SAUDIS DON'T NEED $100

FT - September 26 2024 - Saudi Arabia is ready to abandon its unofficial price target of $100 a barrel for crude as it prepares to increase output, in a sign that the kingdom is resigned to a period of lower oil prices, according to people familiar with the country’s thinking.

The world’s largest oil exporter and seven other members of the Opec+ producer group had been due to unwind long-standing production cuts from the start of October. But a two-month delay sparked speculation over whether the group would ever be able to raise output, with the price of Brent crude, the international benchmark, briefly dropping below $70 this month to its lowest since December 2021.

However, officials in the kingdom are committed to bringing back that production as planned on December 1, even if it leads to a prolonged period of lower prices, the people said.

The prospect of Riyadh ditching its unofficial target hit the Brent price and the shares of oil companies on Thursday.

Saudi Arabia’s energy ministry did not respond to a request for comment.

The shift in thinking represents a major change of tack for Saudi Arabia, which has led other Opec+ members in repeatedly cutting output since November 2022 in an attempt to maintain high prices.

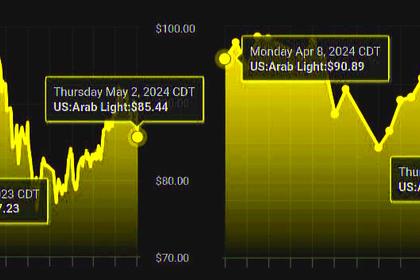

The price of Brent averaged $99 a barrel in 2022, the highest level in eight years, as the fallout from Russia’s invasion of Ukraine roiled markets, but has since fallen back.

By contrast, Brent crude was down 2 per cent on the day at $71.99 on Thursday, while West Texas Intermediate, the US benchmark, dropped 2 per cent to $68.28. The declines hit the share prices of Europe’s big oil producers, with BP falling 3.6 per cent, Shell down 3.2 per cent and TotalEnergies off 3.1 per cent.

Increased supply from non-Opec producers, particularly the US, and weak demand growth in China, have reduced the impact of the group’s cuts over time. Brent has averaged $73 a barrel so far in September, even as Israel’s war with Hamas in Gaza has threatened to escalate into a wider regional conflict.

Saudi Arabia needs an oil price of close to $100 a barrel to balance its budget, according to the IMF, as Crown Prince Mohammed bin Salman seeks to fund a series of megaprojects at the heart of an ambitious economic reform programme.

However, the kingdom has decided it is not willing to continue ceding market share to other producers, the people said. It also believes it has enough alternative funding options to weather a period of lower prices, such as tapping foreign exchange reserves or issuing sovereign debt, they added.

A decade ago Saudi Arabia brought the $100 a barrel oil era to a close, increasing output as prices fell in 2014 in an effort to thwart the rapid emergence of the US shale industry.

More recently, under energy minister Prince Abdulaziz bin Salman, the kingdom has sought to maximise revenues, cutting production to support prices.

However, the policy has at times inflamed tensions with the US, which tried and failed to get Riyadh to boost production in 2022 after Russia’s invasion of Ukraine sent prices soaring.

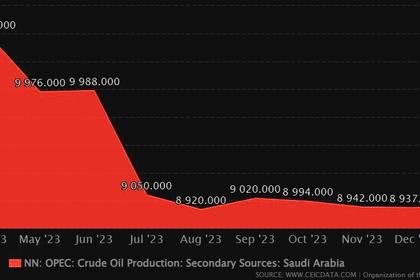

Saudi Arabia has shouldered the majority of the Opec+ cuts to date, reducing its own production by 2mn barrels a day in the past two years, representing over one-third of the cuts by members.

The kingdom is currently pumping 8.9mn b/d, the lowest level since 2011, outside of the coronavirus pandemic and the 2019 attack on the state oil company’s processing facility at Abqaiq.

Under the delayed plan to begin unwinding the cuts, Saudi Arabia will increase its monthly production by an additional 83,000 b/d each month from December, boosting its output by a total of 1mn b/d by December 2025.

A key frustration for Saudi Arabia has been that several members of the cartel, including Iraq and Kazakhstan, have been partially ignoring the cuts by pumping more than their respective quotas.

Opec secretary-general Haitham Al Ghais visited both countries in August and extracted commitments that they would adjust their future production plans to compensate for past oversupply.

But Saudi Arabia remains concerned about compliance and could decide to unwind its own cuts faster than planned if either country does not toe the line, one of the people added.

-----

Earlier: