Downstream

2022, February, 11, 11:40:00

GLOBAL OIL DEMAND 2022: +4.2 MBD

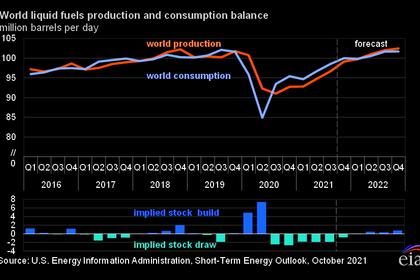

In 2022, oil demand growth is expected at 4.2 mb/d unchanged from last month, with OECD and non-OECD projected to grow by 1.8 mb/d and 2.3 mb/d, respectively.

2022, February, 4, 10:50:00

ГАЗОМОТОРНЫЙ РЫНОК РОССИИ

"Наша страна поддерживает тренд по зелёному энергопереходу и снижению выбросов в атмосферу. Развитие газомоторного рынка – один из шагов в этом направлении. Поэтому у газомоторного рынка в России огромные перспективы", – сказал Юрий Борисов.

2022, January, 12, 10:35:00

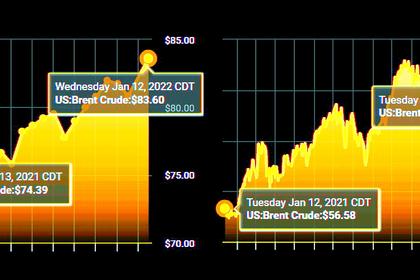

OIL PRICES 2022-23: $75-$68

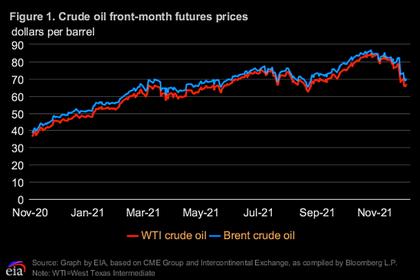

Brent crude oil spot prices averaged $71 per barrel (b) in 2021, and we forecast Brent prices will average $75/b in 2022 and $68/b in 2023.

2021, December, 14, 14:35:00

GLOBAL OIL DEMAND 2021: + 5.7 MBD ANEW

World oil demand is kept unchanged compared to last month’s assessment, showing a growth of 5.7 mb/d in 2021.

2021, December, 8, 16:10:00

OIL PRICES 2021-22: $71-$70

We expect Brent prices will average $71/b in December and $73/b in the first quarter of 2022 (1Q22). For 2022 as a whole, we expect that growth in production from OPEC+, of U.S. tight oil, and from other non-OPEC countries will outpace slowing growth in global oil consumption, especially in light of renewed concerns about COVID-19 variants. We expect Brent prices will remain near current levels in 2022, averaging $70/b.

2021, November, 30, 13:20:00

ЭНЕРГЕТИЧЕСКОЕ ПАРТНЕРСТВО РОССИИ, КИТАЯ

Сотрудничество России и КНР в ТЭК за последнее десятилетие успешно развивается и вышло на беспрецедентно высокий уровень благодаря совместным усилиям лидеров стран.

2021, November, 19, 11:25:00

RUSSIAN DIESEL FOR U.S. UP

Four tankers with 2 million barrels of Russian diesel aboard, the most in data going back to 2018, are set to arrive next week, as natural gas-rich Russia cranks up diesel-producing units that are dependent on a feedstock extracted from costly natural gas,

2021, November, 18, 13:00:00

ROSNEFT, SHELL DEAL

Rosneft exercised the pre-emption right for 37.5% share of the PCK (Schwedt) refinery from Shell.

2021, November, 12, 12:35:00

GLOBAL OIL DEMAND 2021: + 5.7 MBD

World oil demand growth in 2021 is revised lower by around 0.16 mb/d, compared to last month’s assessment, to stand at 5.7 mb/d.

2021, November, 10, 12:20:00

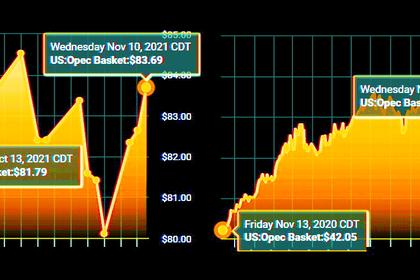

OIL PRICES 2021-22: $82-$72

We expect Brent prices will remain near current levels for the rest of 2021, averaging $82/b in the fourth quarter of 2021. In 2022, we expect that growth in production from OPEC+, U.S. tight oil, and other non-OPEC countries will outpace slowing growth in global oil consumption and contribute to Brent prices declining from current levels to an annual average of $72/b.

2021, October, 15, 09:35:00

GLOBAL OIL DEMAND WILL UP BY 5.8 MBD

World oil demand is estimated to increase by 5.8 mb/d in 2021, revised down from 5.96 mb/d in the previous month’s assessment.

2021, October, 14, 12:55:00

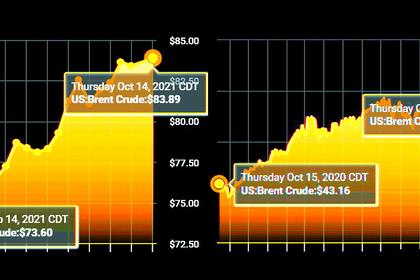

OIL PRICES 2021-22: $81-$72

We expect Brent prices will remain near current levels for the remainder of 2021, averaging $81/b during the fourth quarter of 2021. In 2022, we expect that growth in production from OPEC+, U.S. tight oil, and other non-OPEC countries will outpace slowing growth in global oil consumption and contribute to Brent prices declining from current levels to an annual average of $72/b.

2021, September, 20, 12:35:00

НАДЕЖНЫЙ ГАЗ РОССИИ

Последняя зима показала, что «Газпром» эти конкурентные преимущества успешно демонстрирует. Это значит, что мы надежно, стабильно поставляем газ в полном объеме, как и требует наш потребитель, в условиях осенне-зимнего периода.

2021, September, 14, 12:30:00

IRAN'S REFINING CAPACITY UP

Oil products consumption reached 70 Mt in 2020, and Iran exported 18 Mt of petroleum products.

2021, September, 10, 12:40:00

OIL PRICES 2021-22: $71-$66

We expect Brent prices will remain near current levels for the remainder of 2021, averaging $71/b during the fourth quarter of 2021 (4Q21). In 2022, we expect that growth in production from OPEC+, U.S. tight oil, and other non-OPEC countries will outpace slowing growth in global oil consumption and contribute to Brent prices declining to an annual average of $66/b.