N.America

2018, February, 16, 23:40:00

РОССИЯ ПРОДОЛЖАЕТ РАБОТАТЬ

МИНЭНЕРГО РОССИИ - Комментируя внесение его в «кремлевский список» Минфина США, Александр Новак признался, что вспоминает о нём только из-за постоянных вопросов журналистов. «Мы продолжаем работать. И в принципе нет никаких изменений. Всё как прежде».

2018, February, 16, 23:10:00

TRANSCANADA NET INCOME $3.0 BLN

TRANSCANADA - TransCanada Corporation (TSX:TRP) (NYSE:TRP) (TransCanada or the Company) announced net income attributable to common shares for fourth quarter 2017 of $861 million or $0.98 per share compared to a net loss of $358 million or $0.43 per share for the same period in 2016. For the year ended December 31, 2017, net income attributable to common shares was $3.0 billion or $3.44 per share compared to net income of $124 million or $0.16 per share in 2016.

2018, February, 16, 23:00:00

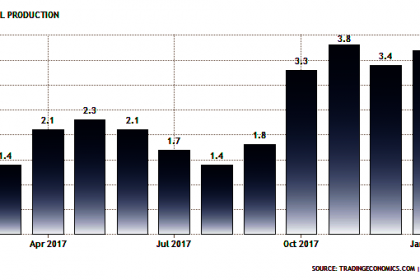

U.S. INDUSTRIAL PRODUCTION DOWN 0.1%

FRB - Industrial production edged down 0.1 percent in January following four consecutive monthly increases. Manufacturing production was unchanged in January. Mining output fell 1.0 percent, with all of its major component industries recording declines, while the index for utilities moved up 0.6 percent. At 107.2 percent of its 2012 average, total industrial production was 3.7 percent higher in January than it was a year earlier. Capacity utilization for the industrial sector fell 0.2 percentage point in January to 77.5 percent, a rate that is 2.3 percentage points below its long-run (1972–2017) average.

2018, February, 14, 09:45:00

U.S. NUCLEAR WILL UP

WNN - The USA has extended production tax credits for advanced nuclear power plants under a budget bill signed into law by President Donald Trump. The nuclear production tax credit is seen as an essential component for the completion of US plants already under construction and for first-of-a-kind small modular reactor (SMR) construction.

2018, February, 14, 09:30:00

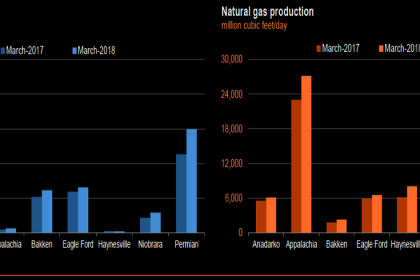

U.S. OIL +110 TBD, GAS + 832 MCFD

EIA - Crude oil production from the major US onshore regions is forecast to increase 110,000 b/d month-over-month in March to 6,756 million b/d, gas production to increase 832 million cubic feet/day to 64,941 million cubic feet/day .

2018, February, 12, 07:35:00

GAS SHORTAGE FOR EUROPE

REUTERS - “Europe completely miscalculated when they assumed that they won’t need much additional gas and if they need some it can be supplied from outside Russia,” Medvedev, who looks after exports for the world’s top gas producer and exporter, said.

2018, February, 12, 07:25:00

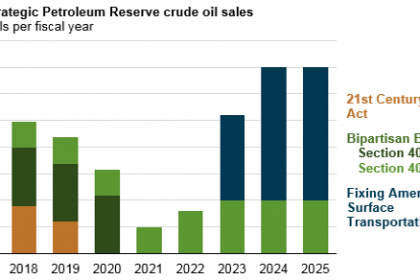

U.S. SALES 100 MB

PLATTS - Congress early Friday approved a two-year budget agreement which mandates the sale of 100 million barrels of crude oil from the Strategic Petroleum Reserve within a decade and authorizes sales of another $350 million of government-owned crude this fiscal year.

2018, February, 12, 07:00:00

U.S. RIGS UP +29 TO 975

BAKER HUGHES A GE - U.S. Rig Count is up 29 rigs from last week to 975, with oil rigs up 26 to 791, gas rigs up 3 to 184, and miscellaneous rigs unchanged.

Canada Rig Count is down 17 rigs from last week to 325, with oil rigs down 13 to 221 and gas rigs down 4 to 104.

2018, February, 7, 07:40:00

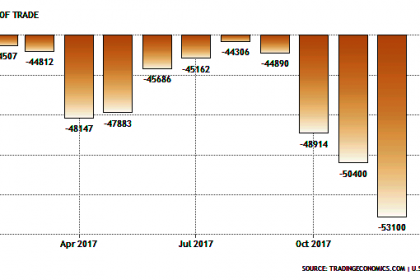

U.S. DEFICIT UP TO $53.1 BLN

BEA - The U.S. Census Bureau and the U.S. Bureau of Economic Analysis, through the Department of Commerce, announced today that the goods and services deficit was $53.1 billion in December, up $2.7 billion from $50.4 billion in November, revised. December exports were $203.4 billion, $3.5 billion more than November exports. December imports were $256.5 billion, $6.2 billion more than November imports.

2018, February, 7, 07:25:00

NOV VARCO NET LOSS $237 MLN

NOV - National Oilwell Varco, Inc. (NYSE: NOV) reported a fourth quarter 2017 net loss of $14 million, or $0.04 per share. Revenues for the fourth quarter were $1.97 billion, an increase of seven percent compared to the third quarter and an increase of 16 percent from the fourth quarter of 2016. Operating loss for the fourth quarter was $111 million, or 5.6 percent of sales. Adjusted EBITDA (operating profit excluding depreciation, amortization, and other items) for the fourth quarter was $197 million, or 10.0 percent of sales, an increase of $30 million from the third quarter. Other items were $133 million, pre-tax, and primarily consisted of charges for inventory write-downs, facility closures and severance. Cash flow from operations for the fourth quarter was $321 million.

2018, February, 5, 07:42:00

MEXICO'S OIL INVESTMENT $100 BLN

FT - Mexico secured almost $100bn in investment in its most successful oil tender to date as Anglo-Dutch oil major Royal Dutch Shell positioned itself as the biggest player in deepwater exploration and new companies including Qatar Petroleum burst on to the scene.

2018, February, 5, 07:20:00

U.S. NUCLEAR RESILENCE

DOE recently released a report that dives into the emerging technology of advanced small modular reactors (SMRs) and their ability to flexibly provide carbon-free power in response to outages caused by severe weather and physical threats to the grid.

2018, February, 5, 07:05:00

U.S. RIGS DOWN 1 TO 946

BAKER HUGHES A GE - U.S. Rig Count is down 1 rig from last week to 946, with oil rigs up 6 to 765, gas rigs down 7 to 181, and miscellaneous rigs unchanged.

Canada Rig Count is up 4 rigs from last week to 342, with oil rigs up 14 to 234 and gas rigs down 10 to 108.

2018, February, 2, 12:17:00

U.S. ENERGY WAR

PLATTS - President Donald Trump said Tuesday that the "war" on American energy is over in a State of the Union speech given as US crude oil output is set to reach levels not seen in more than 47 years.

2018, February, 2, 12:10:00

U.S. FEDERAL FUNDS RATE 1.25 - 1.5%

U.S. FRB - In view of realized and expected labor market conditions and inflation, the Committee decided to maintain the target range for the federal funds rate at 1-1/4 to 1‑1/2 percent. The stance of monetary policy remains accommodative, thereby supporting strong labor market conditions and a sustained return to 2 percent inflation.