Midstream

2020, March, 25, 13:25:00

NORD STREAM 2 HIT FOR POLAND

Significant volumes of Russian gas currently are transited to Germany via Poland, which are a key revenue generator for the country.

2020, March, 20, 12:30:00

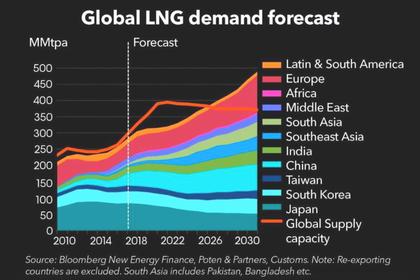

ASIA'S LNG PRICE: $3.5

The average LNG price for May delivery into northeast Asia LNG-AS was estimated at $3.50 per million British thermal units (mmBtu), up 20 cents from the previous week,

2020, March, 19, 12:20:00

SAUDI ARAMCO SUPPLIES 12 MBD

Saudi Aramco will supply 12.3 million b/d of crude to the market during the coming months,

2020, March, 19, 12:10:00

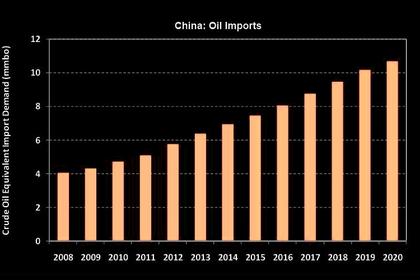

CHINA'S OIL IMPORTS UP TO 10 MBD

China’s annual crude oil imports in 2019 increased to an average of 10.1 million barrels per day (b/d), an increase of 0.9 million b/d from the 2018 average

2020, March, 18, 11:55:00

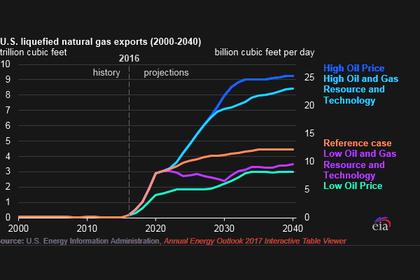

U.S. LNG PROBLEMS

the LNG industry was already under pressure from low international prices and weaker-than-expected demand in key end-user markets.

2020, March, 16, 10:35:00

U.S. STRATEGIC PETROLEUM RESERVE

Replenishing the Strategic Petroleum Reserve would enable the government to take as much as 77 million barrels off the world market.

2020, March, 13, 12:35:00

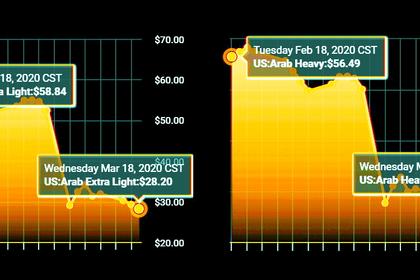

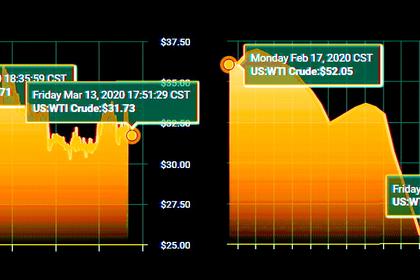

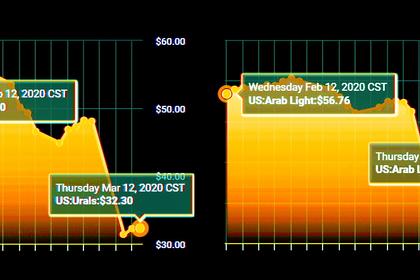

OIL PRICES: NO EXIT

Saudi Arabia and Russia launched a war for market share, flooding global markets with crude. Oil traded in New York was trading at $30.76 a barrel in aftermarket hours on Thursday, down more than 2%.

