Midstream

2019, August, 19, 11:40:00

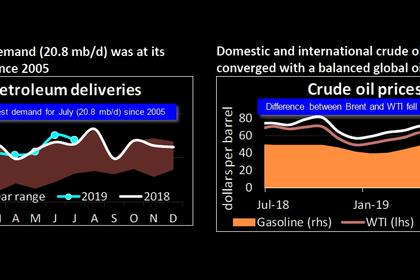

U.S. PETROLEUM DEMAND 20.8 MBD

Total U.S. petroleum demand averaged 20.8 million barrels per day (mb/d) in July 2019, which represented a 0.9% year-over-year increase and the highest demand for the month since 2005,

2019, August, 16, 10:20:00

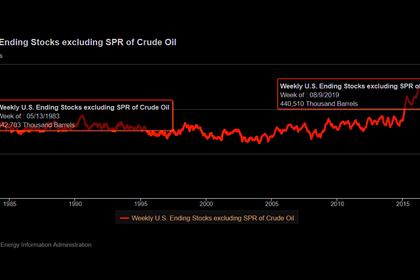

U.S. OIL INVENTORIES 440.5 MLN BBL

At 440.5 million bbl, US crude oil inventories are 3% above the 5-year average for this time of year

2019, August, 14, 12:20:00

CHINA'S OIL THROUGHPUT UP 5.6%

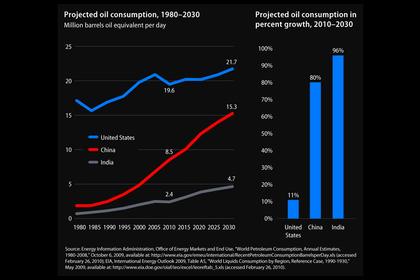

For the first seven months of 2019, Chinese crude throughput rose 5.6% from a year earlier to 369.73 million tonnes, or 12.73 million bpd, the NBS reported.

2019, August, 13, 13:40:00

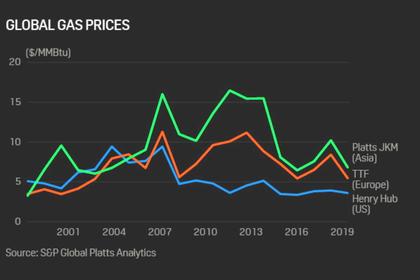

RUSSIA'S LNG FOR INDIA: $25.5 BLN

Russia’s Novatek is interested in supplying liquefied natural gas (LNG) from its Arctic LNG-2 project to Indian companies, Russian Deputy Energy Minister Anton Inyutsyn was quoted as saying by the ministry’s website on Monday.

2019, August, 13, 13:35:00

RUSSIA'S GAS TO EUROPE WILL UP

"Russian imports are expected to rise month on month in August," it said. "A significant amount of ESP sales for August delivery for both northwest Europe and Central and Eastern Europe is expected to counteract the effect of reduced contractual nominations."

2019, August, 13, 13:15:00

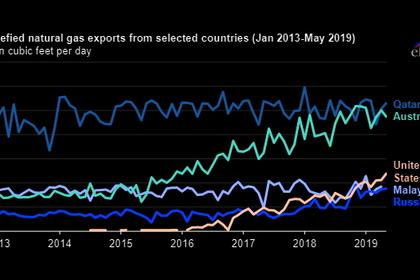

AUSTRALIA'S LNG UP

U.S. EIA - Australia’s LNG export capacity increased from 2.6 billion cubic feet per day (Bcf/d) in 2011 to more than 11.4 Bcf/d in 2019.

2019, August, 13, 13:10:00

LUKOIL'S PRODUCTION 2.3 MBD

For the six months of 2019 LUKOIL Group's average hydrocarbon production excluding the West Qurna-2 project was 2,352 thousand boe per day, which is 2.8% higher year-on-year. The increase was mainly driven by the development of gas projects in Uzbekistan, as well as oil production growth in Russia due to change in terms of the external limitations of Russian companies' production volumes.

2019, August, 12, 13:25:00

UNCERTAINT OIL DEMAND GROWTH

Now, the situation of the oil demand growth is becoming even more uncertain: the US-China trade dispute remains unresolved and in September new tariffs are due to be imposed.

