GLOBAL OIL DEMAND WILL UP

PLATTS- 24 Sep 2024 - Global oil demand will keep rising through at least 2050, OPEC said Sept. 24, as the crude exporting bloc continues to challenge environmental activists and policy makers seeking to curb fossil fuel production and consumption.

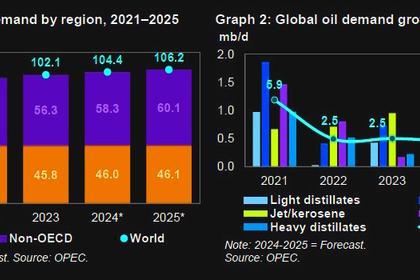

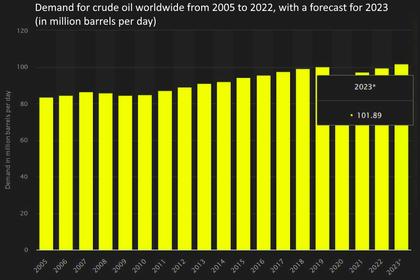

"There is no peak demand on the horizon," OPEC Secretary General Haitham al-Ghais said in the organization's World Oil Outlook, which sees global thirst for liquid fuels increasing from 102.2 million b/d in 2023 to 120.1 million b/d in 2050, "with the potential for it to be higher".

The findings, Ghais said, underscored that "the fantasy of phasing out oil and gas bears no relation to fact."

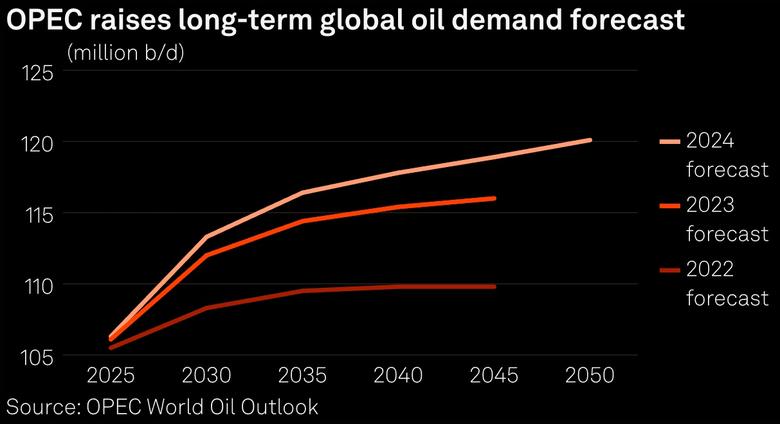

Indeed, the demand forecasts in the report are even more aggressive than last year's, which projected that global consumption would hit 116.0 million b/d in 2045.

This year's outlook pegs oil demand at 118.9 million b/d for 2045, a 2.5% upward revision, and then adds the 2050 forecast, which OPEC said reveals the extent to which India, alongside some other Asian economies, the Middle East and Africa will drive demand growth.

It sees combined demand in those four regions increasing by 22 million b/d between 2023 and 2050.

The bullish forecast puts the organization at odds with some other analysts, including at the International Energy Agency, with whom OPEC has feuded in recent years over the future of oil.

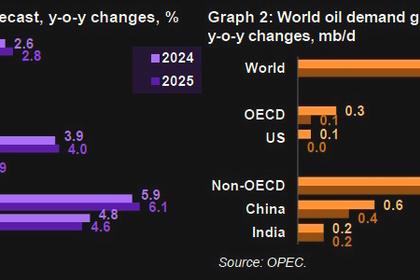

IEA executive director Fatih Birol said Sept. 23 that global oil demand growth will likely remain below 1 million b/d in the near future largely because of a slowdown in China's economy. The IEA expects fossil fuel use to peak before 2030. It is due to release its next long-term energy forecast in October.

Such rhetoric endangers global energy security by discouraging needed investments in oil and gas production, OPEC has said.

OPEC comprises 12 crude exporting nations, whose economies rely heavily on oil revenues, and since 2017 it has partnered with Russia and several other producers in an alliance called OPEC+ to manage the market through output quotas.

