Upstream

2019, April, 26, 11:00:00

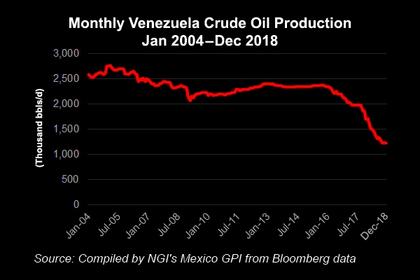

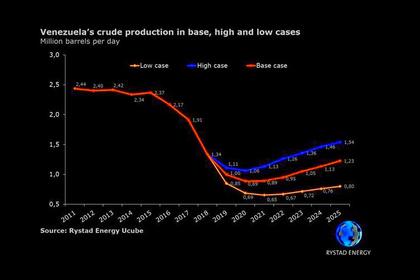

VENEZUELA'S OIL PRODUCTION 840 TBD

In March 2019, Venezuela's crude oil production (excluding condensate) averaged 840,000 barrels per day (b/d), down from 1.1 million b/d in February,

2019, April, 24, 10:50:00

APICORP ENERGY INVESTMENTS $1 TLN

The Arab Petroleum Investments Corporation (APICORP), a multilateral development financial institution, forecast in its MENA Annual Energy Investment Outlook 2019 that current and planned energy investments in the region add up to $1trn for the next five years.

2019, April, 22, 08:50:00

OPEC + RUSSIA IS HERE

"Cooperation will continue between Russia and Saudi Arabia," Ibrahim al-Muhanna said at the International Oil Summit in Paris, stressing that "it is the core of OPEC+ cooperation."

2019, April, 22, 08:45:00

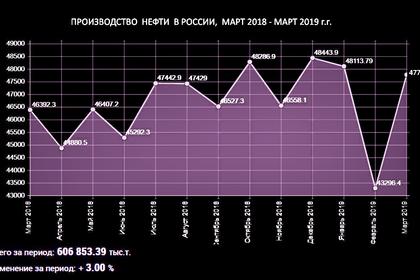

RUSSIA'S OIL PRODUCTION 11.24 MBD

Russian oil production was around 11.24 million barrels per day (bpd) between April 1 and April 18,

2019, April, 22, 08:25:00

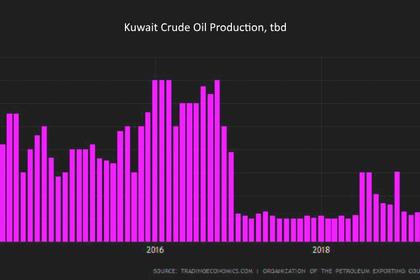

KUWAIT OIL PRODUCTION: +370 TBD

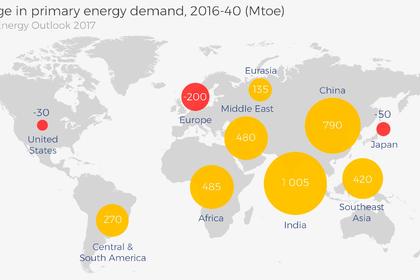

Boosting heavy crude output is a major part of the country's 2040 oil production strategy. Kuwait plans to increase overall oil production capacity to 4.75mbpd by 2040, up from its current capacity of 3.15mbpd.

2019, April, 22, 08:15:00

CONOCO SELLS BRITAIN $2.67 BLN

ConocoPhillips's gas-focused North Sea assets pumped 72,000 b/d of oil equivalent last year, and the acquisition will help boost Chrysaor's total production this year to over 185,000 boe/d, Chrysaor said in a statement.

2019, April, 19, 09:40:00

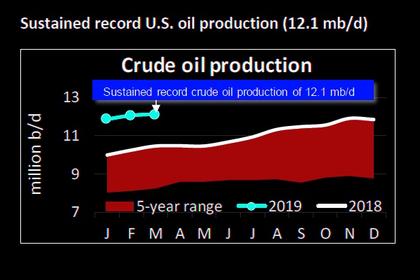

U.S. OIL PRODUCTION 12.1 MBD

the U.S. sustained its position as the world’s leading oil producer, continuing a pace of 12.1 million barrels a day (mb/d), matching February 2019. In addition, petroleum demand in March was the strongest for that month in more than a decade at 20.7 mb/d.