2019, August, 12, 13:20:00

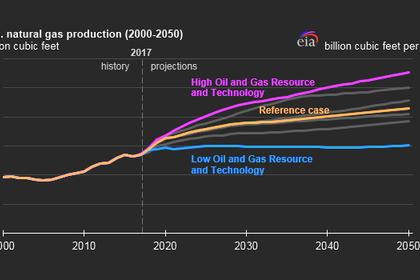

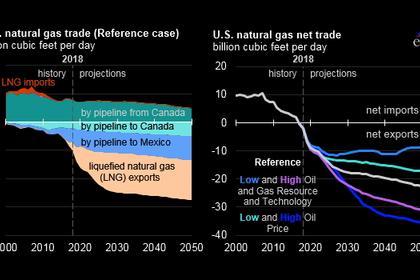

U.S. GAS DEMAND UP

U.S. natural gas demand is rising as power generators shut coal plants and burn more gas for electricity and as rapidly expanding liquefied natural gas (LNG) terminals turn more of the fuel into super-cooled liquid for export.

2019, August, 12, 13:15:00

U.S. GAS SALES UP

Russian gas sales on Gazprom Export's Electronic Sales Platform (ESP) rebounded above 100 million cu m in Thursday's auction, continuing a trend of steady strong sales on the platform this month.

2019, August, 12, 13:10:00

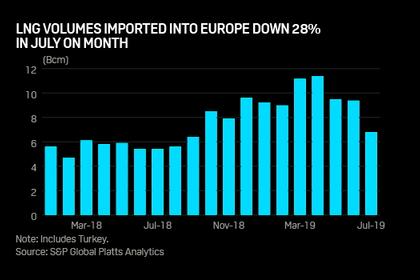

LNG FOR EUROPE DOWN 28%

European LNG imports in July fell 27.6% month on month to 6.8 Bcm due to weaker European pricing and a turndown in Qatari production, but a rebound in flows is expected in September

2019, August, 9, 13:10:00

ARAMCO STABILIZE OIL MARKET

Saudi Aramco will cut customer allocations across all regions by a total of 700,000 barrels a day next month,

2019, August, 9, 13:05:00

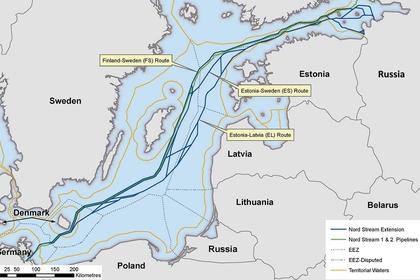

NORD STREAM 2 DELAY: $740 MLN

The 1,230-km (765-mile) Nord Stream 2 pipeline, now under construction, has come under fire from the United States and several eastern European, Nordic and Baltic countries, which say the conduit will increase Europe’s reliance on Russian gas.

2019, August, 8, 11:20:00

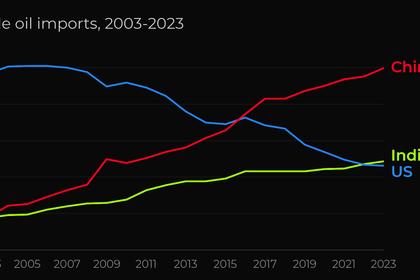

CHINA'S OIL IMPORTS UP 14%

China's arrivals of crude oil last month were 41.04 million tonnes, equivalent to 9.66 million barrels per day (bpd)

2019, August, 7, 12:20:00

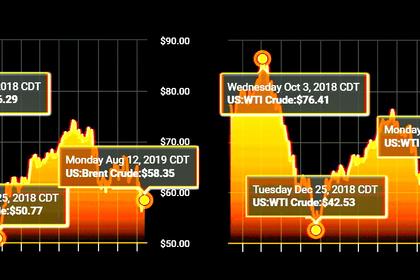

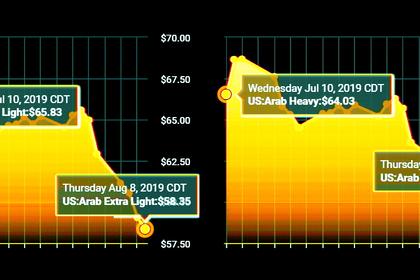

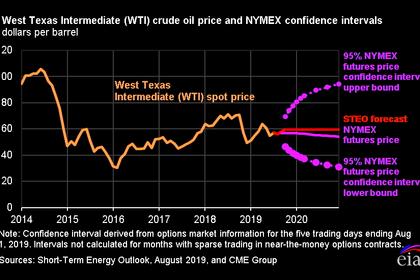

OIL PRICES 2019-20: $64-65

Brent crude oil spot prices averaged $64 per barrel (b) in July, almost unchanged from the average in June 2019 but $10/b lower than the price in July of last year. EIA forecasts Brent spot prices will average $64/b in the second half of 2019 and $65/b in 2020. The forecast of stable crude oil prices is the result of EIA’s expectations of a relatively balanced global oil market. EIA forecasts global oil inventories will increase by 0.1 million barrels per day (b/d) in 2019 and 0.3 million b/d in 2020.