Upstream

2019, February, 20, 10:35:00

LUKOIL RESERVES 101%

LUKOIL - According to the SEC classification, the Company's proved hydrocarbon reserves totaled 15.9 billion barrels of oil equivalent, 76% of which stood for liquids. The proved reserves replacement ratio for liquids totaled 101%. In Russia, the main region of LUKOIL's operations, the replacement ratio reached 127%. The Company's proved hydrocarbon reserves life is 19 years.

2019, February, 18, 12:25:00

OIL DEMAND GROWTH 1.4 MBD

IEA - Growth in 4Q18 was robust at 1.4 mb/d y-o-y and for 2018 as a whole growth was 1.3 mb/d.

2019, February, 18, 12:15:00

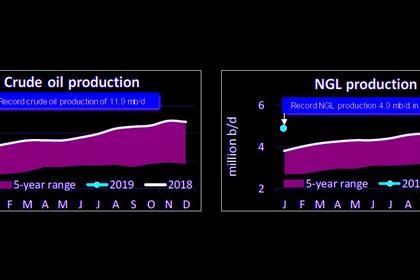

U.S. OIL PRODUCTION 11.9 MBD AGAIN

API - Strongest gasoline demand (8.9 million barrels per day, mb/d) for the month January on record since 1945.

Record refinery and petrochemical demand for other oils’ in any month (5.7 mb/d)

U.S. production of crude oil (11.9 mb/d) and natural gas liquids (NGLs) (4.9 mb/d)

Refinery throughput (17.3 mb/d) and capacity utilization (93.1 percent) for the month of January.

2019, February, 18, 12:10:00

BENEFIT FOR RUSSIA

PLATTS - Russia has benefitted significantly from the OPEC/non-OPEC production agreement, which prevented further oil price drops, energy minister Alexander Novak said Thursday, in a sign that Russia remains committed to the deal, despite recent criticism from Rosneft CEO Igor Sechin.

2019, February, 18, 11:55:00

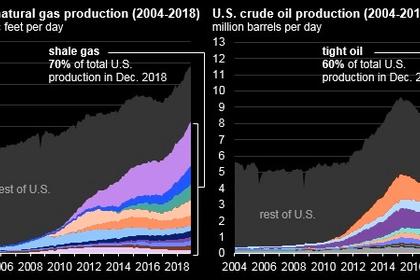

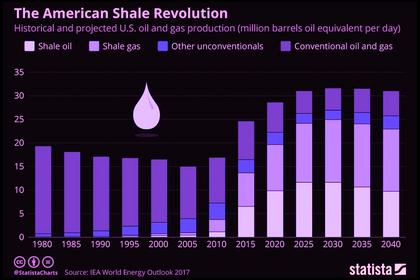

U.S. TIGHT OIL PRODUCTION 7 MBD

U.S. EIA - In December 2018, U.S. shale and tight plays produced about 65 billion cubic feet per day (Bcf/d) of natural gas (70% of total U.S. dry gas production) and about 7 million barrels per day (b/d) of crude oil (60% of total U.S. oil production). A decade ago, in December 2008, shale gas and tight oil accounted for 16% of total U.S. gas production and about 12% of U.S. total crude oil production.

2019, February, 18, 11:50:00

U.S. SHALE NEED INVESTMENT

REUTERS - On Thursday, the regional price of crude was at a $1.10 a barrel premium to U.S. crude futures, the strongest in more than a year as companies including Parsley Energy, Pioneer Natural Resources, Goodrich Petroleum Corp have pared their exploration budgets, easing the constraints.

2019, February, 18, 11:30:00

U.S. RIGS UP 2 TO 1,051

BHGE - U.S. Rig Count is up 2 rigs from last week to 1,051 rigs, Canada Rig Count is down 16 rigs from last week to 224,

2019, February, 15, 12:00:00

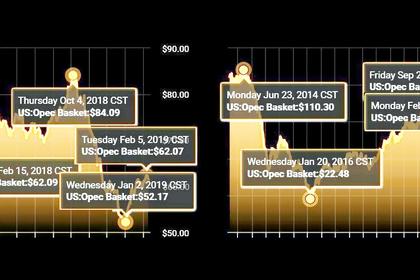

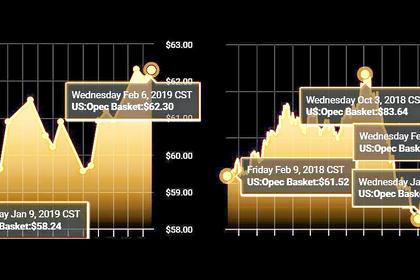

OPEC REMAINS HARD

PLATTS - "Our primary objective is to ensure that the oil market remains in balance throughout 2019 and beyond in order to build on the success of the past couple of years," added Barkindo.