2019, April, 19, 09:35:00

VENEZUELA'S, RUSSIA'S OIL

Since January, Maduro’s administration has been in talks with allies in Moscow about ways to circumvent a ban on clients paying PDVSA in dollars, the sources said. Russia has publicly said the U.S. sanctions are illegal and it would work with Venezuela to weather them.

2019, April, 19, 09:25:00

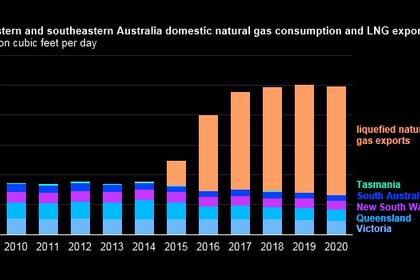

AUSTRALIA'S LNG PRODUCTION UP 11%

Australia's largest gas producer, Woodside, Thursday said LNG production from its three facilities rose 11% year on year in the January-March quarter, and maintained its 2019 production guidance.

2019, April, 19, 09:05:00

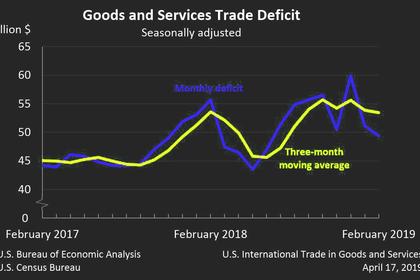

U.S. TRADE DEFICIT $49.4 BLN

the goods and services deficit was $49.4 billion in February, down $1.8 billion from $51.1 billion in January,

2019, April, 19, 09:00:00

U.S. RIGS DOWN 10 TO 1,012

BHGE - U.S. Rig Count is down 10 rigs from last week to 1,012, with oil rigs down 8 to 825, gas rigs down 2 to 187, and miscellaneous rigs unchanged at 0. Canada Rig Count unchanged from last week at 66, with oil rigs up 1 to 19 and gas rigs down 1 to 47.

2019, April, 17, 11:20:00

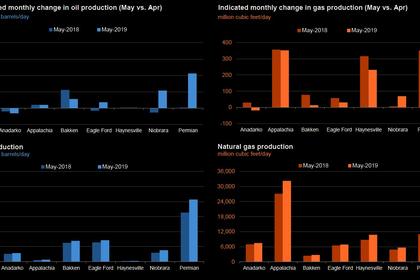

U.S. PRODUCTION: OIL + 85 TBD, GAS + 883 MCFD

U.S. EIA - Crude oil production from the major US onshore regions is forecast to increase 80,000 b/d month-over-month in April from 8,380 to 8,460 thousand barrels/day , gas production to increase 907 million cubic feet/day from 78,930 to 79,837 million cubic feet/day .

2019, April, 17, 11:10:00

RUSSIA'S ARCTIC ENERGY

Russian energy major Gazprom Neft expects the Arctic to account for more than half its oil and gas production by 2020,

2019, April, 17, 10:40:00

AUSTRALIA'S SANTOS PRODUCTION UP 33%

First quarter production of 18.4 mmboe was a record for Santos and 33% higher than the corresponding quarter, primarily due to sustained strong asset performance and the acquisition of Quadrant Energy.

2019, April, 15, 12:10:00

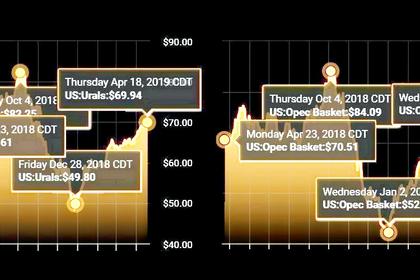

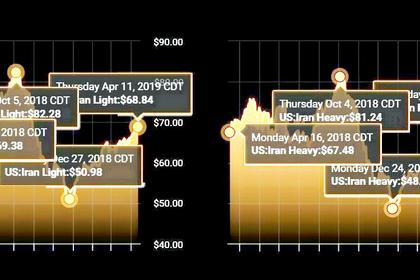

FRAGILE OIL MARKET

Iranian Minister of Petroleum Bijan Zangeneh said the current crude oil market was in a fragile state, adding, “If the US decided to exert more pressure on Iran, the oil market would become unpredictably more fragile.”