W.Europe

2022, May, 27, 12:30:00

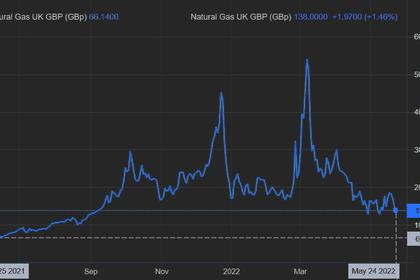

HIGH GAS PRICES

Europe is importing record volumes of liquefied natural gas (LNG) as gas from its top supplier Russia has been disrupted following the Ukraine crisis.

2022, May, 27, 12:15:00

GLOBAL LNG UNCERTAINTY

Some key questions include how much gas or LNG will move from North America to Europe and how much gas demand will move in the opposite direction and when it comes to Europe,

2022, May, 25, 11:20:00

RUSSIAN GAS FOR FINLAND IS STOPPED

Gazprom completely suspends gas supplies to Finland’s Gasum due to failure to pay in rubles

2022, May, 25, 11:15:00

EUROPEAN GAS AMBITIONS

As a result, short-term gas prices in Britain, France and Spain have tumbled to as little as a third of those in markets including the Netherlands and Germany,

2022, May, 25, 11:10:00

BRITAIN'S ENERGY SHOCK

The energy price cap is likely to soar to a record £2,800 ($3,499) in October, Ofgem Chief Executive Officer Jonathan Brearley told a panel of lawmakers on Tuesday.

2022, May, 25, 11:05:00

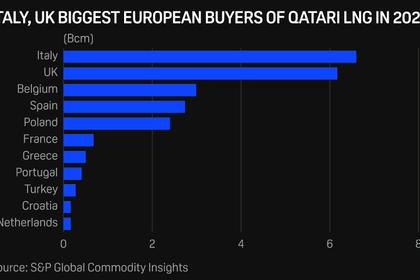

QATAR, BRITAIN STRATEGIC COOPERATION

The ongoing European energy crisis and its impact on economies across the region has seen unprecedented diplomacy efforts to secure a more stable energy supply, and Qatar has repeatedly said it stands ready to help its partners.

2022, May, 25, 10:55:00

EUROPEAN GAS OBLIGATIONS

EU Member States consumed approximatively 400 bcm of gas in 2020 (25% of the EU's primary energy consumption), and they possess a combined gas storage capacity of about 105 bcm (as of 2020).

2022, May, 25, 10:45:00

U.S., ROMANIA NUCLEAR SMR

Romania’s energy minister Virgil Popescu said: "I thank our American partners for supporting Romania's nuclear programmes, a bilateral strategic partnership started in the 1980s.

2022, May, 25, 10:35:00

IRELAND RENEWABLES +20%, 1.9 GW

The auction is set to support the Irish ambition of reaching 80% of power generation from renewables and a 51% reduction in its greenhouse gas (GHG) emissions by 2030,

2022, May, 23, 13:10:00

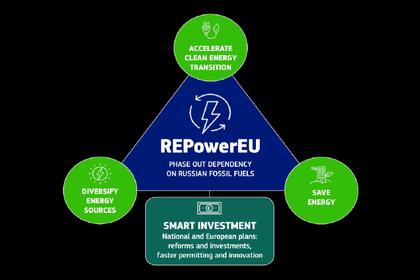

EUROPEAN ENERGY PLAN

REPowerEU is about rapidly reducing our dependence on Russian fossil fuels by fast forwarding the clean transition and joining forces to achieve a more resilient energy system and a true Energy Union.

2022, May, 23, 13:05:00

GERMANY, QATAR LNG DEVELOPMENT

The new pact, inked during a Qatari state visit to Germany, comes as Berlin looks to fast-track a number of new LNG import terminals to reduce its dependence on Russian gas imports.

2022, May, 23, 13:00:00

GERMAN LNG TERMINALS DEVELOPMENT

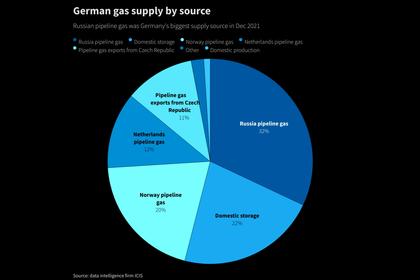

The invasion of Ukraine by Russia has made it clear for all actors in Germany: diversification of gas imports is urgently needed.

2022, May, 23, 12:55:00

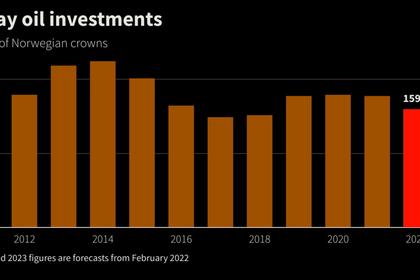

NORWAY OIL, GAS PRODUCTION 1.87 MBD

Preliminary production figures for April 2022 show an average daily production of 1 871 000 barrels of oil, NGL and condensate.

2022, May, 20, 12:10:00

ЭНЕРГЕТИЧЕСКАЯ БЕЗОПАСНОСТЬ РОССИИ

В перспективе отказ ЕС от российской нефти приведёт лишь к перераспределению на рынке, а Россия направит свою нефть туда, откуда уйдёт сырьё для Европы.

2022, May, 20, 12:00:00

GERMANY NEED RUSSIAN GAS

German industry is particularly anxious about energy-intensive factories, such as glass, steel, food or drug manufacturing, as well as the chemicals sector, that provide many of the building blocks for industry.