2019, February, 15, 11:45:00

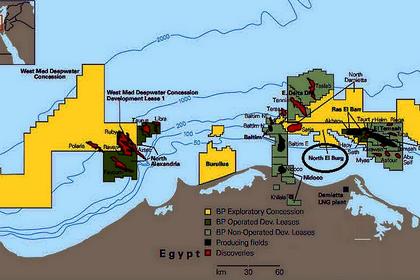

BP INVESTMENT FOR EGYPT $1.8 BLN

CNBC - Asked how much BP could spend in Egypt in 2019, Dudley said the amount would be significant. "There will be a third phase we're spending on, we're exploring today with other companies ... (So we'll be spending) $1.8 billion give or take. That's a lot," he said.

2019, February, 13, 12:15:00

OPEC OIL PRODUCTION 30.81 MBD

PLATTS - OPEC has painted a bearish picture for 2019, with demand for its crude oil expected to fall due to weak demand growth and a sharp rise in output from producers outside the group.

2019, February, 13, 12:10:00

OPEC ISN'T A CARTEL

REUTERS - OPEC Secretary-General Mohammad Barkindo said the exporting group was not in the business of fixing oil prices, when asked on Monday to comment on a U.S. House committee passing a bill targeting OPEC oil supply cuts.

2019, February, 11, 10:00:00

U.S. RIGS UP 4 TO 1,049

BHGE - U.S. Rig Count is up 4 rigs from last week to 1,049 rigs, with oil rigs up 7 to 854 and gas rigs down 3 to 195. Canada Rig Count is down 3 rigs from last week to 240, with oil rigs down 1 to 158 and gas rigs down 2 to 82.

2019, February, 8, 12:10:00

OPEC PRODUCTION DOWN 970 TBD

PLATTS - OPEC pumped the fewest barrels since March 2015 in January, with crude output plunging to 30.86 million b/d, a fall of 970,000 b/d from December as new supply quotas went into force, according to an S&P Global Platts survey of industry officials, analysts and shipping data.

2019, February, 8, 11:25:00

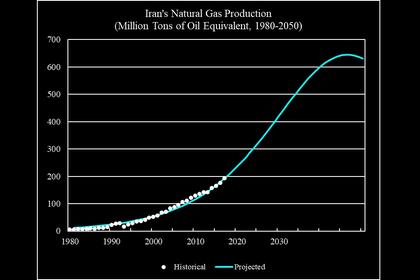

IRAN'S GAS PRODUCTION UP

SHANA - Zangeneh said Iran had outdone Qatar in recovery from the giant offshore South Pars gas field and surpassed Iraq in production from jointly owned oil reservoirs.

2019, February, 8, 11:05:00

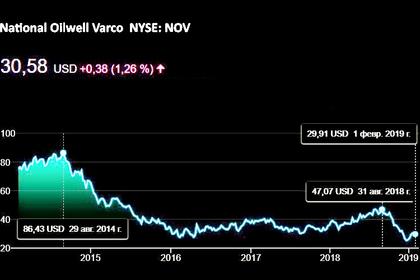

NOV VARCO NET LOSS $31 MLN

NOV - National Oilwell Varco, Inc. (NYSE: NOV) reported fourth quarter 2018 revenues of $2.40 billion, an increase of 11 percent compared to the third quarter of 2018 and an increase of 22 percent from the fourth quarter of 2017. Operating profit for the fourth quarter of 2018 was $87 million, or 3.6 percent of sales, Adjusted EBITDA (operating profit excluding depreciation, amortization, and other items) was $279 million, or 11.6 percent of sales, and net income was $12 million. Operating profit increased 19 percent sequentially, and Adjusted EBITDA increased 14 percent sequentially and 42 percent compared to the fourth quarter of 2017. Other items totaled $21 million, pre-tax, and were primarily related to charges associated with the closure of one of the Company’s facilities.