Downstream

2018, September, 26, 09:35:00

OPEC: GLOBAL ENERGY DEMAND WILL UP BY 33%

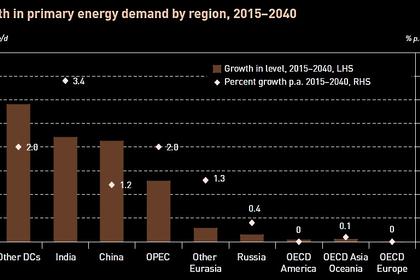

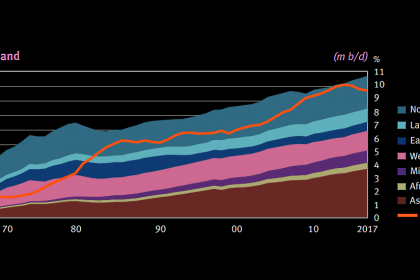

OPEC - Total primary energy demand is expected to increase by 91 mboe/d between 2015 and 2040 to reach 365 mboe/d in 2040

2018, September, 24, 15:15:00

THE TRADE WAR LIMITING U.S.

API - “Placing constraints on exports of American-made energy works against America’s energy future,” said API Chief Economist Dean Foreman. “While the picture is still a bit muddied, it seems to be getting clearer – the trade war appears to be limiting the United States’ access to crude export markets. As we produce more energy here at home, the U.S. needs markets for its products in order for our economy to continue to grow. There’s no question that the 1.6 MBD increase U.S. petroleum net imports, which undid a full year’s worth progress, is a setback to the United States’ goal of energy dominance.”

2018, September, 21, 10:20:00

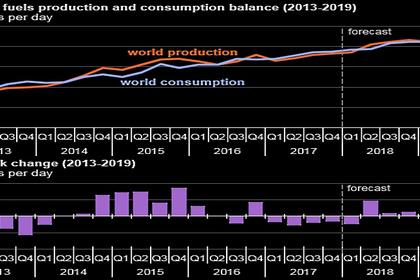

WORLD OIL DEMAND: 100.23 MBD

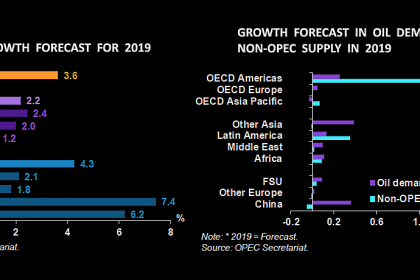

OPEC - Total oil demand for 2018 is now estimated at 98.82 mb/d. In 2019, world oil demand growth is forecast to rise by 1.41 mb/d. Total world oil demand in 2019 is now projected to surpass 100 mb/d for the first time and reach 100.23 mb/d.

2018, August, 31, 11:20:00

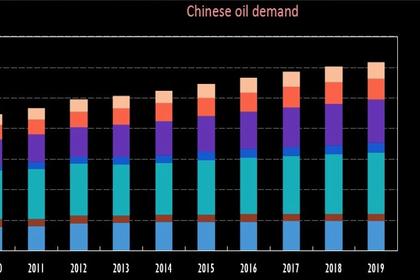

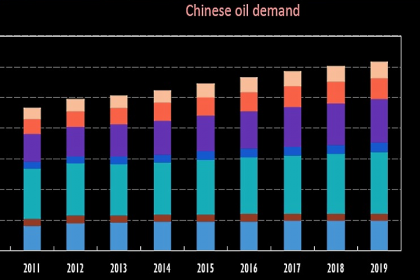

CHINA'S OIL PRODUCT CONSUMPTION UP BY 7.2%

PLATTS - China's consumption of oil products rose 7.2% year on year to 27.54 million mt in July, data released Tuesday by the National Development and Reform Commission showed.

2018, July, 12, 10:45:00

OPEC: OIL DEMAND UP BY 1.65 MBD

OPEC - In 2018, oil demand is expected to grow by 1.65 mb/d, unchanged from the previous month’s assessment, with expectations for total world consumption at 98.85 mb/d. In 2019, the initial projection indicates a global increase of around 1.45 mb/d, with annual average global consumption anticipated to surpass the 100 mb/d threshold. The OECD is once again expected to remain in positive territory, registering a rise of 0.27 mb/d with the bulk of gains originating in OECD America. The non-OECD region is anticipated to lead oil demand growth in 2019 with initial projections indicating an increase of around 1.18 mb/d, most of which is attributed to China and India. Additionally, a steady acceleration in oil demand growth is projected in Latin America and the Middle East.

2018, July, 11, 09:25:00

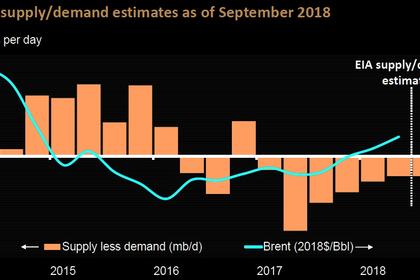

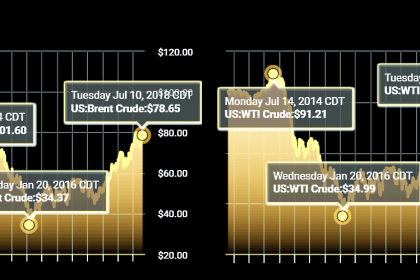

OIL PRICES 2018 - 19: $73 - $69

EIA - Brent crude oil spot prices averaged $74 per barrel (b) in June, a decrease of almost $3/b from the May average. EIA forecasts Brent spot prices will average $73/b in the second half of 2018 and will average $69/b in 2019. EIA expects West Texas Intermediate (WTI) crude oil prices will average $6/b lower than Brent prices in the second half of 2018 and $7/b lower in 2019. NYMEX WTI futures and options contract values for October 2018 delivery that traded during the five-day period ending July 5, 2018, suggest a range of $56/b to $87/b encompasses the market expectation for October WTI prices at the 95% confidence level.

