Midstream

2020, February, 19, 11:40:00

U.S. ANNOYED: NORD STREAM 2

While Gazprom has said it’s looking at options to complete the pipeline, it hasn’t given any details on where it will find the ship to do the work. One of the pipeline’s financial backers, Austrian gas and oil company OMV AG, has predicted that the Russians will follow through.

2020, February, 17, 11:55:00

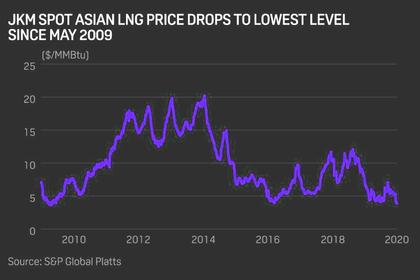

WEAK LNG DEMAND

Weaker-than-expected LNG demand, relatively mild winter weather, the coronavirus outbreak and Chinese tariffs have made the situation worse.

2020, February, 14, 11:35:00

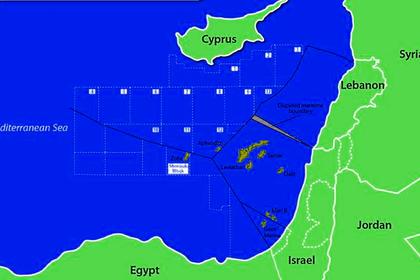

LEVIATHAN NEED INVESTMENT

Leviathan, one of the world’s biggest offshore gas discoveries of the last decade, has turned Israel into an energy exporter in a tumultuous region and has weaned it off more polluting imports, notably coal.

2020, February, 14, 11:30:00

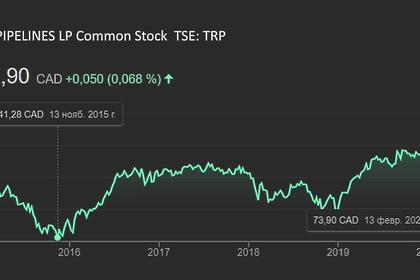

TC ENERGY NET INCOME $4 BLN

TC Energy Corporation (TSX, NYSE: TRP) (TC Energy or the Company) announced net income attributable to common shares for fourth quarter 2019 of $1.1 billion or

$1.18 per share compared to net income of $1.1 billion or $1.19 per share for the same period in 2018.

2020, February, 12, 12:12:00

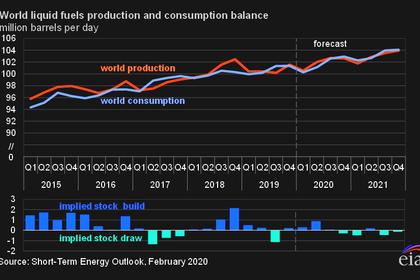

OIL PRICES 2020-21: $61-68

EIA forecasts Brent prices will average $61/b in 2020; with prices averaging $58/b during the first half of the year and $64/b during the second half of the year. EIA forecasts the average Brent prices will rise to an average of $68/b in 2021.

2020, February, 12, 12:10:00

UKRAINE, RUSSIA, CRIMEA: $8 BLN

The Ukrainian company's claims against the Russian state over the Crimea assets were left out of a settlement deal with Russia's Gazprom agreed at the end of December, which canceled out all existing arbitration claims by both parties as part of a new transit contract.

2020, February, 12, 12:00:00

U.S. SHALE GAS WRITE-DOWNS

EQT Corp, the largest U.S. gas producer, recently said it would take a write-down of as much as $1.8 billion, following CNX Resources Corp, Royal Dutch Shell Plc and Chevron Corp in reducing the value of gas properties.

2020, February, 12, 11:50:00

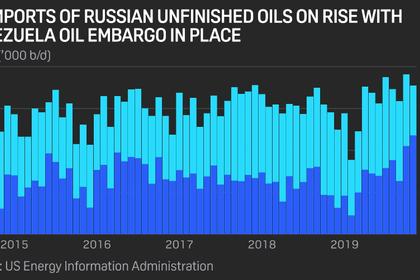

RUSSIA'S OIL FOR U.S.

US imports of unfinished oils from Russia averaged 472,000 b/d in November, the most since May 2013, when the same amount of unfinished oils was imported from Russia.

2020, February, 10, 10:30:00

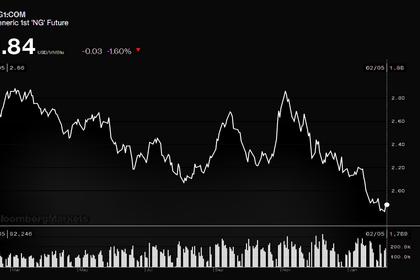

U.S. LNG COMPANIES DOWN

U.S. gas producers are counting on LNG exports to absorb record production from the shale boom. Those exports jumped 68% to a record 5.0 billion cubic feet per day in 2019 after soaring 53% in 2018.

2020, February, 7, 10:25:00

ROSNEFT FOR INDIA: 2 MLN. T.

Rosneft Oil Company and Indian Oil Corporation Limited (IOCL) signed a contract to supply up to 2 million tonnes of oil to India via the port of Novorossiysk by the end of 2020.

2020, February, 5, 11:15:00

RUSSIA'S GAS FOR EUROPE DOWN

Gas demand across Europe has been unseasonably weak in January due to warm weather, with the month also seeing a re-routing of Russian gas exports to Europe with the start-up of the TurkStream gas pipeline to Turkey replacing some flows via Ukraine.

2020, February, 5, 11:10:00

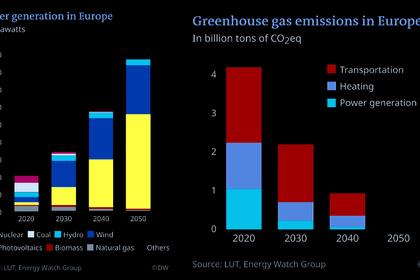

NORD STREAM 2: REDUCTION CO2 EMISSIONS 50%

When replacing hard coal, natural gas achieves an immediate 50 percent reduction of CO2 emissions.

2020, February, 5, 11:00:00

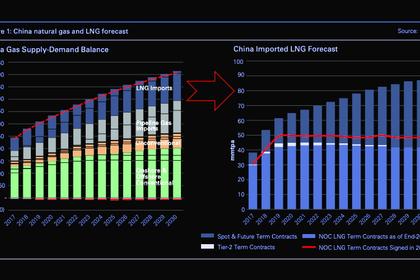

CHINA'S LPG IMPORTS UP 8.5%

China imported 14.91 million mt of propane in 2019, up 10.8% or 1.45 million mt from 2018

2020, February, 3, 11:45:00

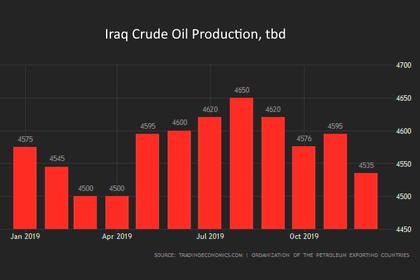

IRAQ'S OIL EXPORTS DOWN 3.5%

Iraq's federal exports averaged 3.3 million b/d, compared with 3.43 million b/d in December, the oil ministry said in a statement on Saturday. The January figure is 420,000 b/d lower than the all-time high of 3.726 million b/d reached in December 2018.

2020, February, 3, 11:35:00

U.S. LNG FOR INDIA: $2.5 BLN

Petronet will invest the money over a five-year period in Tellurian’s proposed $27.5 billion Driftwood LNG export project in Louisiana and the deal will give Petronet an equity stake in the project and rights for up to 5 million tonnes a year of LNG,