Upstream

2018, November, 12, 12:10:00

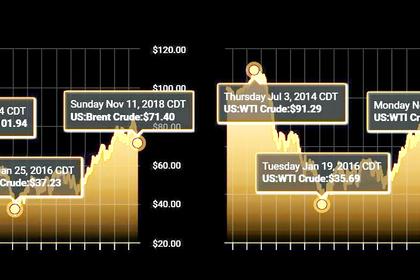

OIL PRICES WILL UP

CNBC - "In the 2020's we are going to have a clear physical shortage of oil because nobody is allowed to fully invest in future oil production," Michele Della Vigna, Head of EMEA Natural Resources Research at Goldman Sachs told CNBC Friday.

2018, November, 12, 12:05:00

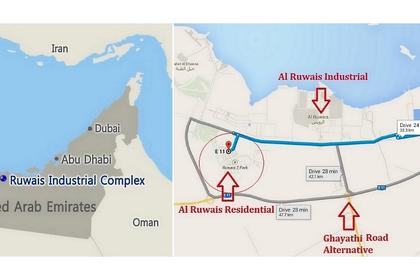

TOTAL & ADNOC: 40%

PLATTS - Abu Dhabi's state-owned oil company, ADNOC, said Sunday it signed a deal with Total, granting the French major a 40% stake in the Ruwais Diyab unconventional gas concession.

2018, November, 12, 12:00:00

TOTAL'S INVESTMENT TO ANGOLA: $16 BLN

THE LOCAL FRANCE - Angola and French oil giant Total formally launched a major new offshore oil project Saturday to aid the country's economy that plunged into crisis following oil price dips in 2014.

2018, November, 12, 11:40:00

U.S. RIGS UP 14 TO 1,081

BHGE - U.S. Rig Count is up 14 rigs from last week to 1,081, with oil rigs up 12 to 886 and gas rigs up 2 to 195. Canada Rig Count is down 2 rigs from last week to 196, with oil rigs down 4 to 117 and gas rigs up 2 to 79.

2018, November, 9, 15:35:00

SAUDIS OIL RECORD: 10.67 MBD

PLATTS - Saudi Arabia pumped 10.67 million b/d in the month, its most in the 30-year history of the Platts OPEC survey, while key ally the UAE also set an all-time high at 3.17 million b/d. Libya produced its most since June 2013 at 1.10 million b/d.

2018, November, 9, 15:20:00

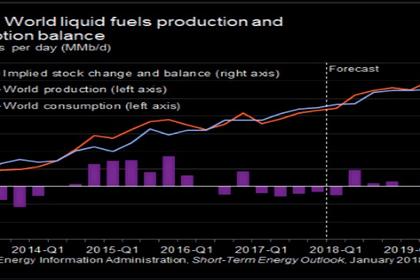

GLOBAL OIL INVENTORIES WILL UP

U.S. EIA - Global inventories are projected to increase and put downward pressure on crude oil prices.

2018, November, 9, 14:40:00

WORLDWIDE RIG COUNT UP 13 TO 2,271

BHGE - The worldwide rig count for October 2018 was 2,271, up 13 from the 2,258 counted in September 2018, and up 194 from the 2,077 counted in October 2017.

2018, November, 7, 11:10:00

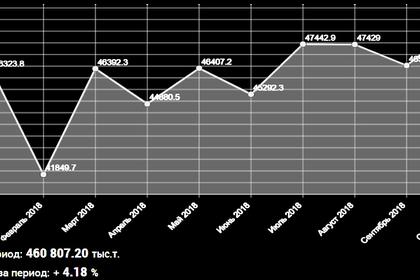

ROSNEFT'S PRODUCTION 5.83 MBD

ROSNEFT - Q3 2018 AVERAGE DAILY HYDROCARBON PRODUCTION REACHED 5.83 MMBOE, DEMONSTRATING A 2.1% GROWTH VS. Q2 2018 LEVEL

2018, November, 7, 10:40:00

VARCO BUYS $500 MLN

NOV VARCO - National Oilwell Varco, Inc. (NYSE: NOV) announced that its Board of Directors has authorized a share repurchase program to purchase up to $500 million of the Company's outstanding common stock.

2018, November, 5, 12:20:00

RUSSIA'S OIL PRODUCTION 11.4 MBD

BLOOMBERG - Russia’s crude and condensate output averaged 11.412 million barrels a day last month, according to data from the Energy Ministry’s CDU-TEK unit released Friday. That’s about 160,000 barrels a day more than two years ago, before Russia agreed to cut supply with OPEC. It’s a post-Soviet record, and not far off the highest-ever output.

2018, November, 5, 11:50:00

ADNOC'S CAPEX $132 BLN

MEOG - ADNOC plans $132bn Capex until 2023, gas self-sufficiency and oil production capacity of 4mn bpd in 2020

2018, November, 5, 11:40:00

U.S. RIGS DOWN 1 T0 1,067

BHGE - U.S. Rig Count is down 1 rig from last week to 1,067, with oil rigs down 1 to 874 and gas rigs unchanged at 193. Canada Rig Count is down 2 rigs from last week to 198, with oil rigs down 3 to 121, gas rigs up 1 to 77, and miscellaneous rigs unchanged at 0.

2018, November, 2, 12:05:00

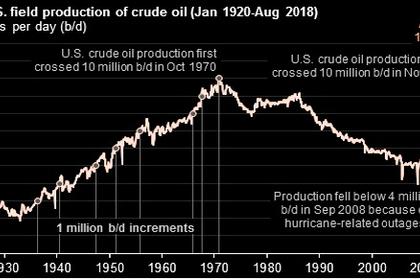

U.S. OIL PRODUCTION 11.3 MBD

U.S. EIA - U.S. crude oil production reached 11.3 million barrels per day (b/d) in August 2018,

2018, October, 31, 12:40:00

BHGE NET INCOME $13 MLN

BHGE - Orders of $5.7 billion for the quarter, down 5% sequentially and flat year-over-year. Revenue of $5.7 billion for the quarter, up 2% sequentially and up 7% year-over-year. GAAP operating income of $282 million for the quarter, increased $204 million sequentially and increased $475 million year-over-year.

2018, October, 29, 12:40:00

RUSSIA: NO REASON OIL FREESE

REUTERS - Russian Energy Minister Alexander Novak said on Saturday there was no reason for Russia to freeze or cut its oil production levels, noting that there were risks that global oil markets could be facing a deficit.