S.America

2018, November, 26, 13:25:00

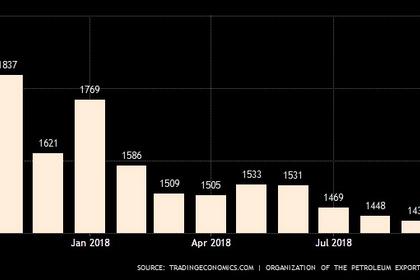

VENEZUELA'S OIL DOWN TO 1.17 MBD

REUTERS - The country’s oil production has fallen to just 1.17 million barrels-per-day, a 37 percent drop in the last year, according to reports from secondary sources to OPEC, leaving itstruggling to ship Russian entities the roughly 380,000 bpd it has agreed to send, according to PDVSA

2018, November, 23, 12:05:00

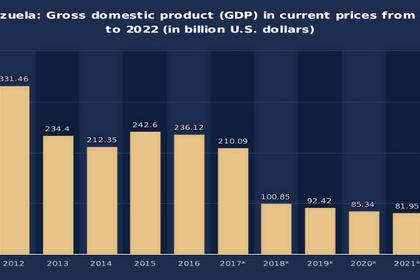

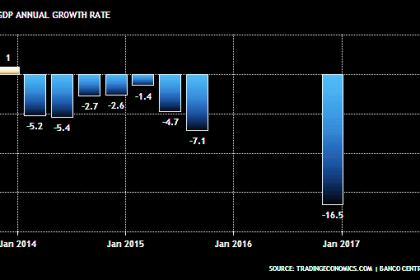

VENEZUELA'S ECONOMY DOWN 17%

REUTERS - Preliminary data compiled by Venezuela’s central bank shows the economy shrank by 16.6 percent in 2017 compared with the year before, two sources familiar with the matter said on Thursday, the country’s sharpest decline on record.

2018, October, 17, 09:55:00

PETROBRAS - CNPC COOPERATION

PLATTS - Petrobras is to form two joint venture companies with China National Petroleum Corp. (CNPC) to complete construction of a refinery and revitalize four mature fields in the offshore Campos Basin, the state-owned Brazilian company said

2018, September, 26, 09:00:00

NOVATEK LNG FOR BRAZIL

NOVATEK - PAO NOVATEK (“NOVATEK” and/or the “Company”) announced today that its wholly owned subsidiary, NOVATEK Gas and Power Asia Pte. Ltd. has shipped its first LNG cargo to the Brazilian market with LNG produced from the Yamal LNG project. The cargo was delivered to the Bahia Regasification Terminal owned by Petrobras.

2018, September, 21, 10:20:00

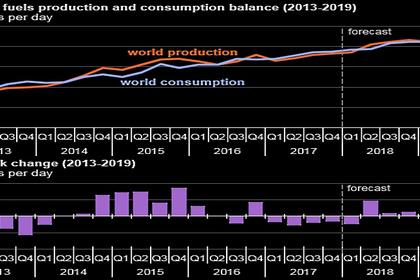

WORLD OIL DEMAND: 100.23 MBD

OPEC - Total oil demand for 2018 is now estimated at 98.82 mb/d. In 2019, world oil demand growth is forecast to rise by 1.41 mb/d. Total world oil demand in 2019 is now projected to surpass 100 mb/d for the first time and reach 100.23 mb/d.

2018, September, 17, 15:00:00

VENEZUELA - CHINA COOPERATION

REUTERS - Venezuela gave China another stake in the OPEC nation’s oil industry and signed several other deals in the energy sector, but Beijing made no mention of new funds for Caracas during President Nicolas Maduro’s visit to his key financier on Friday.

2018, September, 13, 14:10:00

U.S. SANCTIONS AGAINST THE WORLD

CNBC - "We can see that the pricing situation today depends not just on the supply/demand balance or the general economic situation but also on the uncertainty that we observe today in the global markets: the trade wars, the sanctions that the U.S. pursue," Novak said, speaking to CNBC's Geoff Cutmore at the Eastern Economic Forum (EEF) in Vladivostok, Russia.

