N.America

2021, June, 16, 11:00:00

U.S. SOLAR POWER OVER 100 GW

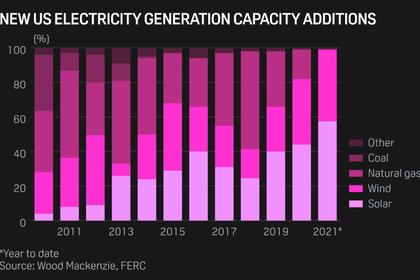

Renewable energy accounted for nearly 100% of all new electric capacity in Q1 with solar doubling in the last 3.5 years

2021, June, 16, 10:55:00

U.S. OFFSHORE WIND 7 GW

The United States aims to develop 30 GW of offshore wind by 2030.

2021, June, 16, 10:35:00

U.S. RIGS UP 5 TO 461

U.S. Rig Count is up 5 from last week to 461, Canada Rig Count is up 16 from last week to 93.

2021, June, 10, 12:40:00

U.S. NUCLEAR POWER NEEDS SUPPORT

U.S. nuclear plants produce 20% of the nation's total electricity and more than 50% of its carbon-free electricity,

2021, June, 10, 12:35:00

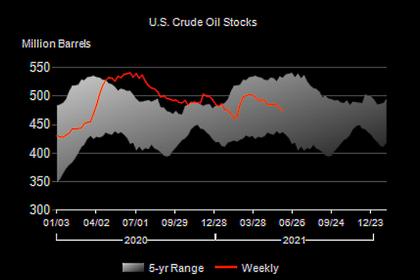

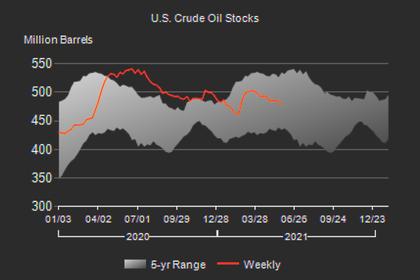

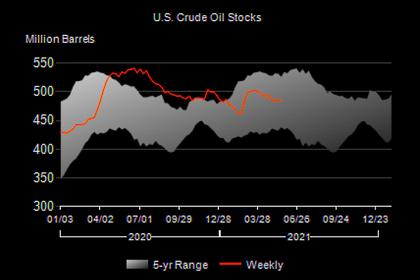

U.S. OIL INVENTORIES DOWN 5.2 MB TO 474.0 MB

U.S. commercial crude oil inventories decreased by 5.2 million barrels from the previous week to 474.0 million barrels.

2021, June, 10, 12:30:00

TC ENERGY HAS TERMINATED KEYSTONE

TC Energy Corporation (TSX, NYSE: TRP) (TC Energy or the Company) confirmed today that after a comprehensive review of its options, and in consultation with its partner, the Government of Alberta, it has terminated the Keystone XL Pipeline Project (the Project).

2021, June, 8, 13:35:00

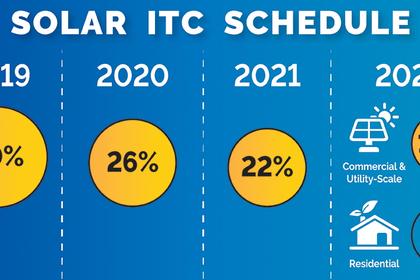

U.S. TAX BENEFITS FOR CLEAN ENERGY

Tax credit extensions and cash refunds for clean energy are current motions under consideration in the US House of Representatives cabinets.

2021, June, 7, 11:30:00

U.S. RIGS DOWN 1 TO 456

U.S. Rig Count is down 1 from last week to 456 , Canada Rig Count is up 15 from last week to 77.

2021, June, 4, 11:45:00

U.S. OIL INVENTORIES DOWN 5.1 MB TO 479.3 MB

U.S. commercial crude oil inventories decreased by 5.1 million barrels from the previous week to 479.3 million barrels.

2021, June, 2, 13:50:00

U.S., FRANCE CLEAN ENERGY

Ensuring that these energy systems are efficient and reliable, integrating larger shares of renewables coupled with nuclear energy, which is a significant part of today’s electricity production in both our countries, will be crucial to accelerate energy transitions

2021, May, 31, 13:30:00

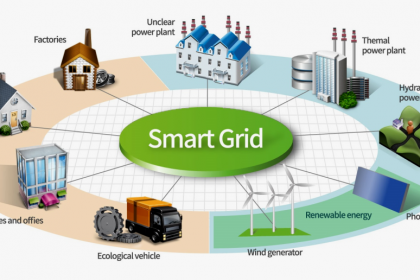

SMART GRID MODERNIZATION

Smart grid technology helps in building platform which has features like two-way communication, control systems, and computer processing.

2021, May, 31, 13:20:00

U.S. RIGS UP 2 TO 457

U.S. Rig Count is up 2 from last week to 457, Canada Rig Count is up 4 from last week to 62.

2021, May, 27, 12:45:00

U.S. OIL INVENTORIES DOWN 1.7 MB TO 484.3 MB

U.S. commercial crude oil inventories decreased by 1.7 million barrels from the previous week to 484.3 million barrels.

2021, May, 25, 12:05:00

U.S., S.KOREA NUCLEAR COOPERATION

The statement came in line with the summit between South Korean President Moon Jae-in and U.S. President Joe Biden held at the White House on Friday.

2021, May, 24, 12:25:00

GEOTHERMAL ENERGY UP

The U.S. is the largest producer of geothermal energy, though its uses and popularity remain low.