W.Europe

2022, June, 6, 13:00:00

AZERBAIJAN'S GAS FOR EUROPE

Representatives from several European countries, including Romania, Serbia, Hungary and Italy travelled to Azerbaijan to discuss growing demand for gas in early June, in light of recent Gazprom cut offs and the threat that further sanctions could hit gas imports.

2022, June, 3, 13:10:00

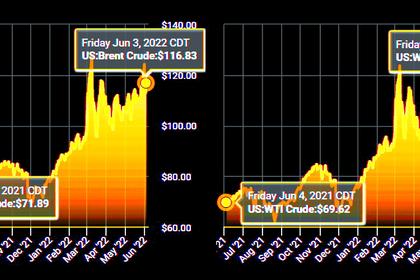

RUSSIAN SANCTIONS RISES PRICES

"The EU's decisions to partially phase out Russian oil and oil products, as well as to ban the insurance of Russian merchant ships, are highly likely to provoke further price increases, destabilize energy markets, and disrupt supply chains," the Russian Foreign Ministry said in a statement.

2022, June, 2, 11:40:00

RUSSIA SANCTIONS SPLIT

Another group of officials, many based at Janet Yellen’s Treasury Department, worry about further strains on a global economy already suffering from supply-chain woes, inflation, volatile oil prices and a potential food crisis.

2022, June, 2, 11:30:00

GAZPROM PRODUCTION DOWN BY 4.8%

Gas exports to the countries beyond the FSU amounted to 61 billion cubic meters, which is 27.6 per cent (or 23.2 billion cubic meters) lower than the figure for the same period of 2021.

2022, June, 2, 11:25:00

GAZPROM STOPPED FOR SHELL

Gazprom completely suspends gas supplies to Shell Energy Europe Limited due to failure to pay in rubles

2022, June, 2, 11:20:00

GAZPROM STOPPED FOR ORSTED

Gazprom completely suspends gas supplies to Denmark’s Orsted Salg & Service A/S due to failure to pay in rubles

2022, June, 2, 11:10:00

BRITAIN'S NUCLEAR STOP

Hinkley Point B started operations in 1976 and, in 2012, the estimated end of its generation was extended to 2023, with a +/- 2 years proviso.

2022, June, 1, 10:55:00

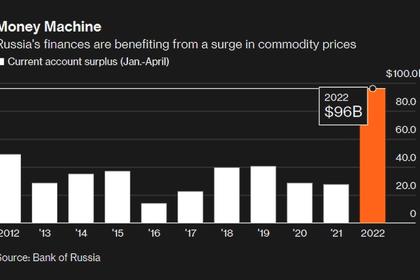

RUSSIA SANCTIONS $285 BLN

Even with some countries halting or phasing out energy purchases, Russia's oil-and-gas revenue will be about $285 billion this year, according to estimates from Bloomberg Economics based on Economy Ministry projections.

2022, June, 1, 10:50:00

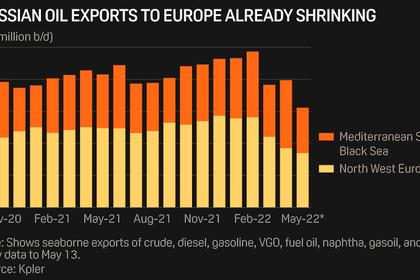

EUROPEAN BAN ON RUSSIAN OIL

First proposed on May 4, the EU's sixth sanctions package against Russia was designed to ban its crude imports into the bloc within six months and halt flows of its oil products by the year-end to help hit Moscow's oil revenues.

2022, June, 1, 10:30:00

EUROPE ISN'T WITHOUT COAL

The war in Ukraine has triggered a scramble among some countries to buy more non-Russian fossil fuels and burn coal to cut their reliance on Russian supplies.

2022, June, 1, 10:25:00

RUSSIAN GAS FOR NETHERLANDS STOPPED

Gazprom completely suspends gas supplies to Netherlands’ GasTerra B.V. due to failure to pay in rubles

2022, May, 31, 13:25:00

RUSSIAN SANCTIONS FOR EUROPE

Vladimir Putin explained the real reasons for the unstable food supplies, saying that the disruptions were due to Western countries’ erroneous economic and financial policies, as well as their anti-Russia sanctions.

2022, May, 31, 13:15:00

RUSSIA, AUSTRIA COOPERATION

Vladimir Putin reaffirmed Russia’s commitment to its contractual obligations with regard to natural gas supplies to Austria.

2022, May, 31, 13:10:00

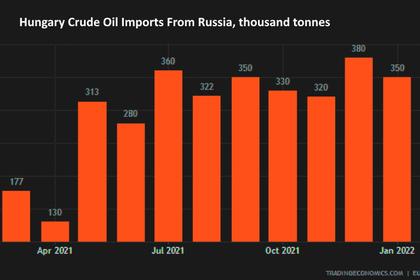

HUNGARY AGAINST THE BAN OF RUSSIAN OIL

Hungarian Prime Minister Viktor Orban said May 30 he wants a complete exemption from the European Union's plans to ban Russian oil imports

2022, May, 31, 13:05:00

EUROPE BANS RUSSIAN OIL

"The sanctions will immediately impact 75% of Russian oil imports. And by the end of the year, 90% of the Russian oil imported in Europe will be banned," Michel said in a tweet after a summit meeting.