2018, September, 13, 14:00:00

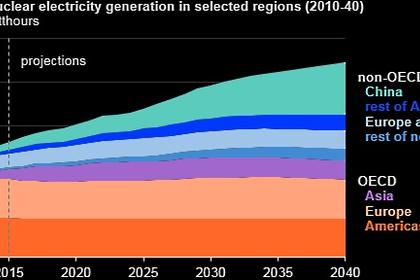

NUCLEAR POWER NEEDS INVESTMENT

IAEA - Overall, the new projections suggest that nuclear power may struggle to maintain its current place in the world’s energy mix. In the low case to 2030, the projections show nuclear electricity generating capacity falling by more than 10% from a net installed capacity of 392 gigawatts (electrical) (GW(e)) at the end of 2017. In the high case, generating capacity increases 30% to 511 GW(e), a drop of 45 GW(e) from last year’s projection. Longer term, generating capacity declines to 2040 in the low case before rebounding to 2030 levels by mid-century, when nuclear is seen providing 2.8% of global generating capacity compared with 5.7% today.

2018, August, 22, 12:30:00

CONOCOPHILLIPS - PDVSA: $2 BLN

OGJ - the ICC tribunal awarded ConocoPhillips $2.04 billion after PDVSA failed to uphold its contractual commitments. The award applies to contracts ConocoPhillips had with PDVSA and two of its subsidiaries in the Hamaca and Petrozuata heavy crude oil projects expropriated by the government and to fiscal changes enacted before the nationalizations in 2007.

2018, August, 8, 11:35:00

PETROBRAS NET INCOME R$ 17 BLN

PETROBRAS - Petrobras reported net income of R$ 17 billion in the first half of 2018. The positive result was mainly influenced by the increase in international oil prices, associated with the depreciation of the Brazilian Real against the US dollar. In the same period, net debt fell 13% compared to December 2017, to US$ 73.66 billion.

2018, July, 30, 13:40:00

PETROBRAS NEEDS CHINA

REUTERS - The new supply could enlarge Brazil’s market share in China as buyers there cut oil imports from the United States following Beijing’s announcement it would impose tariffs on U.S. crude in retaliation against similar moves by Washington.

2018, July, 25, 09:15:00

VENEZUELA'S ECONOMIC COLLAPSE

IMF - On Venezuela, it is difficult to discuss because it is in a state of economic collapse. We have not engaged with them in over a decade on their economic policies.

2018, July, 23, 13:25:00

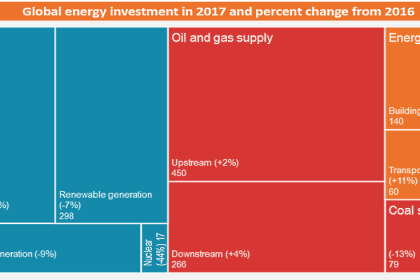

GLOBAL ENERGY INVESTMENT DOWN 2%

IEA - For the third consecutive year, global energy investment declined, to USD 1.8 trillion (United States dollars) in 2017 – a fall of 2% in real terms. The power generation sector accounted for most of this decline, due to fewer additions of coal, hydro and nuclear power capacity, which more than offset increased investment in solar photovoltaics.

2018, July, 16, 10:15:00

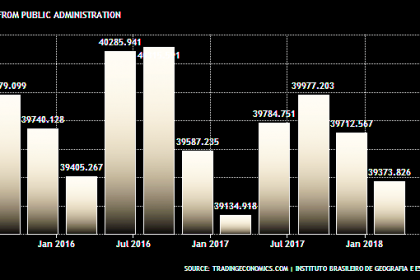

BRAZIL'S GDP UP 1.8%

IMF - Following the severe recession in 2015−16, real GDP grew by 1 percent in 2017. Growth is projected to be 1.8 and 2.5 percent in 2018 and 2019, respectively, driven by a recovery in domestic consumption and investment. Even if federal expenditure remains constant in real terms at its 2016 level, as mandated by a constitutional rule, public debt is expected to rise further and peak in 2023 at above 90 percent of GDP.

2018, July, 11, 09:25:00

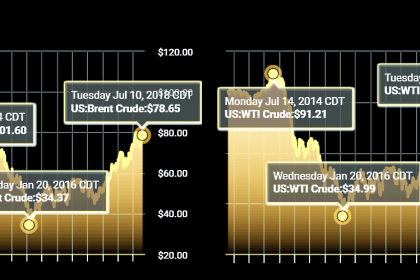

OIL PRICES 2018 - 19: $73 - $69

EIA - Brent crude oil spot prices averaged $74 per barrel (b) in June, a decrease of almost $3/b from the May average. EIA forecasts Brent spot prices will average $73/b in the second half of 2018 and will average $69/b in 2019. EIA expects West Texas Intermediate (WTI) crude oil prices will average $6/b lower than Brent prices in the second half of 2018 and $7/b lower in 2019. NYMEX WTI futures and options contract values for October 2018 delivery that traded during the five-day period ending July 5, 2018, suggest a range of $56/b to $87/b encompasses the market expectation for October WTI prices at the 95% confidence level.