W.Asia

2020, March, 19, 12:15:00

U.S., IRAN SANCTIONS AGAIN

The US State Department named nine entities Wednesday under new sanctions for continuing to trade petrochemicals with Iran.

2020, March, 18, 12:10:00

SAUDI ARABIA'S OIL 12 MBD

"Saudi Aramco can sustain low oil prices for a long time," Aramco CEO Amin Nasser said on an earnings call. "We are very comfortable with a $30/b price [and] can meet our dividend and shareholder expectations at $30/b and even lower."

2020, March, 18, 12:05:00

IRAQ CALLS OPEC+

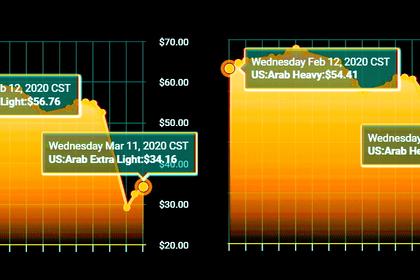

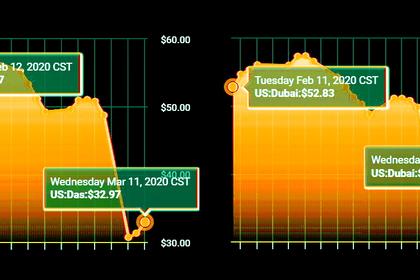

Saudi Arabia and Russia have signaled plans to boost production, causing oil prices to nosedive.

2020, March, 18, 12:00:00

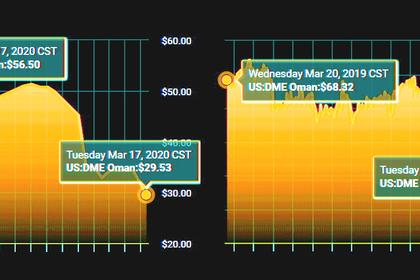

OMAN'S OIL UP TO 1 MBD

Oman pumped 970,500 b/d of crude and condensate in December 2019, according to its ministry of oil and gas, but will be boosting volumes to its full capacity of 1 million b/d over the next few months,

2020, March, 16, 10:45:00

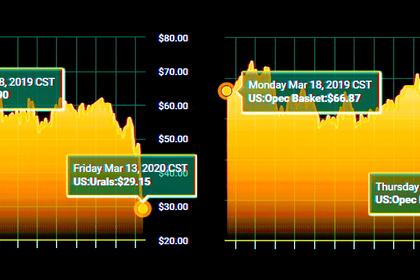

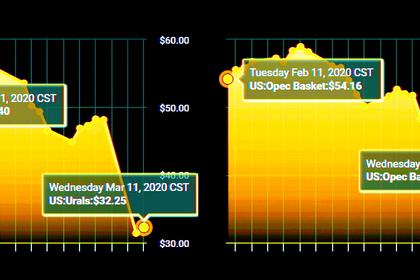

OPEC - RUSSIA: NO DEAL

In April, Russia may fully return to production levels reached before the OPEC+ deal in October 2018, Novak said.

2020, March, 16, 10:25:00

UAE, SAUDI ARABIA INCENTIVES $40 BLN

The UAE's central bank announced a package of $27.3 billion, Saudi Arabia's central bank announced the same day a $13.3 billion package

2020, March, 13, 12:25:00

U.S. ENERGY BONDS: $110 BLN

The falls in the bonds come in the wake of the failure of Opec and Russia late last week to agree a deal on cutting production,

2020, March, 13, 12:20:00

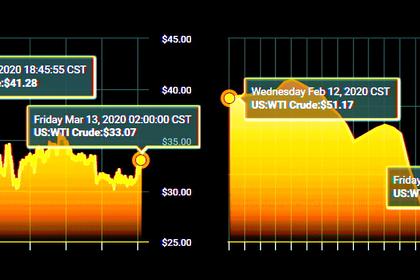

RUSSIA FOR U.S. SHALE: $570 BLN

Moscow’s decision to withdraw last week from a pact with Saudi Arabia to limit crude production, sparking an oil war that sent prices crashing 30 per cent on Monday, upending global markets.

2020, March, 12, 13:00:00

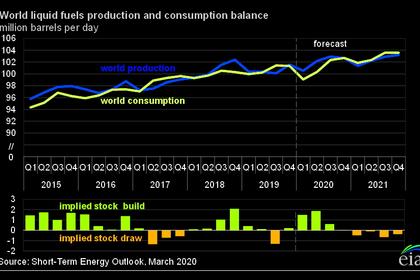

GLOBAL OIL DEMAND 2020: 99.73 MBD

Total global oil demand is now assumed at 99.73 mb/d in 2020, with 2H20 forecast to see higher consumption than 1H20. Considering the latest developments, downward risks currently outweigh any positive indicators and suggest further likely downward revisions in oil demand growth, should the current status persist.

2020, March, 12, 12:55:00

SAUDI ARABIA, RUSSIA TALKS

Russia has long been seeking to capitalize on its OPEC ties with investment deals, which have been slow to materialize despite official state visits by Saudi King Salman to Moscow in 2017 and Russian President Vladimir Putin to Riyadh in October.

2020, March, 12, 12:50:00

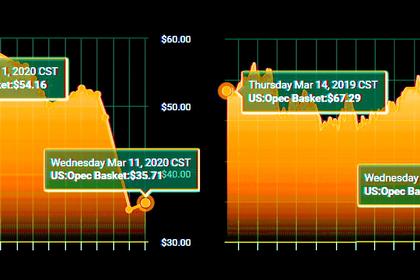

THE NEW OPEC+ AGREEMENT

Al Mazrouei said, via a series of tweets, "OPEC and OPEC+ played an important role in delivering market stability. The UAE Ministry of Energy and Industry firmly believes that a new agreement is essential to support a balanced and less volatile market."

2020, March, 12, 12:45:00

ARAMCO WILL INCREASE TO 13 MBD

Saudi Aramco received a directive from the Ministry of Energy to increase its maximum sustainable capacity (MSC) from 12 million barrels per day (MMBD) to 13 MMBD.

2020, March, 12, 12:40:00

ADNOC CAN SUPPLY 4 MBD

UAE Minister of State and ADNOC Group CEO, Dr. Sultan Ahmed Al Jaber has commented on recent market developments, noting that the UAE oil company is set to supply the market with over four million barrels of oil per day in April 2020.