Upstream

2019, November, 11, 12:40:00

U.S. RIGS DOWN 5 TO 817

U.S. Rig Count is down 5 rigs from last week to 817, Canada Rig Count is down 2 rigs from last week to 140,

2019, November, 8, 10:25:00

WORLDWIDE RIG COUNT DOWN 18 TO 2,123

The worldwide rig count for October 2019 was 2,123, down 18 from the 2,141 counted in September 2019, and down 148 from the 2,271 counted in October 2018.

2019, November, 6, 13:00:00

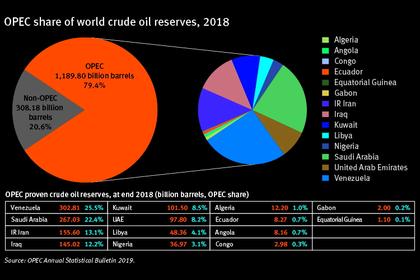

OPEC'S SHARE WILL DOWN

OPEC’s production of crude oil and other liquids is expected to decline to 32.8 million barrels per day (bpd) by 2024,

2019, November, 6, 12:20:00

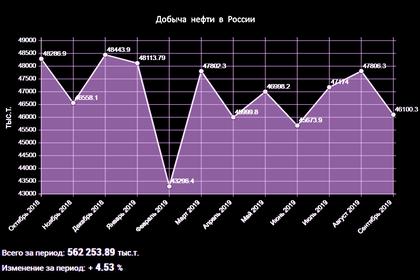

ROSNEFT'S PRODUCTION 5.78 MBD

9M 2019 AVERAGE DAILY HYDROCARBON PRODUCTION AMOUNTED TO 5.78 MMBOED, INCREASING BY 0.6% YOY

2019, November, 5, 14:45:00

THE NEW ABU DHABI'S OIL: 7 BBL

During the meeting held at ADNOC headquarters, the Council revealed the discovery of new hydrocarbon reserves estimated at 7 billion barrels of crude oil and 58 trillion standard cubic feet of conventional gas, putting the UAE in the sixth place in terms of global oil and gas reserves, with a total reserves of 105 billion barrels and 273 trillion cubic feet of conventional gas.

2019, November, 5, 14:00:00

U.S. RIGS DOWN 8 TO 822

U.S. Rig Count is down 8 rigs from last week to 822, Canada Rig Count is down 5 rigs from last week to 142

2019, November, 1, 13:15:00

BAKER HUGHES NET INCOME $57 MLN

Baker Hughes Company (NYSE: BKR) ("Baker Hughes" or the "Company") announced results for the third quarter of 2019.

2019, October, 30, 09:35:00

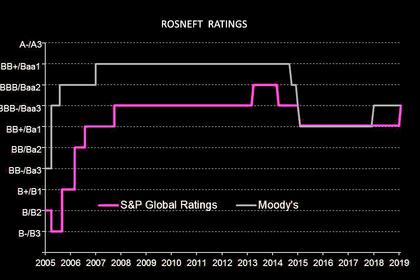

U.S. SANCTIONS FOR ROSNEFT

Rosneft welcomes the work of Chevron, Halliburton, Schlumberger, Baker Hughes, and Weatherford companies due to another renewal of their licences by the American regulator.

2019, October, 28, 14:00:00

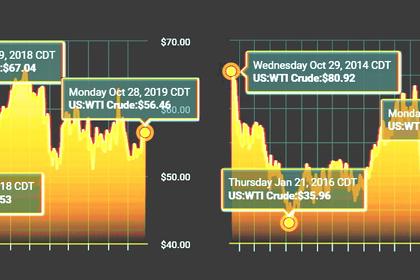

U.S. SHALE DOWN

Investors are bracing for weaker results from U.S. shale players in coming days as lower oil and natural gas prices and cost-cutting measures have weighed on third-quarter operations.

2019, October, 28, 13:55:00

RUSSIA'S OIL PROJECT: $157 BLN

Vostok Oil, a joint project of Rosneft and Independent Petroleum Company (IPC), is set to include some oil fields that are already producing and others which have yet to start, including Rosneft’s Vankor group and IPC’s Payakhskoye field.

2019, October, 28, 13:10:00

SCHLUMBERGER NET LOSS $11.4 BLN

Schlumberger Announces Third-Quarter 2019 Results

Worldwide revenue of $8.5 billion increased 3% sequentially

GAAP loss per share, including charges of $8.65 per share, was $8.22

Cash flow from operations was $1.7 billion and free cash flow was $1.1 billion

2019, October, 28, 13:05:00

U.S. RIGS DOWN 21 TO 830

U.S. Rig Count is down 21 rigs from last week to 830, Canada Rig Count is up 4 rigs from last week to 147

2019, October, 25, 09:25:00

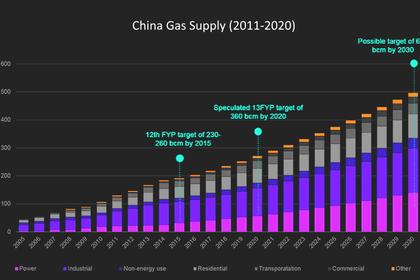

CHINA'S GAS DEMAND WILL UP BY 82%

City gas demand is likely to experience rapid growth over the next 10-15 years, driven by consumption growth from heating and the public sector.

This growth will be supported by China's growing urbanization and urban gasification, which are expected to exceed 70% within the next decade, up from 59.7% and 50.9% at the end of 2018, respectively.

2019, October, 25, 09:20:00

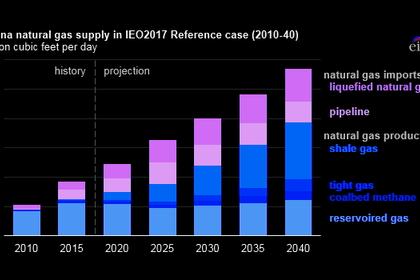

CHINA'S GAS PRODUCTION WILL UP

In June 2019, the Chinese government introduced a subsidy program that established new incentives for production of natural gas from tight formations and extended existing subsidies for production from shale and coalbed methane resources. This subsidy is scheduled to be in effect through 2023. In addition to the changes in the subsidy program, the government allowed foreign companies to operate independently in the country’s oil and natural gas upstream sector.

2019, October, 23, 11:50:00

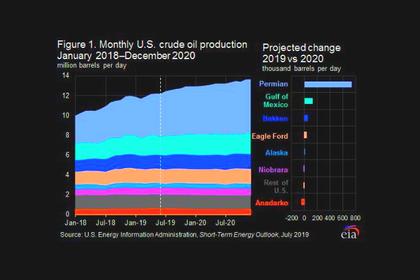

U.S. OIL MAXIMUM

The brisk pace of U.S. production, now the world’s largest, in the past few years has been a key factor behind the relative weakness in oil prices. Output has slowed recently, however.