure a liveable planet, build secure, sustainable supply chains for clean energy and bolster prosperity around the world, we need to make sure that nuclear energy does its part. I know we can make it happen - as long as we work together."

Slovenian Prime Minister Robert Golob added, "The only riddle left to solve is the financial side, the financial costs. Financial markets need to adapt and develop new financial instruments in order for nuclear energy to become competitive with other CO2-free energy sources."

"It is time to take concrete action towards necessary expansion of nuclear energy," said Sweden's Minister for Energy, Business and Industry and Deputy Prime Minister Ebba Busch. "The Swedish government is exploring a proposed financing model which includes government-backed loans, contracts-for-difference (CfDs) and risk-sharing mechanisms. The aim of the proposal is to significantly improve the conditions for nuclear new build in Sweden and with it, a more sustainable future."

Last month, a Swedish government study proposed that state aid be given to companies for investments in new nuclear power following an application procedure. It said a new legislative act should regulate conditions for receiving the support, the support measures, and what an application must contain.

James Schaefer, senior managing director of Guggenheim Securities, said: "New nuclear power is both clean and safe, and more importantly proven, with a number of nations now operating highly advanced and commercially viable third and fourth-generation fission technologies. It is essential that we accelerate the progression of planned projects into plants on the ground given the huge demand coming down the line for data centres and AI technologies. This will require nuclear companies, plant owners, data centre and technology companies, together with banks and financial institutions to collaborate closely."

"Including nuclear energy as a zero-carbon technology alongside renewables is essential to meeting the world's carbon reduction goals and ensuring that heavy industrial manufacturers like Nucor have a reliable and clean electricity supply to continue growing, prospering, and providing high-paying jobs," said Benjamin Pickett, vice president and general manager of public affairs and government relations at Nucor Corporation.

"Since COP28 in Dubai last year, we have witnessed a step change in momentum across the nuclear sector, buoyed by a significant increase in demand for clean electrons for data centres and AI, with global power demand for this sector alone set to double by 2026," said Mohamed Al Hammadi, Managing Director and CEO of the Emirates Nuclear Energy Corporation and chairman of World Nuclear Association.

"With the support of 14 global banks and financial institutions witnessed this morning on the sidelines of New York Climate Week, it is clear that not only is nuclear energy viewed as a crucial enabler to decarbonise the power sector, but it also fits the profile for sustainable and transition financing, especially as we now see multiple nuclear plants being delivered efficiently, providing confidence to the market and a clear market signal that nuclear is a proven, bankable route to energy security and net zero in parallel."

Last week, ten industry associations issued a communiqué during the second Roadmaps to New Nuclear conference in Paris, organised by the OECD Nuclear Energy Agency. They called on all OECD member states to set out clear plans for nuclear energy deployment. Among the eight key areas highlighted by the associations were: ensuring ready access to national and international climate finance mechanisms for nuclear development; ensuring that multilateral financial institutions include nuclear energy in their investment portfolios; and providing clarity to investors on the funding and investment recovery mechanisms available for nuclear projects and including nuclear energy in clean energy financing mechanisms.

Sama Bilbao y León, Director General of World Nuclear Association, welcomed Monday's announcement from leaders in the global finance community. "Now we need to see today's commitment translate to changes in lending policies and greater access for nuclear to sustainable finance mechanisms. Nuclear offers investors long-term returns and a means of tackling the world's urgent and growing need for abundant, affordable, 24/7 clean energy.

"Today was a major step forward. Meeting the goal of tripling nuclear output will require the commitment and ingenuity of policy makers, financial leaders, the nuclear industry, and many others in a coalition of the ambitious."

-----

Earlier: