Upstream

2021, July, 8, 12:45:00

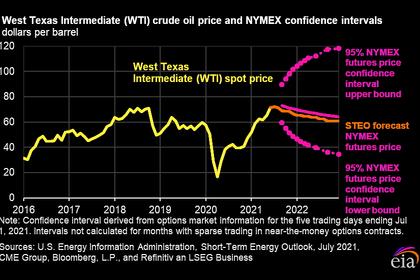

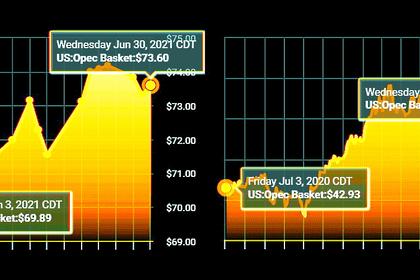

OIL PRICES 2021-22: $72-$67

We expect rising production will reduce the persistent global oil inventory draws that have occurred for much of the past year and keep prices similar to current levels, averaging $72/b during the second half of 2021 (2H21).

2021, July, 7, 11:30:00

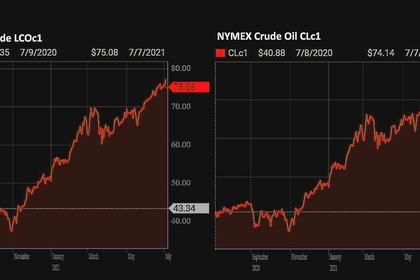

OIL PRICE: NEAR $75

Brent was up 74cents, or 1%, at $75.27 a barrel , WTI was up 88 cents, or 1.2%, at $74.25 a barrel,

2021, July, 7, 11:25:00

OPEC+ NO QUOTAS

The OPEC+ had failed to agree to increase production quotas from August onward after the UAE objected to Saudi Arabia's plan to tie the production increases to a lengthening of the supply management pact through to the end of 2022.

2021, July, 7, 11:20:00

NUCLEAR POWER: NO MORE HARM

This comprehensive 397-page report concluded that there was no science-based evidence that nuclear energy does more harm to human health or to the environment than other electricity production technologies already included in the taxonomy and that the impacts of nuclear energy are mostly comparable with hydropower and the renewables, with regard to non-radiological effects.

2021, July, 6, 12:20:00

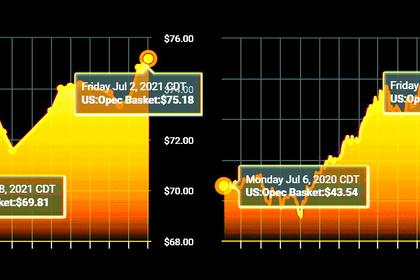

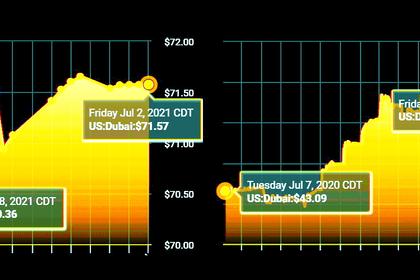

OIL PRICE: NOT BELOW $77

Brent climbed 18 cents or 0.2% to stand at $77.34 a barrel, WTI were at $76.57 a barrel, up $1.41 or 1.9% from Friday’s close.

2021, July, 6, 12:15:00

OPEC+ NO DECISION

“The 18th OPEC and non-OPEC Ministerial Meeting has been called off,” OPEC Secretary General, HE Mohammad Sanusi Barkindo, said in a letter to Heads of Delegation of OPEC Member Countries and non-OPEC oil producing countries participating in the Declaration of Cooperation (DoC).

2021, July, 6, 12:10:00

UAE SUPPORT OPEC

The Ministry of Energy and Infrastructure has affirmed that the UAE is a longstanding and committed member of OPEC, and OPEC+, and have been a reliable partner in the current OPEC+ agreement, delivering compliance of 103% throughout its 2-year term.

2021, July, 6, 12:00:00

ЦЕНА URALS: $63,35

Средняя цена на нефть марки Urals в январе-июне 2021 года сложилась в размере $63,35 за баррель, в январе-июне 2020 года - $39,68 за баррель.

2021, July, 5, 13:30:00

OIL PRICE: NOT BELOW $76

Brent was up 30 cents, or 0.4%, at $76.47 a barrel, WTI gained 32 cents, or 0.4%, to $75.48 a barrel.

2021, July, 5, 13:15:00

BRITAIN'S NUCLEAR HURDLES

"Recognising that many sustainable investors have exclusionary criteria in place around nuclear energy, the UK government will not finance any nuclear energy-related expenditures under the Framework."

2021, July, 5, 12:45:00

WORLDWIDE RIG COUNT UP 63 TO 1,325

The Worldwide Rig Count for June was 1,325, up 63 from the 1,262 counted in May 2021

2021, July, 5, 12:40:00

U.S. RIGS UP 5 TO 475

U.S. Rig Count is up 5 from last week to 475, Canada Rig Count is up 10 from last week to 136.

2021, July, 2, 12:40:00

OIL PRICE: BELOW $76

Brent were down 20 cents at $75.64 a barrel , WTI were down 15 cents at $75.08.

2021, July, 2, 12:35:00

OPEC+ 2 MBD

If agreed, the OPEC+ alliance's collective production cuts would shrink by about one-third by the end of the year to about 3.76 million b/d, from July's 5.76 million b/d.

2021, July, 2, 12:20:00

NORWAY OIL & GAS UP

Equinor has started the Martin Linge oil and gas field in the Norwegian North Sea.