2020, March, 13, 12:15:00

U.S. SANCTIONS FOR RUSSIA

Rosneft Trading and TNK Trading handled a "large percentage" of Venezuela's oil exports in 2019

2020, March, 13, 12:05:00

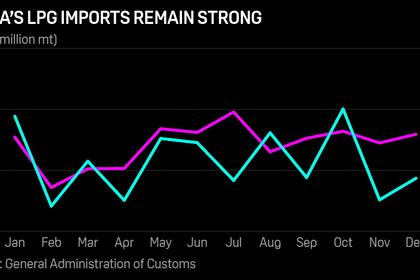

U.S. LPG TO CHINA

The US was the second biggest LPG supplier to China in 2017 at 3.54 million mt, comprising 3.37 million mt of propane and 162,668 mt of butane. The volume dropped 54% a year later in 2018 to 1.62 million mt as a result of trade tensions between the two economies, and in 2019 only 2,443 mt of US propane was imported into China, customs data showed.

2020, March, 12, 13:05:00

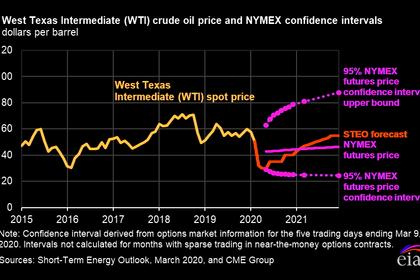

OIL PRICES 2020-21: $43-$55

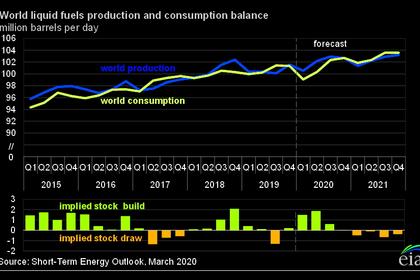

EIA forecasts Brent crude oil prices will average $43/b in 2020, down from an average of $64/b in 2019. For 2020, EIA expects prices will average $37/b during the second quarter and then rise to $42/b during the second half of the year. EIA forecasts that average Brent prices will rise to an average of $55/b in 2021, as declining global oil inventories put upward pressure on prices.

2020, March, 12, 13:00:00

GLOBAL OIL DEMAND 2020: 99.73 MBD

Total global oil demand is now assumed at 99.73 mb/d in 2020, with 2H20 forecast to see higher consumption than 1H20. Considering the latest developments, downward risks currently outweigh any positive indicators and suggest further likely downward revisions in oil demand growth, should the current status persist.

2020, March, 11, 12:05:00

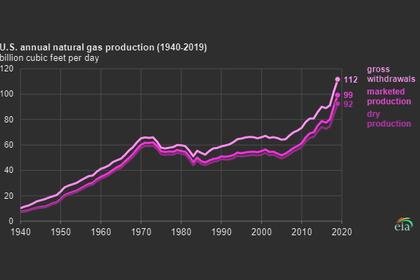

U.S. GAS PRODUCTION UP 10%

U.S. natural gas production grew by 9.8 billion cubic feet per day (Bcf/d) in 2019

2020, March, 11, 12:00:00

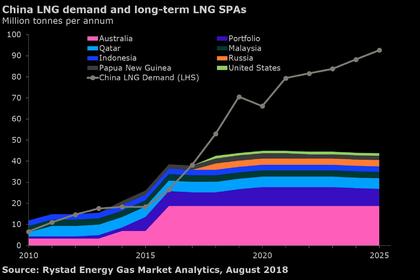

U.S., CHINA LNG DOWN

Asian LNG prices hit historic lows in February, the benchmark price for spot-traded LNG in Northeast Asia, falling to $2.71/MMBtu on underlying weak Asian demand compounded by mild temperatures and the coronavirus.

2020, March, 11, 11:55:00

U.S., RUSSIA'S LNG COMPETITION

In late February, the Spanish energy companies Repsol SA and Endesa SA rejected a hefty deal on the purchase of 200 million cubic metres of LNG from the biggest US liquefied natural gas exporter Cheniere Energy Inc.

2020, March, 6, 12:30:00

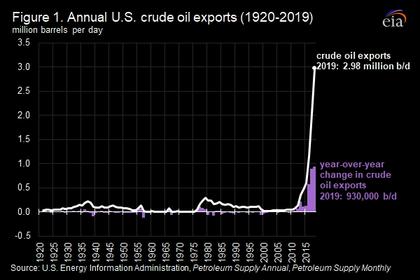

U.S. OIL EXPORTS +45%

U.S. crude oil exports averaged 2.98 million barrels per day (b/d) in 2019,