N.America

2018, January, 15, 09:50:00

OIL PRICES & IRAN SANCTIONS

PLATTS - On Thursday, US Secretary of State Rex Tillerson told reporters that Trump would likely announce the decision in the afternoon in Washington.

If that deal unravels, 800,000 b/d of Iranian crude exports would be at risk, according to analysts.

2018, January, 15, 09:30:00

U.S. RIGS UP 15 TO 939

BHGE - U.S. Rig Count is up 15 rigs from last week to 939, with oil rigs up 10 to 752, gas rigs up 5 to 187, and miscellaneous rigs unchanged.

Canada Rig Count is up 102 rigs from last week to 276, with oil rigs up 87 to 185 and gas rigs up 15 to 91.

2018, January, 12, 13:00:00

ТРАНСФОРМАЦИЯ МИРОВОГО РЫНКА

МИНЭНЕРГО РОССИИ - На энергетическом рынке происходят существенные трансформации, появляются новые технологии, что в итоге приводит к изменению энергобаланса. В частности, за последние 10 лет добыча газа в мире выросла на 20% -- до 580 млрд м3, его доля в энергобалансе расширилась с 21 до 22%. При этом мировая торговля газом за тот же период увеличилась на 42%, или на 313 млрд м3.

2018, January, 12, 12:30:00

U.S. GAS EXPORTS

BLOOMBERG - “Never before has the global LNG market had such significant flexible LNG volumes as the volumes coming online in the next three years, mostly from the U.S., which will lead to a fundamental shift in how LNG is marketed and traded globally,”

2018, January, 10, 12:55:00

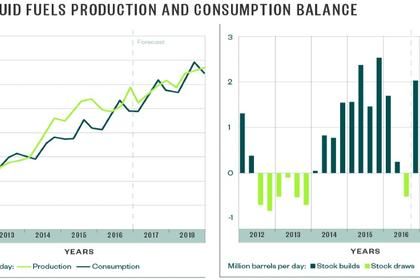

U.S. OIL INVENTORIES DOWN

BLOOMBERG - Futures climbed as much as 0.9 percent in New York after rising 2.5 percent the previous two sessions. Inventories fell by 11.2 million barrels last week, the American Petroleum Institute was said to report on Tuesday. If the draw is replicated in Energy Information Administration data Wednesday, it will be the biggest decline for this time of the year since 1999.

2018, January, 10, 12:35:00

RUSSIAN LNG FOR U.S.

REUTERS - If the vessel is carrying Russian LNG and ends up in the United States despite the U.S. sanctions against Novatek, it would be the first ever Russian LNG to go to the United States, according to U.S. energy data.

2018, January, 8, 19:25:00

U.S. - IRAN SANCTIONS

U.S.DT - "These sanctions target key entities involved in Iran's ballistic missile program, which the Iranian regime prioritizes over the economic well-being of the Iranian people. As the Iranian people suffer, their government and the IRGC fund foreign militants, terrorist groups, and human rights abuses," said Treasury Secretary Steven T. Mnuchin. "The United States will continue to decisively counter the Iranian regime's malign activity, including additional sanctions targeting human rights abuses. We will not hesitate to call out the regime's economic mismanagement, and diversion of significant resources to fund threatening missile systems at the expense of its citizenry."

2018, January, 8, 19:20:00

U.S. - VENEZUELA SANCTIONS

U.S.DT - “President Maduro and his inner circle continue to put their own interests above those of the Venezuelan people,” said Treasury Secretary Steven T. Mnuchin. “This action underscores the United States’ resolve to hold Maduro and others engaged in corruption in Venezuela accountable. We call on concerned parties and international partners around the world to join us as we stand with the Venezuelan people to further isolate this oppressive regime.”

2018, January, 8, 19:15:00

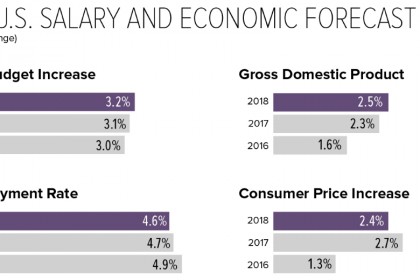

U.S. DEFICIT $50.5 BLN

BEA - The U.S. Census Bureau and the U.S. Bureau of Economic Analysis, through the Department of Commerce, announced that the goods and services deficit was $50.5 billion in November, up $1.6 billion from $48.9 billion in October, revised. November exports were $200.2 billion, $4.4 billion more than October exports. November imports were $250.7 billion, $6.0 billion more than October imports.

2018, January, 8, 19:00:00

U.S. RIGS DOWN 5 TO 924

U.S. Rig Count is down 5 rigs from last week to 924, with oil rigs down 5 to 742, gas rigs unchanged at 182, and miscellaneous rigs unchanged.

Canada Rig Count is up 38 rigs from last week to 174, with oil rigs up 36 to 98 and gas rigs up 2 to 76.

2018, January, 4, 12:15:00

U.S. WANT PETROBRAS: $3 BLN

PETROBRAS - The agreement does not constitute any admission of wrongdoing or misconduct by Petrobras. In the agreement, Petrobras expressly denies liability. This reflects its status as a victim of the acts uncovered by Operation Car Wash, as recognized by Brazilian authorities including the Brazilian Supreme Court. As a victim of the scheme, Petrobras has already recovered R$1.475 billion in restitution in Brazil and will continue to pursue all available legal remedies from culpable companies and individuals.

2018, January, 3, 15:30:00

U.S. RIGS DOWN 2 TO 929

U.S. Rig Count is down 2 rigs from last week to 929, with oil rigs unchanged at 747, gas rigs down 2 to 182, and miscellaneous rigs unchanged.

Canada Rig Count is down 74 rigs from last week to 136, with oil rigs down 58 to 62 and gas rigs down 16 to 74.

2017, December, 25, 20:45:00

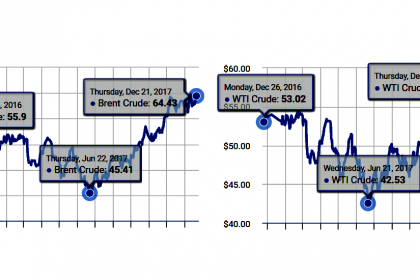

OIL PRICES - 2018: VOLATILE

The price of oil in 2018 will be volatile with commodity market traders selling on signals of OPEC-Russia “cheating” or members producing more oil than the extended Algiers Agreement output quotas.

2017, December, 25, 20:00:00

U.S. RIGS UP 1 TO 931

U.S. Rig Count is up 1 rig from last week to 931, with oil rigs unchanged at 747, gas rigs up 1 to 184, and miscellaneous rigs unchanged.

Canada Rig Count is down 28 rigs from last week to 210, with oil rigs down 14 to 120 and gas rigs down 14 to 90.

2017, December, 22, 22:25:00

GAZPROM DEVELOPING LNG

GAZPROM - With LNG demand on the rise, Gazprom is making further efforts in this line of business.