Upstream

2019, June, 3, 12:30:00

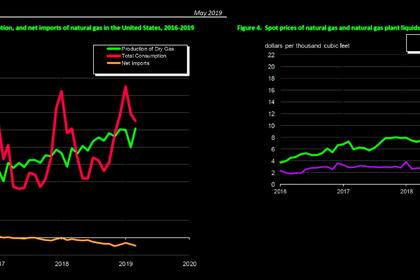

U.S. GAS PRODUCTION UP

In March 2019, for the 23rd consecutive month, dry natural gas production increased year to year for the month. The preliminary level for dry natural gas production in March 2019 was 2,771 billion cubic feet (Bcf), or 89.4 Bcf/d. This level was 9.2 Bcf/d (11.5%) higher than the March 2018 level of 80.2 Bcf/d.

2019, June, 3, 12:20:00

TOTAL BUYS U.S. LNG

The transaction, among other things, will give Total control over 2.2 million mt/year of LNG to be produced by the third train at the Freeport LNG export terminal in Texas. The facility is currently preparing to begin production from its first train, after several construction- and weather-related delays hampered the project.

2019, June, 3, 12:10:00

U.S. RIGS UP 1 TO 984

BHGE - U.S. Rig Count is up 1 rig from last week to 984, with oil rigs up 3 to 800, gas rigs down 2 to 184, and miscellaneous rigs unchanged at 0. Canada Rig Count is up 7 rigs from last week to 85, with oil rigs up 6 to 44 and gas rigs up 1 to 41.

2019, May, 31, 12:25:00

GAZPROM'S PROFIT UP 44%

Profit attributable to owners of PJSC Gazprom amounted to RUB 535,908 million for the three months ended March 31, 2019 which is by RUB 164,285 million, or 44%, more than for the same period of the prior year.

2019, May, 31, 12:15:00

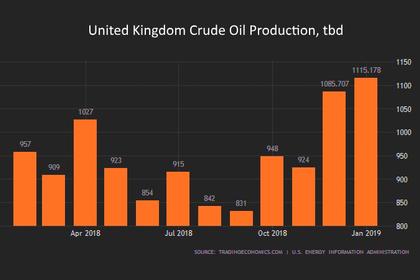

BRITAIN'S OIL PRODUCTION UP 9%

UK oil production rose by nearly 9% on the year in the first quarter of 2019 to 1.18 million b/d, continuing a half-decade revival and beating industry expectations, government statistics released Thursday showed.

2019, May, 30, 18:10:00

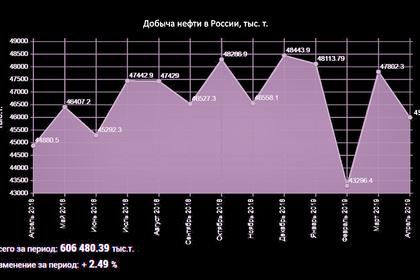

RUSSIA'S OIL PRODUCTION 11.12 MBD

Russia’s recent oil output is below the 11.18 billion bpd target Moscow has pledged as part of an international deal among producers to curb production to support prices.

2019, May, 30, 17:45:00

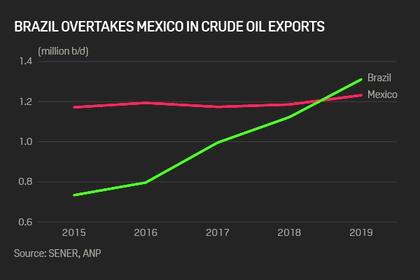

BRAZIL'S OIL UP

Brazil has seen its exports of crude grow from 734,000 b/d in 2015 to 1.3 million b/d in Q1 of this year. In contrast, Mexico, which was once a powerhouse of oil production, has maintained its export status only through curtailment of domestic refining, not increased crude oil output.

2019, May, 30, 17:35:00

GAZPROM'S PROFIT UP

Russia’s state-owned gas giant Gazprom increased its first-quarter net profit by 44 per cent over the previous year as higher gas prices offset lower gas export volumes.

2019, May, 30, 17:30:00

LUKOIL'S PROFIT +36,8%

Profit attributable to shareholders totaled RUB 149.2 bln, up 36.8% year-on-year. The growth was restrained with higher DD&A due to the launch of new production facilities.

2019, May, 30, 17:20:00

TOTAL, ALGERIA PARTNERSHIP

Algeria’s energy minister said on Monday he would seek a “good compromise” when asked about his earlier comments that Algiers would block Total’s plan.

2019, May, 29, 11:10:00

U.S. SHALE PROBLEM

Despite the classic “wildcatting” image of plucky entrepreneurs trying their luck, smaller, independent drillers are losing access to capital

2019, May, 29, 11:00:00

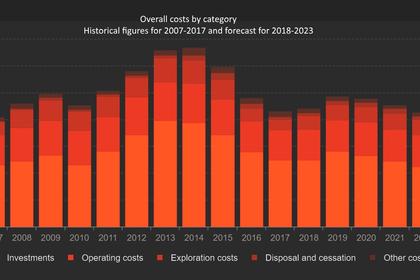

NORWAY'S OIL INVESTMENT UP

Investments are now seen at a four-year high of 183.7 billion Norwegian crowns ($21.11 billion) in 2019, up from the 172.7 billion crowns seen in February, according to SSB, which collects the data from oil firms.

2019, May, 29, 10:35:00

GRONINGEN'S SEISMIC RISKS

A 3.4 magnitude earthquake prompted the Dutch government last year to promise to end Groningen production by 2030 and to lower output as quickly as possible in the coming years.

2019, May, 27, 11:50:00

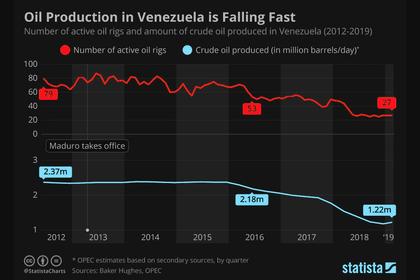

VENEZUELA'S OIL TO CUBA UP

Venezuela's state-owned PDVSA exported 1.416 million barrels of combined crude and products in May to Cuba's state Cubametales, up from 355,000 barrels in April.

2019, May, 27, 11:40:00

OILFIELD SERVICES RATING DOWN

"Oilfield services companies will no longer be able to generate the high operating margins they did in 2014," Carin Dehne-Kiley, an analyst at S&P, wrote Friday in a report to investors. "The oilfield services industry has fundamentally changed due to permanent efficiency and productivity gains realized by E&P companies as well as investor sentiment calling for E&P companies to live within cash flow and limit production growth."