To meet demand in 2050, the industry will require a cumulative $17.4 trillion in upstream and downstream projects, OPEC estimated.

"A realistic view of demand growth expectations necessitate adequate investments in oil and gas, today, tomorrow, and for many decades into the future," Ghais said in the report.

Production pressure

The outlook puts much of the burden on OPEC+ producers themselves.

Supply from outside the group will rise 1.2 million b/d annually through 2029, largely due to growth in the US, Brazil and Canada, with Argentina, Norway and Qatar also bringing additional barrels to market.

But that non-OPEC+ supply will peak at 59 million b/d in the early 2030s and then decline to 57.3 million b/d by 2050.

That leaves the call on OPEC+ liquids, including NGLs -- the amount the group would need to pump to balance supply with demand -- to go from 50.3 million b/d in 2023 to 53.8 million b/d in 2029 and then surge to 62.9 million b/d in 2050.

Accordingly, the OPEC+ alliance's share of the global oil market will increase from 49% in 2032 to 52% in 2050.

In January, Saudi Arabia's energy ministry directed state-backed Aramco to suspend plans to increase production capacity to 13 million b/d from 12 million b/d.

In the UAE, ADNOC's expansion plans are close to completion. The Abu Dhabi company, which pumps the vast majority of the UAE's crude, in May said it was capable of pumping 4.85 million b/d en route to its target of 5 million b/d by 2027.

Actual production in the two countries is significantly lower, with Saudi Arabia held to a quota of 8.99 million b/d and the UAE 2.99 million b/d through at least November under the current OPEC+ agreement.

In Africa, underinvestment has hampered many members' attempts to increase and maintain production, while Russia, Iran and Venezuela are under stringent Western sanctions targeting their oil sectors.

Iraq and Libya continue to grapple with political risks, which have led to significant supply disruptions.

Some supply growth will come from OPEC+ member Kazakhstan, as well as Brazil -- which has signed a so-called "charter of cooperation" with OPEC+, although it has not taken up full membership. OPEC's decision to release its report in Brazil reflects its efforts to increase ties with the country.

Securing long-term investment in oil projects is complicated by uncertainty over the pace of energy transition and the volatile energy security landscape, as well as current sluggish prices.

"All policymakers and stakeholders need to work together to ensure a long-term investment-friendly climate, one that works for producers and consumers, as well as developed and developing countries," Ghais said in the report.

Azerbaijan, which is not a member of OPEC but belongs to the wider OPEC+ group, is hosting the next UN Climate Change Conference (COP30).

In the meantime, OPEC+ countries have implemented major output cuts aimed at shoring up prices amid weak economic indicators and growing non-OPEC+ production.

The alliance is next due to review policy Oct. 2 at a meeting of the OPEC+ Joint Ministerial Monitoring Committee. A full OPEC+ ministerial meeting is scheduled for Dec. 1 in Vienna.

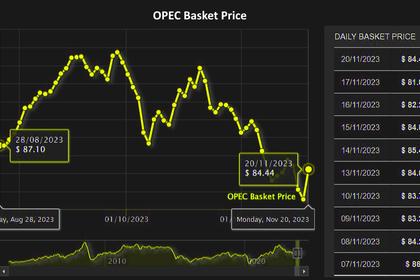

Platts, part of S&P Global Commodity Insights, assessed Dated Brent at $75.17/b on Sept. 23.

OPEC long-term oil demand forecast (million b/d):

| 2023 | 2030 | 2035 | 2040 | 2045 | 2050 | Growth 2023–2050 | |

| OECD | 45.7 | 45.9 | 43.7 | 40.6 | 37.9 | 35.6 | –10.1 |

| Non-OECD | 56.6 | 67.4 | 72.7 | 77.2 | 81.1 | 84.6 | 28 |

| World | 102.2 | 113.3 | 116.4 | 117.8 | 118.9 | 120.1 | 17.9 |

Unit: million b/d

Source: OPEC World Oil Outlook

-----

Earlier: