Upstream

2021, November, 12, 12:35:00

GLOBAL OIL DEMAND 2021: + 5.7 MBD

World oil demand growth in 2021 is revised lower by around 0.16 mb/d, compared to last month’s assessment, to stand at 5.7 mb/d.

2021, November, 12, 12:25:00

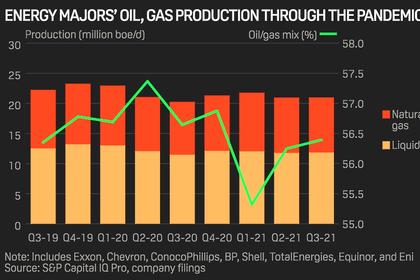

LIMITED OIL GAS PRODUCTION

At the end of 2019, combined oil output from ExxonMobil, BP, Shell, Chevron, TotalEnergues, Equinor, ConocoPhillips, and Eni stood at 13.3 million b/d, or about 13% of total global supplies,

2021, November, 12, 12:20:00

IRAN GAS INVESTMENT $11 BLN

Gas accounts for around 70% of fuel use in Iran, with the household sector being the largest consumer at up to 400 million cu m/d on cold days, followed by power plants and petrochemical facilities.

2021, November, 12, 12:10:00

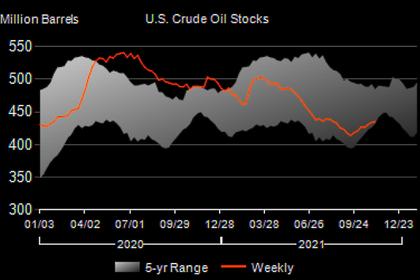

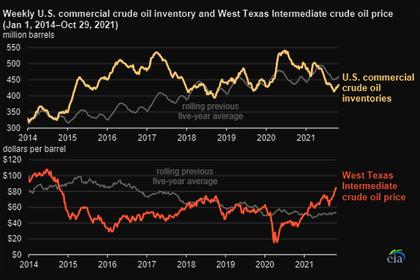

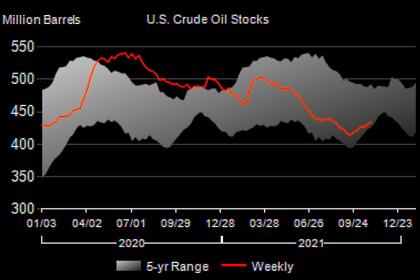

U.S. OIL INVENTORIES UP BY 1.0 MB TO 435.1 MB

U.S. commercial crude oil inventories increased by 1.0 million barrels from the previous week to 435.1 million barrels.

2021, November, 11, 15:15:00

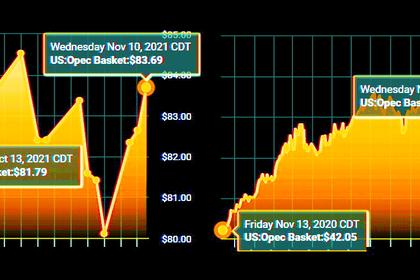

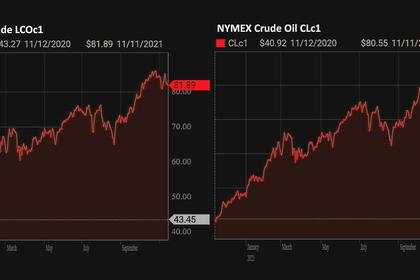

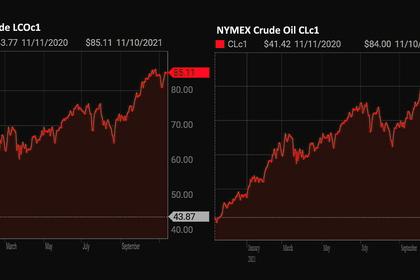

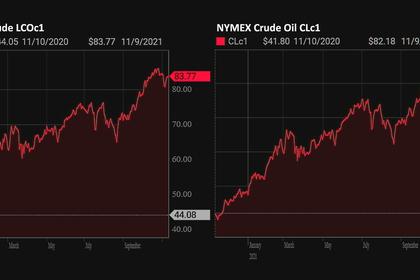

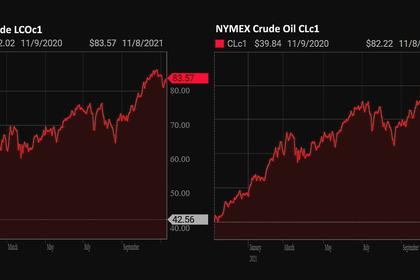

OIL PRICE: NEAR $82

Brent gained 70 cents, or 0.85%, to $83.34 a barrel , WTI rose 79 cents, or 1%, to $82.13.

2021, November, 11, 14:40:00

MAERSK, NOBLE COMBINATION

Noble and Maersk shareholders will each hold 50% in the combined entity, which will be named Noble Corp. with headquarters in Houston.

2021, November, 10, 12:25:00

OIL PRICE: NEAR $85 ANEW

Brent were at $85.22 a barrel, WTI rose 16 cents, or 0.2%, to $84.31 a barrel.

2021, November, 10, 12:20:00

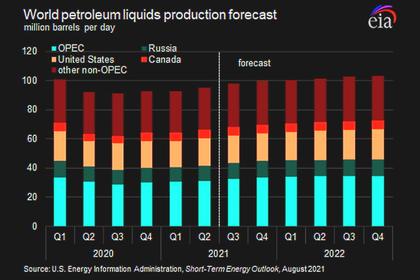

OIL PRICES 2021-22: $82-$72

We expect Brent prices will remain near current levels for the rest of 2021, averaging $82/b in the fourth quarter of 2021. In 2022, we expect that growth in production from OPEC+, U.S. tight oil, and other non-OPEC countries will outpace slowing growth in global oil consumption and contribute to Brent prices declining from current levels to an annual average of $72/b.

2021, November, 9, 17:25:00

OIL PRICE: NOT ABOVE $84

Brent rose 31 cents, or 0.4%, to $83.74 a barrel, WTI advanced 36 cents, or 0.4%, to $82.29

2021, November, 9, 17:20:00

GLOBAL OIL DEMAND GROWTH

This year, demand for petroleum, both in the United States and globally, has largely returned to the pre-pandemic levels in 2019. Demand has grown faster than supply, reducing inventories and contributing to higher prices for crude oil and petroleum products.

2021, November, 9, 17:15:00

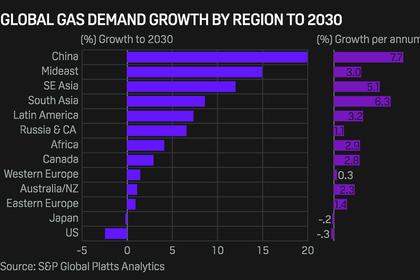

GLOBAL GAS DEMAND GROWTH

"About 50% of the incremental global natural gas demand will come from Asia by 2035, with China and India as the main engines to boost the development of the LNG market," Luo said.

2021, November, 8, 12:30:00

OIL PRICE: ABOVE $83 ANEW

Brent was up by 86 cents or 1% at $83.60 a barrel, WTI gained 89 cents or 1.1% to $82.16.

2021, November, 8, 12:25:00

OPEC+ 400 TBD

Reconfirm the production adjustment plan and the monthly production adjustment mechanism approved at the 19th OPEC and non-OPEC Ministerial Meeting and the decision to adjust upward the monthly overall production by 0.4 mb/d for the month of December 2021, as per the attached schedule.

2021, November, 8, 12:00:00

WORLDWIDE RIG COUNT UP 56 TO 1,504

The Worldwide Rig Count for October was 1,504, up 56 from the 1,448 counted in September 2021,and up 488 from the 1,016 counted in October 2020.

2021, November, 8, 11:55:00

U.S. OIL INVENTORIES UP BY 3.3 MB TO 434.1 MB

U.S. commercial crude oil inventories increased by 3.3 million barrels from the previous week to 434.1 million barrels.