2018, June, 27, 11:15:00

U.S. - RUSSIA COOPERATION

REUTERS - “We met. We discussed energy issues, among other things. We touched upon questions related to sanctions,” Novak said in a press briefing in Washington. “We can’t sidestep these difficult questions, so of course we touched upon them during our contact.”

2018, June, 27, 10:45:00

ARABIAN INVESTMENT FOR INDIA: $44 BLN

AOG - Sheikh Abdullah said: “This agreement strengthens the already close ties between the UAE and the Kingdom of Saudi Arabia and between the UAE and India. The UAE is unwavering in its commitment to its strategic multi-lateral relationships with both Saudi Arabia and India, as well as being a reliable partner in India’s energy security. We look forward to exploring further opportunities to expand our energy partnerships and to collaborating on new, broader, opportunities that will further strengthen and deepen the long-standing economic links between our three countries.”

2018, June, 22, 13:10:00

THE LARGEST VENEZUELA'S OIL

U.S. EIA - Venezuela holds the largest oil reserves in the world, in large part because of the heavy oil reserves in the Orinoco Oil Basin. In addition to oil reserves, Venezuela has sizeable natural gas reserves, although the development of natural gas lags significantly behind that of oil. However, in the wake of political and economic instability in the country, crude oil production has dramatically decreased, reaching a multi-decades low in mid-2018.

2018, June, 15, 11:00:00

SAUDI ARAMCO INVESTMENTS WILL UP

REUTERS - Saudi Aramco plans to boost investments in refining and petrochemicals to secure new markets for its crude, and sees growth in chemicals as central to its downstream strategy to lessen the risk of a slowdown in oil demand.

2018, June, 8, 13:20:00

OPEC: WORLD OIL DEMAND UP, PRODUCTION DOWN

OPEC - World oil demand averaged 97.20 mb/d in 2017, up by 1.7 per cent y-o-y, with the largest increases taking place in Asia and Pacific region (particularly China and India), Europe and North America. The 2017 oil demand in Africa and the Middle East grew by around 100,000 b/d, as compared to 2016, while oil demand declined in Latin America for the third year in a row.

2018, May, 30, 13:55:00

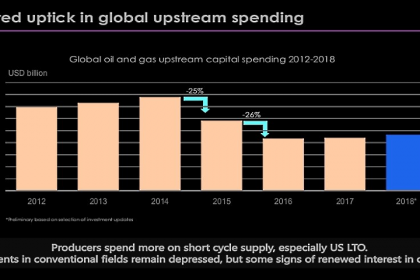

GLOBAL INVESTMENT UP, DEBT DOWN

EIA - Financial Review of the Global Oil and Natural Gas Industry: 2017

- Brent crude oil daily average prices were $54.75 per barrel in 2017—21% higher than 2016 levels

- Excluding proved reserve acquisitions, upstream costs incurred increased from 2016 levels but remained lower than 2008–15 levels

- Proved reserves additions in 2017 approached the highest levels in the 2008–17 period

- Finding plus lifting costs fell to $29 dollars per barrel of oil equivalent in 2017, the lowest level in the 2008–17 period

- The energy companies reduced debt in 2017, the first year in the 2008–17 period

- Refiners with global refining assets reduced distillation capacity for the eighth consecutive year

2018, May, 14, 11:00:00

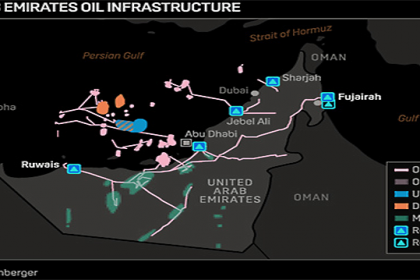

ADNOC INVESTMENT PLAN: $45 BLN

AOG - The Abu Dhabi National Oil Company (ADNOC) has unveiled plans to invest $45bn alongside partners, over the next five years, to become a leading global downstream player.

2018, May, 4, 15:25:00

CHINA'S OIL DEMAND UP 6.8%

PLATTS - China ended the first quarter of 2018 with robust apparent oil demand growth of 6.8% year on year, as stronger-than-expected GDP growth boosted consumption from the industrial and construction sectors and outweighed concerns over rising oil prices

2018, April, 25, 09:35:00

SHELL SELLS ARGENTINA $0.95 BLN

SHELL - Shell has signed an agreement to sell its Downstream business in Argentina to Raízen for US$0.95 billion in cash proceeds at completion, subject to customary closing conditions. The sale includes the Buenos Aires Refinery, around 645 retail stations, liquefied petroleum gas, marine fuels, aviation fuels, bitumen, chemicals and lubricants businesses, as well as supply and distribution activities in the country. Additionally, after the transaction closes, the businesses acquired by Raízen will continue their relationships with Shell through various commercial agreements, which represent an estimated value of US$0.3 billion.